Latest News

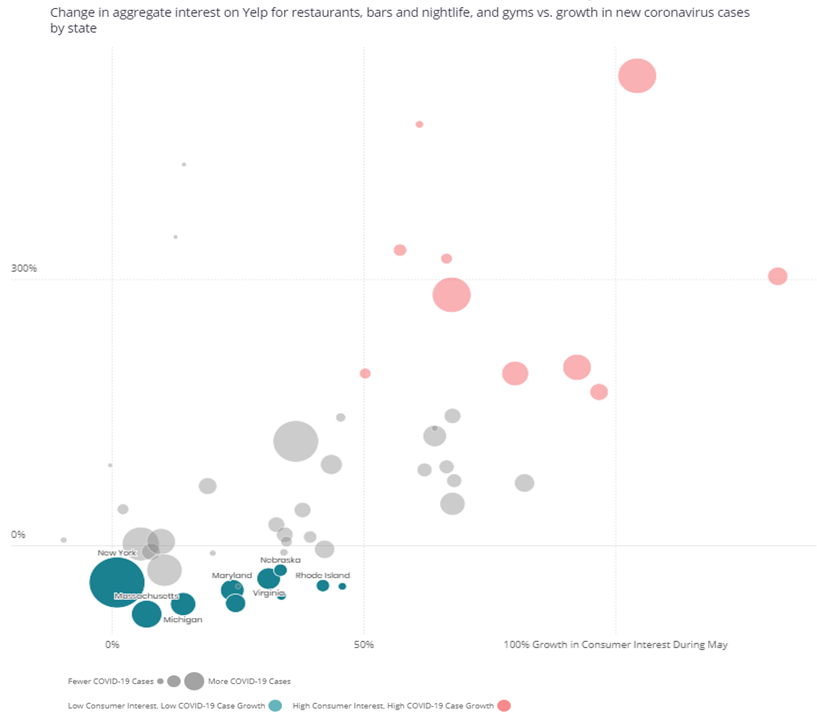

Increased Consumer Interest Correlates with COVID-19 Hot Spots (Yelp). As people began resuming common pre-pandemic activities – specifically, frequenting restaurants, bars, and gyms – a clear spike in COVID-19 cases within those locations quickly followed. Yelp website and mobile app activity data shows a statistically significant correlation between an increase of consumer interest in these activities in May and an increase in COVID-19 cases in June. The ten states with the largest increase in cases in June, including Idaho and Nevada, all saw a significant increase (50%+) in consumer interest in restaurants, bars, and gyms in May, relative to the shutdown level of activity in late March and early April. In the ten states with the largest decrease in cases in June, like Massachusetts and Michigan, consumer interest in the same activities increased by less than 50% in May relative to the shutdown in all ten states. The Yelp data offers state specific figures.

Bipartisan Interstate Compact Announced for Rapid Antigen Tests (Rockefeller Foundation). As the nation continues to face severe testing shortages and delays, the first interstate testing compact of its kind was signed by six governors – three Republicans and three Democrats – from Maryland, Louisiana, Ohio, Massachusetts, Michigan, and Virginia. North Carolina later announced its plans to join the compact as well. The agreement puts these states in discussions with Becton Dickinson and Quidel—the U.S. manufacturers of antigen tests that have already been authorized by the FDA—to purchase 500,000 tests per state, for a total of three million tests. By banding together, the states are demonstrating to private manufacturers that there is significant demand to scale up the production of these tests, which deliver results in 15-20 minutes. In addition, the states will coordinate on policies and protocols regarding rapid antigen testing technology. Additional states, cities, and local governments may join the compact in the coming days and weeks.

