|

Issue 66, February 2024

HEADLINES

SEDE News 🗞️

Meetings and Conferences

- SEDE Hosts Meeting for Top Executives (SEDE)

- NADO & DDAA Washington Conference (NADO)

- Register: State Planning Grantee Summit (CREC)

Webinars

- February 29th Webinar: Statewide Planning Grant Topical Webinar, Supply Chain (SEDE)

- March 7th: State Energy Financing: A Conversation with LPO and IWG (SEDE)

News

- NACIE Releases Recommendations to Strengthen Leadership in Technology Innovation (EDA)

- Deadline Extension: RFP for SSBCI for Manufacturers in the Southeast (Urban Manufacturing Alliance)

Economy 💰

- January CPI Report – Prices Rose More than Expected (CNBC)

- CHIPS and Science Act Programs are Writing a New Story About the Rust Belt (Brookings)

- Understanding America’s Labor Shortage (U.S. Chamber of Commerce)

Trade 📈

- U.S. is Now Buying More from Mexico than China for the First Time in 20 Years (Business Insider)

- U.S. Trade Gap Narrows to Smallest in Three Years (Yahoo News)

- China and U.S. Hold Economic Talks as Trade Issues Heat up (Associated Press)

Industry Trends 💡

- Solving the Housing Puzzle: EDDs as Regional Housing Changemakers (NADO)

- Rethinking Concerns About AI’s Energy Use (Center for Data Innovation)

- A Realist Approach to Hydrogen (ITIF)

- Announcement of $5B for R&D of Computer Chips (Associated Press)

Workforce ⚒️

- Bridging Data Disparities Report (CREC)

- Commerce Invests $7M to Support Healthcare Workforce Training in Arkansas (EDA)

- Philadelphia Wins $1.47M for Workforce Development Pilot Program (City of Philadelphia)

- Can Apprentice Programs Increase Worker Satisfaction? (International Journal of STEM Education)

Business Finance and Incentives 📊

- How Investing in Sites and Infrastructure In Ohio Will Help Your Business Thrive (Business Facilities)

- Mississippi Finalizes Largest Economic Development Project in State History (MEC)

- U.S. to Announce Billions in Subsidies for Advanced Chips (Reuters)

- Minnesota Announces Over $7.8M for Business Expansion Statewide (State of Minnesota)

- Michigan Proposed Spending Plan Includes $60M for Innovation Fund (SSTI)

|

SEDE News 🗞️ |

|---|

Meetings and Conferences

SEDE Hosts Meeting for Top Executives (SEDE) The State Economic Development Executives (SEDE) Network hosted its Winter 2024 meeting for state economic development executives in Las Vegas on January 29 and 30. Tom Burns (Executive Director of Nevada Governor’s Office of Economic Development) and his team hosted the meeting. The agenda included discussions of current issues facing states and many opportunities for networking among the state economic development commissioners, secretaries and executive directors or their top deputy. The executive summary of the meeting can be found here.

NADO & DDAA Washington Conference (NADO) Join the National Association of Development Organizations (NADO) and the Development District Association of Appalachia (DDAA) for conference sessions focused on regional development, the federal landscape, and the programs and policies that matter most to Regional Development Organizations and their stakeholders. Conference content will begin on the morning of Sunday, March 10 for Committee and Board meetings with conference plenary and breakout sessions beginning on Monday, March 11 and continuing through 11:00 a.m. on Wednesday, March 13. Register here.

State Planning Grantee Summit (CREC) Following the NADO & DDAA Washington Conference, CREC will be hosting a Summit for EDA Statewide Planning Grant recipients and EDD partners. Attendees will have the opportunity to meet other grant administrators and share best practices from their projects. The agenda includes insightful presentations and discussions where grantees can share valuable lessons learned in the grant administration journey. This is an opportunity to meet other grantees, while also offering a platform to provide crucial feedback and learn tips to improve research skills, grant applications and project management. Register here.

