|

Issue 65, January 2024

HEADLINES

SEDE News 🗞️

Meetings and Conferences

- SEDE Hosts Meeting for Top Executives (SEDE)

- NADO & DDAA Washington Conference (NADO)

- State Planning Grantee Summit (CREC)

Webinars

- February 8th and 15th Webinars: Aligning Strategies: Lessons from 6 States

- February 29th Webinar: Statewide Planning Grant Topical Webinar, Supply Chain (SEDE)

- 3/7 Webinar: State Energy Financing: A Conversation with LPO and IWG (SEDE)

News

- Recompete Pilot Program Finalists Announced (U.S. EDA)

- Investing in Rural Downtowns: What Roles are EDDs Playing? (NADO)

- RFP for SSBCI for Manufacturers in the Southeast (Urban Manufacturing Alliance)

Economy 💰

- The 2023 U.S. Economy in a Dozen Charts (CNBC)

- Higher Education R&D by State and Institution (SSTI)

- How Cities Can Thrive in the New Industrial Era (Governing)

Trade 📈

- Does Trade Uncertainty Affect Bank Lending? (Federal Reserve Bank of Atlanta)

- U.S. Trade Gaps Fell in November (Kiplinger)

- U.S. and India Bolster Trade Ties on Critical Minerals (Business Standard)

Industry Trends 💡

- AI Will Transform the Global Economy. Let’s Make Sure it Benefits Humanity (IMF)

- How Leaders Can Leverage the CHIPS Act as a Landmark Workforce Opportunity (Brookings)

- How AI is Reshaping Five Manufacturing Industries (Forbes)

Workforce ⚒️

- Semiconductor and Advanced Manufacturing Technician Apprenticeship Program (NIIT)

- Duke Energy Invest $350K to Support Future Energy Workforce (CSR Wire)

- DOE Sponsors Underrepresented Institutions in STEM Workforce Programs (HPC Wire)

- Workforce Training Program Created for Indiana Biomanufacturing Plant (Inside Indiana Business)

Business Finance and Incentives 📊

- Life Science Companies Announce Connecticut Expansions (Hartford Business Journal)

- Missouri Expansion Investing Nearly $6M (Business Facilities)

- Birmingham Construction Firm to Receive $5.3M in Incentives (Alabama Daily News)

- Colorado Springs Receives CHIPS Act Grant (Colorado Public Radio)

- Nebraska Manufacturing Facility to Invest $50M to Expand (PR Newswire)

|

SEDE News 🗞️ |

|---|

Meetings and Conferences

SEDE Hosts Meeting for Top Executives. (SEDE) The State Economic Development Executives (SEDE) Network is holding its Winter 2024 meeting for state economic development executives or their deputies in Las Vegas on January 29 and 30. Tom Burns (Executive Director of Nevada Governor’s Office of Economic Development) and his team will be hosting the meeting. The agenda will include discussions of current issues facing states and many opportunities for networking among the state economic development commissioners, secretaries and executive directors or their top deputy.

NADO & DDAA Washington Conference (NADO) Join the National Association of Development Organizations (NADO) and the Development District Association of Appalachia (DDAA) for sessions focused on regional development, the federal landscape, and the programs and policies that matter most to Regional Development Organizations and their stakeholders. Conference content will begin on the morning of Sunday, March 10 for Committee and Board meetings with conference plenary and breakout sessions beginning on Monday, March 11 and continuing through 11:00 a.m. on Wednesday, March 13. Register here.

Register: State Planning Grantee Summit (CREC) Following the NADO & DDAA Washington Conference, CREC will be hosting a Summit for EDA Statewide Planning Grant recipients. This summit is open to both grantees and EDDs. Attendees will have the opportunity to meet other grant administrators and share best practices from their projects. The agenda includes insightful presentations and discussions where grantees can share valuable lessons learned in the grant administration journey. This is an opportunity to meet other grantees, while also offering a platform to provide crucial feedback and learn tips to improve research skills, grant applications and project management. Register here.