State Economic Performance

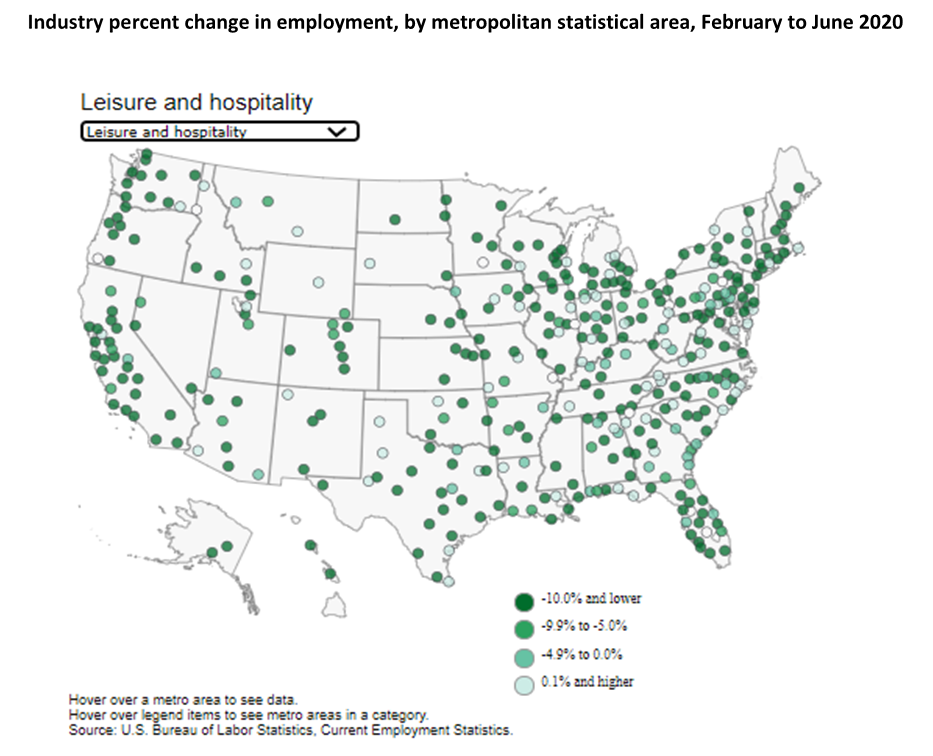

Geographic Impact of COVID-19 by Industry for Metro Areas (Bureau of Labor Statistics). The local spread of COVID-19 has differentially affected industry employment. Industries that are not very telework friendly are more likely to have job loss related to its spread. In addition, COVID-19’s spread appears to be most correlated with temporary job loss, which could partially explain employment numbers improving slightly in recent months. For industries such as construction and transportation and warehousing, the concern is that as the virus continues to spread, employees in these industries may face the prospect of additional layoffs. The first-order effect of the pandemic on workers’ employment status is clear, but the potential second-order effect of income uncertainty leading to even more reduced demand will also affect the economy. Evidence shows that increased uncertainty at the time likely led to a worsening of the Great Recession, partially because of reduced demand. Recent data shows savings dramatically increased in April 2020 as individuals are saving in response to future economic uncertainty. These considerations should be kept in mind as decisions surrounding opening businesses are made.

* * *

* Economic Outlook *

Perspectives on the Economy and What is Next for Recovery

The scale of the current pandemic-driven economic crisis is unprecedented. Tom Barkin, President and Chief Executive Officer of the Federal Reserve Bank of Richmond shared his perspectives on the state of the economy and prospects for recovery at a digital town hall held on August 11, 2020. The event was presented by the Center for Regional Economic Competitiveness and co-hosted by the State Economic Development Executives network. SEDE member Chris Chung, CEO of the Economic Development Partnership of North Carolina, moderated the digital town hall. President Barkin fielded a series of questions on what the future potentially holds for businesses, workers, and jobseekers as states move forward with reopening the economy. A link to the town hall recording is included above and available on the SEDE website.

