State Economic Development Bulletin – June 2023

Headlines

SEDE News

Spotlight: Kevin McKinnon – Deputy Commissioner, MN Dept. of Employment & Economic Development

$50M ‘Build to Scale’ Program Launched (U.S. EDA)

Regional Technology and Innovation Hubs (Tech Hubs) NOFO Released (U.S. EDA)

EDA Prepares for Recompete Pilot Program NOFO (U.S. EDA)

MEP Awards $20 Million for Domestic Supply Chains Resiliency (NIST)

Economy

The U.S. Added 339,000 Jobs in May. It’s a Stunningly Strong Number (NPR)

Inflation Has Eased, but Economists Are Still Worried (The New York Times)

Trade

More Countries Line Up for U.S.’s EV Tax Credits (Politico)

Why the World Still Needs Trade (Foreign Affairs)

Industry Trends

From Teachers to Waiters: The Industries that Haven’t Bounced Back from the Pandemic (CNN)

A Manufacturing Investment Supercycle is Starting (Axios)

DOD Enters $13.8 Million Agreement to Expand Domestic Manufacturing (U.S. DOD)

How AI Will Accelerate the Circular Economy (Harvard Business Review)

Workforce

The Post-Pandemic Workforce: New Data About the U.S. Labor Market After Coronavirus (Reuters)

Why Americans Want Part-time Jobs Again (Time)

Commerce Invests $1.7 Million to Expand Truck Driver Workforce Training in NC (EDA)

Finance And Incentives

GM, SDI Will Build a $3 Billion Battery Manufacturing Plant in Indiana (Reuters)

Energy Tax Credits, Meant to Help U.S. Suppliers, May Be Hard to Get (The New York Times)

Company Secures $850M Loan for Battery Manufacturing Plant in Arizona (VTDigger)

Oregon Lawmakers Advance $255M in Additional Chip Industry Tax Incentives (OregonLive)

Ultra Safe Nuclear Corp. Plans $232M Micro-Reactor Assembly Plant in Alabama (Al.com)

Nevada Introduces State Incentives for Electric Trucks and Buses (Electrek)

SEDE News

Spotlight: Kevin McKinnon – Deputy Commissioner, MN Dept. of Employment & Economic Development Kevin McKinnon was appointed Deputy Commissioner of Economic Development at the Minnesota Department of Employment and Economic Development (DEED) in November 2014 after serving as the director of business development and executive director of the division. As Deputy Commissioner, he oversees five offices covering business development, business finance, community finance, trade, and broadband development. In addition to his positions at DEED, McKinnon served as the president of the Greater Fargo Moorhead Economic Development Corp., a Minnesota-North Dakota economic development partnership. He also served in a leadership role with the River Heights Chamber of Commerce in the Twin Cities area and was an economic development analyst with the City of Colorado Springs, Colorado. McKinnon has served on various committees and boards, including the Economic Development Association of Minnesota and the International Economic Development Council, and is a member of Economic Development and Corporate Real Estate Associations. He holds a bachelor’s degree from the University of North Dakota in Grand Forks and lives with his family in a Twin Cities suburb.

Spotlight: Kevin McKinnon – Deputy Commissioner, MN Dept. of Employment & Economic Development Kevin McKinnon was appointed Deputy Commissioner of Economic Development at the Minnesota Department of Employment and Economic Development (DEED) in November 2014 after serving as the director of business development and executive director of the division. As Deputy Commissioner, he oversees five offices covering business development, business finance, community finance, trade, and broadband development. In addition to his positions at DEED, McKinnon served as the president of the Greater Fargo Moorhead Economic Development Corp., a Minnesota-North Dakota economic development partnership. He also served in a leadership role with the River Heights Chamber of Commerce in the Twin Cities area and was an economic development analyst with the City of Colorado Springs, Colorado. McKinnon has served on various committees and boards, including the Economic Development Association of Minnesota and the International Economic Development Council, and is a member of Economic Development and Corporate Real Estate Associations. He holds a bachelor’s degree from the University of North Dakota in Grand Forks and lives with his family in a Twin Cities suburb.

$50M ‘Build to Scale’ Program Launched (U.S. EDA) The EDA is accepting applications for its Build to Scale (B2S) program to “support projects that strengthen equitable ecosystems and increase access to

capital for innovators, entrepreneurs, and startups.” The B2S Program has two competitions: the Venture Challenge, which supports programs that enable high-growth technology entrepreneurship, and the Capital Challenge, which increases access to capital in communities where risk capital is in short supply. Each challenge has multiple funding tiers, with an entry-level opportunity created this year for the Venture Challenge. The deadline to apply for this opportunity is July 28, 2023. For more information, visit EDA’s B2S program website.