Webinars

February 8th and 15th Webinars: Aligning Strategies: Lessons from 6 States (SEDE) Strategy alignment is essential to economic development. Join us for two webinars to learn how teams from six states have driven improved alignment between economic development districts and state economic development agencies through a policy academy process guided by the Center for Regional Competitiveness (CREC) and funded by EDA. Each webinar will provide an opportunity for the three teams to share highlights from their 9-month journey. Join us on February 8th at 4:00 PM CT to listen to presentations from Idaho, Louisiana, and Michigan. Register here. Join us on February 15th at 4:00 PM CT to listen to presentations from Colorado, Kansas, and Wisconsin. Register here.

February 29th Webinar: Statewide Planning Grant Topical Webinar, Supply Chain (SEDE) Join fellow EDA Statewide Planning Grant recipients as they discuss their activities related to industry and supply chain. New Jersey focused their work on the aviation industry, and will share on their five projects, including supply chain developments and improvements on an air cargo facility at the Atlantic City airport. Wisconsin will share their story on their numerous automotive suppliers, but with the coming electric vehicle transitions, WEDC wanted to study the extent the supply chain depends on the internal combustion engine. Join us on February 29th from 3:00 PM – 4:00 PM ET. Register here.

3/7 Webinar: State Energy Financing: A Conversation with LPO and IWG (SEDE) Please join the SEDE Network for this webinar on state energy financing and federal programming. We will host two presenters, Hans Reimer, Senior consultant and state and local outreach lead at DOE’s Loan Programs Office (LPO) and Brian Anderson, Executive Director, The Interagency Working Group (IWG) on Coal and Power Plant Communities and Economic Revitalization. These presentations will focus on available federal programs and potential partnership opportunities for states interested in energy finance. Join us on March 7th at 4:00 PM ET. Register here.

News

Recompete Pilot Program Finalists Announced (U.S. EDA) The U.S. Department of Commerce’s Economic Development Administration (EDA) announced the 22 finalists of the Distressed Area Recompete Pilot Program (Recompete). Recompete targets the hardest-hit and most economically distressed areas where prime-age (25-54 years) employment is significantly lower than the national average, with the goal to close this gap through flexible, locally-driven investments. Authorized by the CHIPS and Science Act, Recompete will invest $200 million in economic and workforce development projects that connect workers to good jobs in geographically diverse and persistently distressed communities across the country. These Recompete Finalists are located across 20 states and Territories and represent a cross-section of urban and rural regions. Of the 22 Finalists, seven are focused exclusively on rural American communities and five are led by or involve Tribal organizations as a primary partner.

Investing in Rural Downtowns: What Roles are EDDs Playing? (NADO) Investing in Rural Downtowns is a new resource from NADO Research Foundation exploring what it means to be investment ready for engaging in downtown development, while also showcasing the varied downtown revitalization work that Economic Development Districts (EDDs) are doing in their communities. This report highlights EDD best practices from across the country in a variety of geographies and provides an idea of the roles that EDDs have taken including Downtown Planning, Brownfields, Facilitation, Funding and Implementation and EDD-Produced Resources.

RFP for SSBCI for Manufacturers in the Southeast (Urban Manufacturing Alliance) The Urban Manufacturing Alliance is launching a practitioner cohort in selected regions of the Southeast to better connect SSBCI funding to small and mid-sized manufacturers and product based companies – particularly those in the SEDI category. This project addresses the current issue of small and mid-size manufacturers being unaware of SSBCI or how its funding and technical assistance can benefit their business. The goal of the project is to build a robust local lending and technical support ecosystem for small and mid-sized manufacturers and makers to assist them in seeking and obtaining capital and scaling their business with SSBCI funds and related partners. Click here to view the RFP. The application deadline is February 9th.

|

Economy 💰 |

|---|

The 2023 U.S. Economy in a Dozen Charts (CNBC) The state of the U.S. economy may be a chief concern among Americans, but 2023 wound up as a pretty good year for the macroenvironment. Spending remained high, markets posted big gains and the Federal Reserve’s battle against inflation showed signs of cooling — without freezing. Then there’s the almost logic-defying resilience of the job market.

The U.S. labor market ended the year strong, creating more than 200,000 jobs in December, according to figures released by the U.S. Bureau of Labor Statistics. While previous job creation estimates for October and November were revised downward by a combined 75,000, the unemployment rate remained at a low 3.7%, and December marked the 36th consecutive month of job creation for the U.S. economy.