* * *

Topics and Trends

Industry Watch

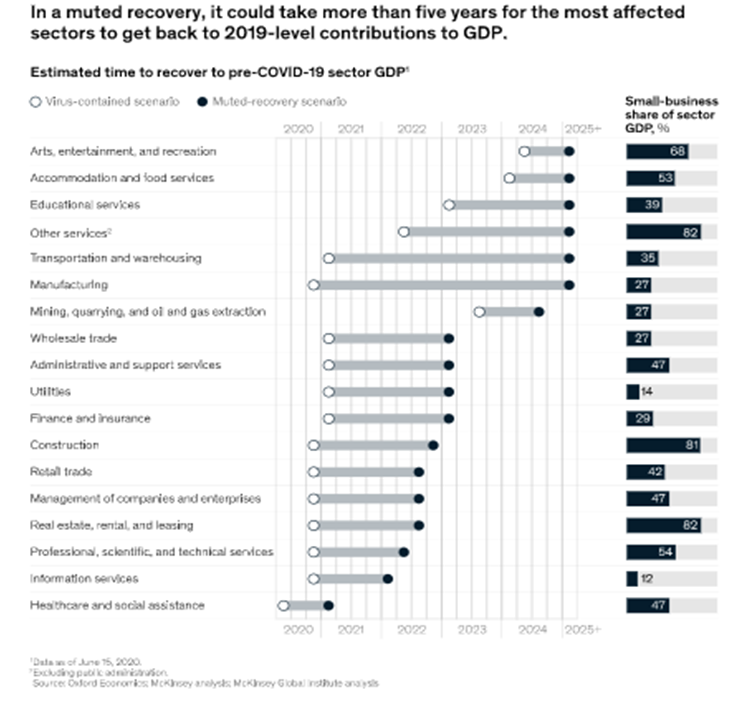

Maybe Years for COVID-19 Recovery in Hard-Hit Industries like Airlines (NPR). The airline industry is being heavily impacted by the pandemic. In the history of commercial air travel, airlines have never had a stretch as bad as the last few months. For instance, early in the pandemic, Delta Air Lines was losing $100 million each day. Now it is losing about $27 million a day. In an interview with National Public Radio, Delta CEO, Ed Bastian, discusses how the airline is prioritizing the health and well-being of passengers and crew through enhanced protocols to ensure the best travel experience for customers. “The bottom line is we’ve got to restore confidence amongst our consumer base in air travel,” Bastian said. Unfortunately, the airline industry is not alone. If the economic recovery from COVID-19 is muted (one of two scenarios executives view as most likely), some industries will take years to get back to their pre-pandemic normal. Many in those industries are small businesses, and their recovery may take even longer, if at all. For a McKinsey piece related to chart below, click here.

Trade/Tariffs

Canada to Slap Counter-Tariffs on U.S. Aluminum (International Business Times). The U.S. imposed punitive levies on imports of Canadian aluminum and steel in June 2018, and then relented as part of a free trade deal between the two countries and Mexico. The U.S. is now re-imposing a 10 percent tariff on Canadian aluminum, starting mid-August, in response to what Washington called a 27 percent “surge” in aluminum imports from Canada over the past year which “threatens to harm domestic aluminum production.” The Canadian aluminum industry disputed the U.S. data, saying there was no surge and noting that the United States consumes six times more aluminum than it produces and so relies on imports. Attacking Canadian suppliers, Ottawa said, would open the door to increased aluminum shipments from China and hit auto parts manufacturers particularly hard. Seventy percent of aluminum in cars sold in North America must be sourced from the continent, under the USMCA, which took effect on July 1. Canada plans to hit American aluminum products with $2.7 billion in counter-tariffs, targeting items like soda and beer cans, bicycles, golf clubs, and washing machines.

Opportunity Zones

Can Opportunity Zones Recover from the COVID-19 Crisis? (OpportunityDb). Opportunity Zones have the potential to help build national recovery and resiliency in the wake of the COVID-19 pandemic and economic crisis. OpportunityDb co-hosted a webinar briefing with OZ Accelerator to discuss prospects on August 5, 2020. The webinar featured opening remarks from Senator Tim Scott (R-SC) and a panel with guests from Urban Institute, Sen. Scott’s office, Sorenson Impact Foundation, Emsi, EIG, and SBA. Panelist remarks included how intentionality and collaboration are key to generating competitive returns with measurable social impact across four key impact categories: housing affordability, economic development, access to services, and environmental sustainability. Speakers also commented on how data can help tell a community’s OZ story to fit with economic recovery strategies, examples of ongoing OZ investments, how the SBA’s mission intersects with OZs in helping support small businesses, and new guidance from Treasury, among other topics. To view the Final Regulations on Opportunity Zones issued by the U.S. Treasury Department and IRS, click here.