Webinars

February 29th Webinar: Statewide Planning Grant Topical Webinar, Supply Chain (SEDE) Join fellow EDA Statewide Planning Grant recipients as they discuss their activities related to industry and supply chain. New Jersey focused their work on the aviation industry, and will share on their five projects, including supply chain developments and improvements on an air cargo facility at the Atlantic City airport. Wisconsin will share their story on their numerous automotive suppliers, but with the coming electric vehicle transitions, WEDC wanted to study the extent the supply chain depends on the internal combustion engine. Join us on February 29th from 3:00 PM – 4:00 PM ET. Register here.

March 7th: State Energy Financing: A Conversation with LPO and IWG (SEDE) Please join the SEDE Network for this webinar on state energy financing and federal programming. We will host two presenters, Hans Reimer, Senior consultant and state and local outreach lead at DOE’s Loan Programs Office (LPO) and Brian Anderson, Executive Director, The Interagency Working Group (IWG) on Coal and Power Plant Communities and Economic Revitalization. These presentations will focus on available federal programs and potential partnership opportunities for states interested in energy finance. Join us on March 7th at 4:00 PM ET. Register here.

News

NACIE Releases Recommendations to Strengthen Leadership in Technology Innovation (EDA) The National Advisory Council on Innovation and Entrepreneurship (NACIE) released its “Competitiveness Through Entrepreneurship: A Strategy for U.S. Innovation” report that includes 10 recommendations for how the U.S. Department of Commerce, the federal government, and the private sector can foster an entrepreneurship ecosystem that ensures the United States leads in critical technology innovation. The 10 recommendations include investments in research & development (R&D), entrepreneurial ecosystems, talent pipelines, and incentives for intellectual property commercialization. The report identifies opportunities for providing capital, tools, and resources to entrepreneurs to break down barriers and enable faster U.S. innovation in technologies of the future. The recommendations also include action items that ensure diversity, equity, and inclusion are prioritized, including proposed tax credits and incentives for those that invest in early-stage startups, and women- and minority-owned startups.

Deadline Extension: RFP for SSBCI for Manufacturers in the Southeast (Urban Manufacturing Alliance) The Urban Manufacturing Alliance is launching a practitioner cohort in selected regions of the Southeast to better connect SSBCI funding to small and mid-sized manufacturers and product based companies – particularly those in the SEDI category. This project addresses the knowledge gap of small and mid-size manufacturers around SSBCI and how its funding and technical assistance can benefit their business. The goal of the project is to build a robust local lending and technical support ecosystem for small and mid-sized manufacturers and makers to assist them in seeking and obtaining capital and scaling their business with SSBCI funds and related partners. Click here to view the RFP. The application deadline has been extended to March 8th.

|

Economy 💰 |

|---|

January CPI Report – Prices Rose More than Expected (CNBC) The consumer price index, a broad-based measure of the prices shoppers face for goods and services across the economy, increased 0.3% for the month, the Bureau of Labor Statistics reported. On a 12-month basis, that came to 3.1%, down from 3.4% in December. Shelter prices, which comprise about one-third of the CPI weighting, accounted for much of the rise. The index for that category climbed 0.6% on the month, contributing more than two-thirds of the headline increase, the BLS said. On a 12-month basis, shelter rose 6%. Fed officials expect inflation to recede back to their 2% long-run target in large part because they think shelter prices will decelerate through the year.

CHIPS and Science Act Programs are Writing a New Story About the Rust Belt (Brookings) The U.S. is beginning to roll out striking instances of place-based industrial policy — a good amount of it focused on federal investment in heartland geographies still making a spotty transition from their “old” industrial economy to a new tech-driven model. The Midwest has formidable innovation assets upon which to build a tech economy and leadership in multiple emerging sectors. Add up investment announcements such as Build Back Better, NSF Engines, and EDA Tech Hubs and the recognition of value with the possibility of follow-up investment in heartland communities is writing a new story about the industrial Midwest and its technology-oriented revitalization.