Higher Education R&D by State and Institution (SSTI) This edition of Useful Stats explores Higher Education Research and Development (HERD) Survey data from the newest fiscal year (FY) 2022 data release. Specifically, this edition explores trends in state and institution-level HERD expenditures over the last decade of available data. Twenty-seven states had higher education R&D expenditures totaling over $1 billion in FY 2022, while an additional nine states and Washington, D.C. had less than a billion but more than half a million. The remaining 14 states and Puerto Rico had between $100-500 million in HERD expenditures. California had the highest HERD expenditures of any state or territory at $12.1 billion—over 12% of the national total—while New York and Texas followed behind with $8.3 and $7.4 billion, respectively. Two additional states, Pennsylvania and Maryland, were the only others with over $5 billion in HERD expenditures.

How Cities Can Thrive in the New Industrial Era (Governing) Fueled by macro dynamics and unprecedented federal investments, businesses are reshoring advanced manufacturing at a pace and scale that would have been inconceivable even three years ago. As a result, in many respects the hierarchy of American metros is being reset. If the decade between the Great Recession and the pandemic seemed to be all about “superstar” tech cities, many of the winners in the remote-work era are going to be places that make tangible things. Building networks of public, private and civic players is key to rebuilding a robust industrial base, because advanced industries need many kinds of support to thrive. This means that collaborating across sectors and knitting together investments in a wide range of areas are the core elements of modern competitiveness.

|

Trade 📈 |

|---|

Does Trade Uncertainty Affect Bank Lending? (Federal Reserve Bank of Atlanta) This post describes how the lending activities of US banks were affected by the rise in trade uncertainty during the 2018–19 “trade war.” In particular, banks that were more exposed to trade uncertainty contracted lending to all of their domestic nonfinancial business borrowers, regardless of whether these borrowers were facing high or low uncertainty themselves. Furthermore, banks’ lending strategies exhibited the type of “wait-and-see” behavior usually found in corporate firms facing investment decisions under uncertainty, and the lending contraction was larger for those banks that were more financially constrained. Overall, this study confirms that banks are a conduit for amplifying the effects of trade uncertainty. This financial channel is contractionary for a broad spectrum of firms, not exclusively those in sectors directly exposed to the trade war.

U.S. Trade Gaps Fell in November (Kiplinger) The U.S. trade deficit narrowed slightly as both imports and exports fell in November. Including both goods and services, it fell to a seasonally adjusted $63.2 billion in November, from $64.5 billion in October. With the global economy weakening and domestic consumption and investment growth slowing down, the strength in trade flows will subside over the coming months. Through November, the combined goods and services deficit decreased $161.8 billion, or 18.4%, from the same 11-month period in 2022, thanks to a 1% increase in year-to-date exports and a 3.6% decline in imports.

U.S. and India Bolster Trade Ties on Critical Minerals (Business Standard) India and the United States have agreed to bolster trade ties and deepen cooperation in critical minerals. The two nations are pushing to improve bilateral trade prospects, overcoming diplomatic tensions. India said it was interested in a bilateral critical mineral partnership, and Washington and New Delhi would exchange information to deepen their partnership in this area. India also asked the United States to improve its visa processes for business professionals from India and requested Washington restore duty-free access to some goods under the so-called generalized system of preferences.

|

Industry Trends 💡 |

|---|

AI Will Transform the Global Economy. Let’s Make Sure It Benefits Humanity (IMF) The rapid advance of artificial intelligence has captivated the world, causing both excitement and alarm, and raising important questions about its potential impact on the global economy. The net effect is difficult to foresee, as AI will ripple through economies in complex ways. In a new analysis, IMF staff examine the potential impact of AI on the global labor market. The findings are striking: almost 40 percent of global employment is exposed to AI. In advanced economies, about 60 percent of jobs may be impacted by AI. Roughly half the exposed jobs may benefit from AI integration, enhancing productivity. For the other half, AI applications may execute key tasks currently performed by humans, which could lower labor demand, leading to lower wages and reduced hiring. In the most extreme cases, some of these jobs may disappear. In emerging markets and low-income countries, by contrast, AI exposure is expected to be 40 percent and 26 percent, respectively.