COVID’s Impact on Opportunity Zone Funds May Surprise You (Millionacres). Considering that opportunity zones are among the most rural or low-income census tracts across the United States, concern over the performance of these funds as well as their ability to execute their initial projects is understandable. The Economic Innovation Group (EIG) conducted a national study in June in which 52% of Opportunity Zone Fund (OZF) respondents stated they have been negatively impacted by the coronavirus in some way. While some OZFs are being hit hard, with 37% of respondents saying they are making significant changes to their original OZ strategy, many OZFs are pushing forward, with minimal negative impacts from the pandemic. It seems the nature of the project and fund plays a huge role in the impact felt from the virus, more so than the location or demographics of the census tract. For instance, opportunity zone fund strategies focused on investments in hotels, retail, and office buildings have seen significant headwinds during the pandemic. By contrast, renewable energy projects are not tied to near-term fluctuations of power prices or the business cycle. For more information on Opportunity Zones, CDFA has extensive resources available, click here.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Automation and AI Can Level Playing Field for Women in Manufacturing (National Institute of Standards and Technology). Women make up 29 percent of the manufacturing workforce despite filling 47 percent of the positions in the overall workforce. While there have been periods of growth and decline, the dynamic is mostly unchanged since 1970, when women held 27 percent of the manufacturing jobs. But many experts say the growing adoption of automation and artificial intelligence (AI), combined with the critical need for knowledge-based workers, will create more opportunities for women in manufacturing. Manufacturing has been at the center of automation. The robot density rate in the United States has increased to 189 robots per 10,000 workers; a rate that will only increase with higher adoption of automation and AI. Meanwhile, research shows that gender diversity benefits a manufacturing firm by improving its ability to innovate and providing higher return on equity and increased margins. As the largest underutilized pool of available workers to manufacturers, women can be the key to closing the skills gap.

Innovation

Innovations Improving Global Health (McKinsey Global Institute). Today’s medical interventions are the innovations of the past. Without them, healthy lifespans would not be as long. The McKinsey Global Institute identified ten promising innovations, now in progress, that could have a material impact on health by 2040. For example, cellular aging (senescence) is considered an unavoidable physiological process that is not a viable field for drug development. But “Next-Generation Pharmaceuticals” like senolytics (a class of small molecules) may decrease or eliminate aging cells that can cause cellular inflammation, dysfunction, and tissue damage. This has implications for delaying age-related diseases. Other promising health innovations include: Omics and Molecular Technologies; Cellular Therapy and Regenerative Medicine; Innovative Vaccines; Advanced Surgical Procedures; Connected and Cognitive Devices; Electroceuticals; Robotics and Prosthetics; Digital Therapeutics; and Tech-Enabled Care Delivery. By 2040, these new technologies could reduce the total burden of disease by 6 to 10 percent.

Infrastructure

Billions Worth of Infrastructure Projects Delayed or Canceled during COVID-19 (ConstructionDive). Infrastructure projects totaling more than $9.6 billion have been delayed or canceled due to the COVID-19 pandemic, according to a report released by the American Road & Transportation Builders Association (ARTBA). Sixteen states announced project delays or cancellations worth approximately $5 billion, while another 20 local governments and authorities have scratched or put off projects worth another $4.54 billion. State DOTs have already seen revenues plummet by 14 percent through June 2020 when compared to the previous year and the National League of Cities found 65 percent of cities are being forced to delay or completely cancel capital expenditures and infrastructure projects. Going forward, at least 44 states project transportation authorities and local governments will have declining revenues. This points to additional increased pressure on transportation-related projects, as well as state and local budgets, leaving infrastructure contractors feeling grim about the funding environment.

* Check out the SEDE Website *

The SEDE Network engages in regular activities and events throughout the year. You can stay up to date on all these activities via the SEDE Network website. The newest addition to the site includes a collection of websites and other communication resources used by states to address the Coronavirus Challenge.

Click the link above and check it out!