Understanding America’s Labor Shortage (U.S. Chamber of Commerce) The latest data captured by a Chamber analysis shows that the U.S. has 9.5 million job openings, but only 6.5 million unemployed workers. There are a lot of jobs, but not enough workers to fill them. Factors contributing to labor shortages include early retirements and an aging workforce, lower levels of international migration, lack of access to childcare, and a growing number of new entrepreneurs.

|

Trade 📈 |

|---|

U.S. is Now Buying More from Mexico than China for the First Time in 20 Years (Business Insider) The Commerce Department released data showing that in 2023, Mexico was the leading source of goods imported to the U.S. — ahead of China for the first time in over 20 years. Mexico surpassing China as America’s top trade partner signals a significant shift in global commerce dynamics. As tensions between the U.S. and China persist, fueled by trade disputes and tariffs, this transition to Mexico may help reduce costs and speed up the supply chain, ultimately lowering the costs of goods.

U.S. Trade Gap Narrows to Smallest in Three Years (Yahoo News) For all of 2023, the overall trade gap was $773.4 billion, down 18.7 percent from the $951.2 billion figure in the prior year, U.S. Commerce Department figures showed. In 2022, the country saw the biggest deficit in government data dating back to 1960. But the latest numbers showed a fall in the goods deficit last year, with imports of products dropping more than exports. Purchases of supplies like crude oil and fuel oil fell, while Americans bought less consumer goods like clothing and cell phones. Surprisingly, resilient consumption last year has helped to support the US economy, but analysts expect higher interest rates to slow consumer spending and add pressure on imports.

China and U.S. Hold Economic Talks as Trade Issues Heat up (Associated Press) Chinese and U.S. officials have met in Beijing for talks on tough issues dividing the two largest economies, as trade and tariffs increasingly draw attention. The U.S. Treasury Department said U.S. officials reiterated concerns over Chinese industrial policy practices and overcapacity, and the resulting impact on U.S. workers and firms. The two sides said the talks in Beijing also touched on issues such as debt problems in developing countries, financial cooperation, and economic policies. Both sides agreed to meet again in April.

|

Industry Trends 💡 |

|---|

Solving the Housing Puzzle: EDDs as Regional Housing Changemakers (NADO) This housing research report is the first step for NADO Research Foundation staff and partners in showcasing the valuable housing work that Economic Development Districts (EDDs) are doing in their communities. Each EDD approaches housing in a different way depending on the regional housing market, community priorities, regional stakeholder input, and what other organizations or businesses are doing in their regional housing ecosystem. This report will showcase EDD best practices from across the country in a variety of regional market contexts and provide implementable strategies for a variety of different roles that EDDs have taken including Planner, Financier, Land Manager, and Developer.

Rethinking Concerns About AI’s Energy Use (Center for Data Innovation) Some observers speculate that the rapid adoption of AI combined with an increase in the size of deep learning models will lead to a massive increase in energy use with a potentially devastating environmental impact. This report provides an overview of the debate, including some of the early missteps and how they have already shaped the policy conversation, reviews AI’s energy footprint and how it will likely evolve in the coming years, and recommends that policymakers address potential concerns about AI’s energy consumption.

A Realist Approach to Hydrogen (ITIF) Clean hydrogen is expensive to produce, difficult to transport, and a second- or third-best clean energy solution in almost all proposed markets. To help drive the global green transition, this report suggests that hydrogen policy must address all these practical challenges. Key takeaways include the fact that it is critically important to see past the self-interest of multiple players in the hydrogen space. U.S. policymakers should view hydrogen through the “P3” lens: the primary objective should be to find pathways for clean hydrogen to achieve price/performance parity with dirty hydrogen. This is true in theory today, but not necessarily in practice. Most proposed markets for hydrogen are not feasible; they are not competitive with fossil fuels, and often are not competitive with electrification using renewable energy, so advancing R&D will be critical.