How Leaders Can Leverage the CHIPS Act as a Landmark Workforce Opportunity (Brookings) The CHIPS and Science Act remains under-recognized not just for its focus on higher-level STEM education, but also as a source of programs and resources for training the nation’s skilled technical workers without bachelor’s degrees—a workforce of great importance as the nation seeks to expand its high-value industrial base. Both the semiconductor industry specifically and the advanced sector more broadly report persistent challenges in securing sufficient science, technology, engineering, and math (STEM) professionals and technicians. In this vein, the U.S. faces an economy-wide shortage of skilled workers In light of that—and in hopes of further informing state and local implementors—this report provides a practical overview of the numerous but underdiscussed and sometimes indistinct workforce programs included in the CHIPS and Science Act.

How AI is Reshaping Five Manufacturing Industries (Forbes) The manufacturing industry is at the forefront of digital transformation, leveraging technologies like big data analytics, AI, and robotics. The results are tangible, according to McKinsey, who found that machine downtime can be reduced by 30% to 50% and quality-related costs can be reduced by 10% to 20%, among other benefits. Five industries are explored in this article, along with what leaders need to know about what is next for each industry: Automotives, Electronics, Aerospace and Defense, Food and Beverage, and the Pharmaceutical Industry.

|

Workforce ⚒️ |

|---|

Semiconductor and Advanced Manufacturing Technician Apprenticeship Program (NIIT) The National Institute for Innovation and Technology launched the national Semiconductor and Advanced Manufacturing Technician Apprenticeship Program (SAM-TAP). The SAM-TAP initiative is designed to build the nation’s ecosystem of talent needed to support the semiconductor industry and broader advanced manufacturing. Through SAM-TAP, and in collaboration with state apprenticeship offices and commerce departments, the Institute will provide states, employers, and training providers intermediary services free of charge to develop innovative, competency-based Registered Apprenticeship Programs (RAPs). As part of the program, the Institute’s subject matter experts will work with community colleges and training providers to establish the Required Technical Instruction (RTI) to support the programs. State representatives and semiconductor supply chain employers are encouraged to reach out to the Institute directly to learn how to participate in the program.

Duke Energy to Invest $350K to Support Future Energy Workforce (CSR Wire) The Duke Energy Foundation announced $350,000 to support 11 community college programs across the state working to create a pipeline of skilled lineworkers that will help meet the energy industry’s future workforce needs. With this additional funding, the Foundation has awarded more than $6.7 million over the past five years in support of workforce development programs with a focus on the energy sector. The lineworker training program funds will be primarily used by grantees for diversity recruitment, instructor stipends, equipment, materials and program marketing. As Duke Energy executes its clean energy transition, the need for a skilled workforce is rapidly growing. Lineworkers play an integral role in a more efficient, more reliable digital grid. The company’s investment into lineworker training programs and coordination with community colleges will result in a more diverse talent pipeline for the utility industry.

DOE Sponsors Underrepresented Institutions in STEM Workforce Programs (HPC Wire) The U.S. Department of Energy’s Office of Science will sponsor the participation of 173 undergraduate students and eight faculty members in three science, technology, engineering, and mathematics (STEM)-focused workforce development programs at 13 DOE national laboratories and facilities this spring. Collectively, these programs ensure that both DOE and communities across the nation have a strong, sustained workforce trained in the skills needed to address the energy, environment, and national security challenges of today and tomorrow.

Workforce Training Program Created for Indiana Biomanufacturing Plant (Inside Indiana Business) Liberation Labs is partnering with Ivy Tech Community College in Richmond, Indiana, to train future employees at the company’s $115 million biomanufacturing facility currently under construction. The biomanufacturing workforce training program will equip workers with the required skills to work in precision fermentation, which is the primary focus of the facility. Liberation Labs says the goal is to ensure that about 30 people are trained and ready to work in the plant when operations begin later this year. Liberation Labs says the training program will include classroom, laboratory and online training. An on-site training component will be added later. The curriculum will cover biotechnology fundamentals, fermentation fundamentals, biomanufacturing best practices, quality, compliance, and health & safety.

|

Business Finance and Incentives 📊 |

|---|

Life Science Companies Announce Connecticut Expansions (Hartford Business Journal) Four life science companies are expanding their operations in Connecticut, with one making its U.S. debut. ReST Therapeutics, based in Paris, will establish a headquarter facility in New Haven. Another of the four companies, Millstone Medical, recently relocated into a 25,000-square-foot facility in Bloomfield that will allow the company to triple its employee count and increase service capacity by more than 400%. The $10 million investment in the expanded facility, which is expected to be operational in the second quarter of 2024, will allow Millstone to offer a variety of new services to life sciences companies in Connecticut.