Deal Makers

Incentives in Action

New York State’s Largest Incentive Packages (Albany Business Review). Two enormous investments in technology top the Largest State Incentive List for 2019. The largest is the $500 million package going toward the $1 billion Cree semiconductor plant currently being constructed outside Utica. That project — three buildings totaling more than 625,000 square feet of space — is expected to wrap up next year, with production of silicon carbide wafers set to begin in early 2022. Those types of chips can be used in electric vehicles and 5G infrastructure, among other uses. More than 600 jobs are expected to be created at the new factory. Hiring has already begun, and preproduction has started on the wafers at a lab at SUNY Polytechnic in Albany. SUNY Poly is also the home base of the second-largest incentive in 2019: IBM’s new $2 billion AI Hardware Center. New York is providing $300 million for new equipment and tools as part of the computer giant’s statewide investment.

* * *

– SEDE Webinar –

How to Leverage Higher-Ed to Attract New Employers

Northern Virginia became the envy of the nation when Amazon announced that it would build HQ2 at National Landing – a newly-named neighborhood that crosses the jurisdictional boundaries of the City of Alexandria and Arlington County. The region was successful for myriad reasons but the single most important factor, according to Amazon, was the talent pipeline that Virginia Tech (VT) would facilitate through their new Innovation Campus, located in the Alexandria portion of National Landing. Although VT is located hundreds of miles away in southwestern Virginia, their satellite location was a lynchpin for the success of the HQ2 project. The panel, which included Stephanie Landrum, President & CEO, Alexandria Economic Development Partnership; Stephen Moret, President & CEO, Virginia Economic Development Partnership; and Brandy Salmon, Associate Vice President for Innovation and Partnerships, discussed how local and state officials can leverage higher education institutions and establish a talent pipeline to attract new employers.

* * *

State Workforce Programs Show Importance, Need for Training and Talent (C2ER). Even before the COVID-19 pandemic and social unrest, states incentivized employers to support those out of work and provide opportunities for occupational advancement. These programs are crucial for getting people back into the labor market and providing the opportunities for reskilling and upskilling necessary to secure a living wage. A talented pool of labor, aligned with employer needs, encourages businesses to relocate to certain areas or expand their operations. The workforce development programs that states primarily develop and fund include skill upgrading, talent retention, pipeline development, and cluster and sector strategies. States accomplish these goals through internships, apprenticeships, youth training programs, partnerships with secondary schools, and collaboration across industry stakeholders, community-based organizations, educational institutions, and businesses. Several states recently added programs focused on workforce development, on top of the more than 250 programs states already implement. Massachusetts, Minnesota, North Carolina, Virginia, and Arizona all brought on new programs in the past year.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

Marine Energy Uses You Might Not Be Thinking About (U.S. Department of Energy). Expanding demand for ocean-derived food, materials, energy, and knowledge is driving rapid growth in the emerging “blue economy.” Ocean-related industries contribute more than $1.5 trillion in value added each year and that value is expected to double by 2030. The blue economy represents the interplay between economic, social, and ecological sustainability of the ocean. This interest and market size is fueling investment in next-generation maritime technologies. For instance, marine energy applications could provide energy to charging stations for electric boats and aircraft. Opportunities could exist off grid, such as charging stations in remote terrestrial locations or locations without grid accessibility, or at sea for craft (e.g., moored, station kept, or floating unmoored) to use to recharge and extend ranges. Other possibilities exist for ocean pollution cleanup and marine conservation, and for offshore data centers. As the costs and reliability of marine energy technologies continue to improve, they have the potential to provide local, renewable power to shore- and sea-based data centers, reduce cooling electrical loads, and share infrastructure and installation and operation and maintenance efforts.