Announcement of $5B for R&D of Computer Chips (Associated Press) The investment of $5 billion in a newly established public-private consortium – the National Semiconductor Technology Center – is aimed at supporting research and development in advanced computer chips. The Center is being funded through the CHIPS and Science Act and will help fund the design and prototyping of new chips, in addition to training workers for the sector. Companies say they need a skilled workforce to capitalize on the separate $39 billion CHIPS funding being provided to fund new and expanded computer chip plants. U.S. Department of Labor data says that about 375,000 people are employed in the production of computer chips with an average income of $82,830.

|

Workforce ⚒️ |

|---|

Bridging Data Disparities Report (CREC) The Center for Regional Economic Competitiveness prepared a report, titled “Bridging Data Disparities: How Intermediary Organizations Can Build Capacity to Support Equitable Education and Career Pathways,” which demonstrates how state and regional organizations can gain data-related capabilities to improve the education and employment results for low-income, Black, and Latinx youth. State economic development leaders can share this report with education and workforce agency leaders and partners to inspire more data-driven programming. If you find this useful, please forward this to education and workforce policy leaders in your state. Contact Allison Forbes, VP of Research at CREC, if you have any questions. Access the report here.

Commerce Invests $7M to Support Healthcare Workforce Training in Arkansas (EDA) The U.S. Economic Development Administration announced that it is investing $7 million in the state of Arkansas. These investments will support healthcare workforce development and critical infrastructure improvements to support current and future business needs. Arkansas State University – Newport will receive a $5 million EDA grant to support construction of a 24,000-square foot Nursing and Health Sciences workforce training center. The project will be matched with $1.3 million in local funds and is expected to create 225 jobs, according to grantee estimates. The city of Trumann will receive a $2 million EDA grant for construction of a new water treatment facility and ground water storage tank, to support current residents and businesses while providing capacity for future industrial growth. The project will be matched with $500,000 in local funds. These projects are funded under the Disaster Relief Supplemental Appropriations Act.

Philadelphia Wins $1.47M for Workforce Development Pilot Program (City of Philadelphia) The City of Philadelphia has been awarded $1.47 million in federal funds from the U.S. Joint Office of Energy and Transportation to fund the Plug In Philly initiative. The pilot is a workforce development program developed to initially recruit and train 45 diverse Philadelphians for careers in electric vehicle supplies and equipment (EVSE). This pre-apprenticeship program will expand access to career-track training and employment in EVSE installation and maintenance work. During the two-year pilot, a total of 45 participants over three cohorts will successfully complete the pre-apprenticeship program, and City officials are committed to helping these participants access pathways to permanent, fulltime jobs in the EV industry. Long-term aims include an increase in BIPOC, and women electricians employed by 2030 on Philadelphia public works projects.

Can Apprentice Programs Increase Worker Satisfaction? (International Journal of STEM Education) Despite the significant relationship between life satisfaction and education, less is known about the connection between life satisfaction and informal learning in the context of training and apprenticeship programs. This research paper examines the influence of the LaunchCode program, a novel training and apprentice program in STEM, on participant’s life satisfaction and optimism. Findings show high life satisfaction and optimism among those who completed both the training course and the apprenticeship component.

|

Business Finance and Incentives 📊 |

|---|

How Investing in Sites and Infrastructure In Ohio Will Help Your Business Thrive (Business Facilities) The cornerstone of Ohio’s budget strategy is to double down on industrial site identification and development with the All Ohio Future Fund. This $750 million fund will support the preparation of large-scale economic development sites requiring robust water, sewer, energy, and other infrastructure. Ohio is preparing these sites to meet the needs of major projects — semiconductor fabs, industrial recycling, and other advanced manufacturing. The biennial budget provides another $124 million to enhance water infrastructure, remediate brownfield sites, and pursue demolition and site revitalization projects to improve quality of life and support economic growth in Ohio communities.