Missouri Expansion Investing Nearly $6M (Business Facilities) A full-service residential and commercial HVAC provider plans to create 300 new jobs as part of its nearly $6 million expansion in Maryland Heights, Missouri. The Hoffman Brothers’ 20,000-square-foot expansion includes a shared services space to accommodate its growth in the greater St. Louis area. The average wage for jobs is expected to be above the county and city average.

Birmingham Construction Firm to Receive $5.3M in Incentives (Alabama Daily News) Construction firm Brasfield & Gorrie is expected to receive nearly $5.3 million in economic incentives to expand its headquarters in Birmingham, an expansion expected to create 85 jobs and yield an economic impact of $13.5 million over 20 years. The expansion will see the construction of a 28,500 square-foot, three-story building at its headquarters in the city’s Lakeview District, with an estimated completion date of mid-2025. The 85 jobs will be created over a period of five years, with an average annual salary of $74,000.

Colorado Springs Receives CHIPS Act Grant (Colorado Public Radio) A semiconductor manufacturer with facilities in Colorado and Oregon expects to triple its domestic production of computer chips as part of $162 million worth of federal grants. The U.S. Commerce Department is splitting the total $162 million in CHIPS Act funds between Microchip locations in Colorado Springs and in Gresham, Oregon. That money feeds into a broad modernization project the company announced nearly a year ago to boost its production of specialty semiconductors such as microcontrollers and silicon carbide chips, the latter important for electric cars and other decarbonization efforts. The full multi-year modernization of the Springs facility is expected to cost about $940 million. On top of the CHIPS Act funds, the project also received about $47 million in state and local tax incentives.

Nebraska Manufacturing Facility to Invest $50M to Expand (PR Newswire) Lindsay Corporation, a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology, has announced plans to invest more than $50 million over the next two years in its largest global manufacturing facility located in Lindsay, Nebraska. Plans for the modernization of the facility include implementing Industry 4.0 technologies, including data connectivity, analytics, artificial intelligence and the additions of automation and robotics. The facility will house new equipment and the latest advancements in galvanizing, a core process for manufacturing pivot irrigation systems and road safety products. Lindsay will also expand the facility footprint by 40,000 square feet to allow for increased capacity and capabilities in metal forming. This investment is the largest in Lindsay’s history. The company expects to begin capital spending in the second quarter of fiscal 2024 and complete the facility modernization by the end of 2025.

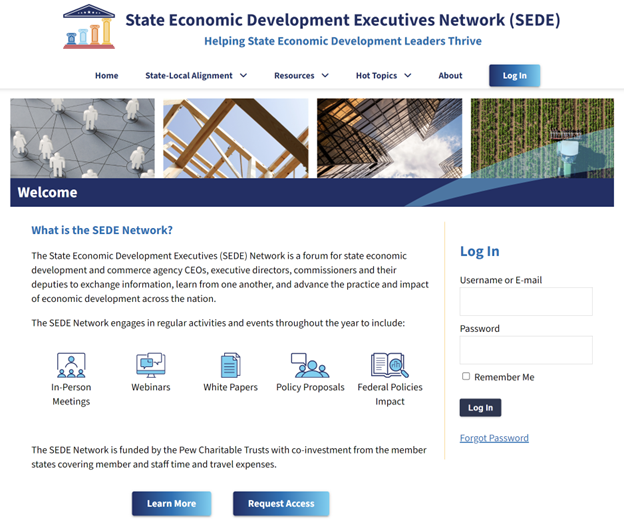

The State Economic Development Executives (SEDE) Network engages in regular events throughout the year. State Economic Development.org lists these activities and offers an interactive forum for discussion among peers.

The SEDE Steering Committee includes: Sandra Watson (AZ), Chair; Kurt Foreman (DE); Kevin McKinnon (MN); Christopher Chung (NC); Andrew Deye (OH); Sophorn Cheang (OR); Adriana Cruz (TX); Joan Goldstein (VT); and Mike Graney (WV).

Allison Ulaky of the Center for Regional Economic Competitiveness (CREC) led the development of this Bulletin; for questions on the content in this Bulletin or for information on the SEDE Network contact Bob Isaacson, CREC Senior Vice President.