Talent Development/Attraction

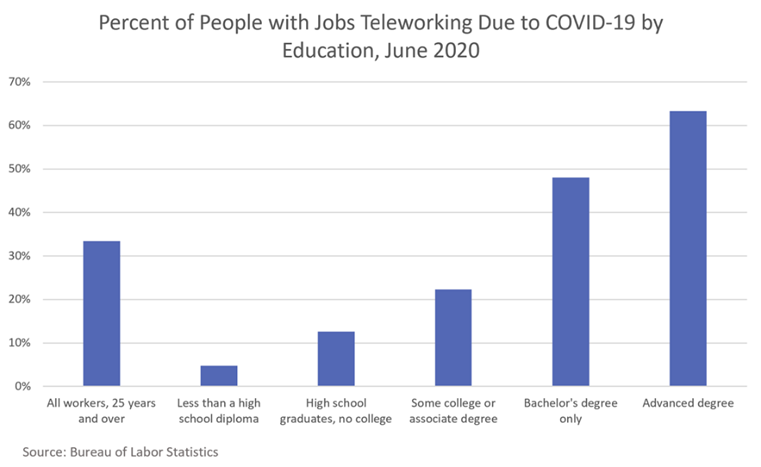

States Should Target Digital Skills Gaps as Economy Transforms (Government Technology). Jobs that require some college education will tend to demand digital literacy, especially in the aftermath of COVID-19. A recent report suggests that states must play a bigger role in meeting the growing need for digital skills, especially for middle-skill jobs. By 2022, the economy is projected to demand 3.4 million more middle-skill workers than what the labor force can provide. Typical examples of middle-skill jobs include clerical or administrative positions, sales, construction, repair/installation, and health care technicians. The more that technology advances in general, the more that middle-skill jobs will require digital literacy. While states generally emphasize broadband infrastructure and access in underserved communities, the report advises states to address digital skills training as part of regional economic development strategies in a widespread way. Broadband access, of course, is vitally important as more workers telework, as shown in the chart below. However, an example like Calbright, a California community college, teaching digital skills to low-wage and rural adult workers is also vital to fill the middle-skill jobs of the future.

Extending Unemployment Insurance Leads to Better Job Matches (National Bureau of Economic Research). While some economists argue that unemployment insurance (UI) may prolong unemployment by inducing jobseekers to put less effort into job search, recent research by Georgetown scholars find that extending UI benefits during recessions allows job-seekers to search for a better job match. Using employer- and employee-level data from the Longitudinal Employer-Household Dynamics survey and household-level data from the Current Population Survey, the authors rank each employee and job by wage, quality, and education or educational requirements. Focusing on the Great Recession, they find that a 53-week increase in UI benefit duration increases wages between 2.6% and 4.4%, increases the similarity between worker and firm quality rankings by 1.1%, and increases the likelihood that workers end up in jobs with higher education requirements by 14.4%. The authors argue that since there is no evidence that recessions affect the skill requirements of firms, workers are finding jobs that better match their education. These effects are larger for women, non-whites, and less-educated workers.

* * *

SEDE Network Updates

* Upcoming SEDE Training Opportunity *

Designing and Managing Business Incentive Compliance Efforts

November 9, 10, 16, 17, 2020

2:00 pm – 4:30 pm EDT

This training workshop provides state agency staff with the skills and insights to implement best practices in incentives monitoring and management. The workshop reviews common operating procedures, identifies critical issues, and explores options and tradeoffs to help staff make intentional choices to protect taxpayer investments in business incentives. Agency staff will be able to review and redesign operating procedures, confident their approach will be effective, but not overly burdensome, in leveraging reliable data for monitoring business compliance and program performance.

Instructors will provide guidance and best practices to state agency staff in incentives compliance procedures, especially related to:

- Clarity on the rules for companies using incentives. By and large, companies are willing to comply if they know the rules and they are easy to follow.

- Public sector data collection, validation, and management procedures

- Working with the company for successful compliance

- Dealing with noncompliance

- Reporting compliance and performance impacts to decision makers

Target Audience:

This training program is targeted to state agency economic development professionals assigned to manage or implement compliance procedures. It may also be valuable to local EDO staff or leadership that oversee compliance personnel or activities or want to learn more about the mechanics of business incentive compliance.

Meet the Instructors:

Ellen Harpel, President, Business Development Advisors/ Smart Incentives

Jane Vancil, CEO, Incentilock

* * *

The SEDE Network Steering Committee includes: Stefan Pryor (RI), Chair; Val Hale (UT), Vice Chair; Julie Anderson (AK); Dennis Davin (PA); Jennifer Fletcher (SC); Kurt Foreman (DE); Joan Goldstein (VT); Manuel Laboy Rivera (PR); Kevin McKinnon (MN); Don Pierson (LA); Mike Preston (AR); Sandra Watson (AZ).

For further questions on the content in this Bulletin or for information on the SEDE Network contact Marty Romitti, CREC Senior Vice President, at mromitti@crec.net