Mississippi Finalizes Largest Economic Development Project in State History (MEC) Amazon Web Services, Inc. (AWS) is investing $10 billion to establish multiple data center complexes in two Madison County, Mississippi industrial parks. The investment will create at least 1,000 high-paying, high-tech jobs. This $10 billion investment by AWS is the single largest capital investment in Mississippi history and four times the size of the previous largest economic development project. Additionally, it follows a $1.9 billion private sector investment by Accelera by Cummins, Daimler Trucks & Buses, and PACCAR, which is bringing advanced battery cell production operations to Marshall County. The economic development project will create 2,000 jobs with an average annual salary of $66,000. This represents the largest payroll commitment of any major project in state history.

U.S. to Announce Billions in Subsidies for Advanced Chips (Reuters) Top semiconductor companies such as Intel and Taiwan Semiconductor Manufacturing, Co. are expected to be awarded billions of dollars in CHIPS funding in the coming weeks to fuel the construction of new factories in the U.S. The forthcoming announcements aim to kick-start manufacturing of advanced semiconductors that power smartphones, artificial intelligence, and weapons systems. In December last year, U.S. Commerce Secretary Gina Raimondo said she would make around a dozen funding awards for semiconductor chips within the next year, including multi-billion-dollar announcements that could drastically reshape U.S. chip production.

Minnesota Announces Over $7.8M for Business Expansion Statewide (State of Minnesota) The Minnesota Department of Employment and Economic Development (DEED) announced more than $7.8 million in funding for seven business expansion projects statewide. The projects are expected to support 719 jobs and leverage more than $169 million in outside investment. The Job Creation Fund and the Minnesota Investment Fund are the state’s major incentive programs that help stimulate economic investment across the state. The seven projects funded included companies in manufacturing and biosciences, among others.

Michigan Proposed Spending Plan Includes $60M for Innovation Fund (SSTI) Michigan Governor Gretchen Whitmer presented her Fiscal Year 2025 Executive Budget recommendations to a joint session of the House and Senate Appropriations committees and included a new $60 million Innovation Fund. The Fund would assist high-growth scalable startups and the innovation and entrepreneurship eco-system. The fund would also provide universities and nonprofits funding to invest in tech startups, with all returns on investment being reinvested back into the program to support additional startups in the future. Overall, the governor’s recommendations are focused on lowering the costs for Michiganders, providing high-quality education, and boosting the state’s economic growth through targeted investments to economic and workforce development initiatives.

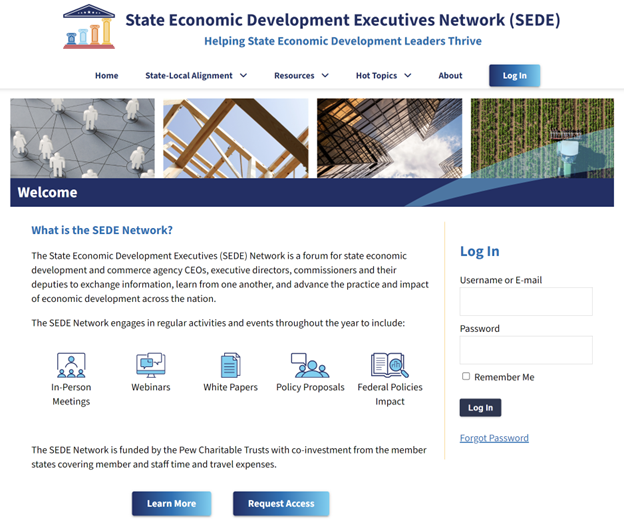

The State Economic Development Executives (SEDE) Network engages in regular events throughout the year. State Economic Development.org lists these activities and offers an interactive forum for discussion among peers.

The SEDE Steering Committee includes: Sandra Watson (AZ), Chair; Joan Goldstein (VT), Vice-Chair; Kurt Foreman (DE); Kevin McKinnon (MN); Christopher Chung (NC); Andrew Deye (OH); Sophorn Cheang (OR); Adriana Cruz (TX); and Mike Graney (WV).

Allison Ulaky of the Center for Regional Economic Competitiveness (CREC) led the development of this Bulletin; for questions on the content in this Bulletin or for information on the SEDE Network contact Bob Isaacson, CREC Senior Vice President.