Regional Technology and Innovation Hubs (Tech Hubs) NOFO Released (U.S. EDA) The Tech Hubs program will invest directly in regions with the assets, resources, capacity, and potential to transform into globally competitive innovation centers in approximately 10 years while catalyzing the creation of good jobs for American workers at all skill levels, both equitably and inclusively. On May 12, 2023, EDA published the Tech Hubs Phase 1 Notice of Funding Opportunity (NOFO) (PDF)—the first of two phases.

- PHASE 1 (Deadline: August 15, 2023): EDA will designate at least 20 Tech Hubs across the country and will separately award approximately $15 million in strategy development grants to accelerate the development of future Tech Hubs. The Tech Hubs designation will be a widely recognized indicator of a region’s potential for rapid technology-led economic growth.

- PHASE 2 (EDA expects to release the Phase 2 NOFO in Fall 2023.): In Phase 2, EDA will make at least 5 implementation awards to designated EDA Tech Hubs. Only Tech Hubs that EDA designates during Phase 1 are eligible to apply for Phase 2.

EDA Prepares for Recompete Pilot Program NOFO (U.S. EDA) The Recompete Pilot Program will support economic revitalization in distressed communities across the country. The program will target areas where prime-age (25-54 years) employment significantly trails the national average, with the goal to close this gap through flexible, bottom-up strategy development and implementation investments.

EDA will deploy funding through a two-phase competition which will be detailed in the upcoming NOFO.

Administration Awards $20 Million for Domestic Supply Chains Resiliency (NIST) The Hollings Manufacturing Extension Partnership (MEP), a program of the U.S. Department of Commerce’s National Institute of Standards and Technology (NIST), awarded roughly $400,000 to each of its MEP National Network Centers. The total $20 million in funding will make domestic supply chains more efficient. These awards will support a database called the National Supply Chain Optimization and Intelligence Network (SCOIN), which focuses on scouting services, filling supply chain gaps, and creating a map of U.S. supplier capacity. Each center must dedicate one staff member or contractor per year for an initial two years, with potential extension.

Economy

The U.S. Added 339,000 Jobs in May. It’s a Stunningly Strong Number (NPR) A report from the U.S. Department of Labor states that job gains for last month were higher than initially expected, continuing trends seen since March. These strong numbers indicate that significant hiring in industries such as business services, health care, and hospitality continue to grow. Construction companies alone added 25,000 jobs in May, despite challenges seen in the housing market. However, despite this growing number of jobs, unemployment increased to 3.7% in May as more workers returned to the workforce. This tight job market has a strong outlook for workers but can contribute to continued concerns about inflation and price stability.

Inflation Has Eased, but Economists Are Still Worried (The New York Times) Inflation is beginning to abate meaningfully for American consumers as prices are no longer climbing as rapidly across a wide array of products. The Fed has spent the past 15 months locked in an aggressive war against inflation, raising interest rates above 5 percent in an attempt to get price increases back down to a more normal pace. Fed Chair Jerome Powell emphasized that it was too early to declare victory in the battle against rapid price increases.

Trade

More Countries Line Up for U.S.’s EV Tax Credits (Politico) Southeast Asian nations including the Philippines, Malaysia, and Indonesia, are in negotiations to take advantage of the U.S. tax perks for electric vehicles. The Indo-Pacific Economic Framework, a trade initiative the Biden Administration launched with 13 other countries, could enable electric vehicle batteries made with critical minerals to qualify for tax credits that were created through the U.S. Inflation Reduction Act. The law requires foreign countries to have a free trade agreement with the U.S. in order to be eligible. These tax credits were created to incentivize the adoption of electric vehicles and increase domestic manufacturing, but these countries are seeking to boost their own production of clean technology using the tax credits..

Why the World Still Needs Trade (Foreign Affairs) Globalization and economic interdependence has historically been crucial for the growth of the world’s largest economies. Barriers have been torn down to increase economic activity between nations, leading to greater prosperity, decreased poverty, and improved relations. However, in the past 15 years, this vision has been contested and shocks such as the global financial crisis, the COVID-19 pandemic, and the war in Ukraine have strained global trade relations. Okonjo-Iweala, the Director General of the World Trade Organization, argues that interdependence of these global economies is not the issue, but the overconcentration of some trade relationships for vital products could be improved upon, so that when there are supply chain challenges, the output of these products is at risk. “Reglobalization,” creating more diversified global supply chains, could be an alternative.

Industry Trends

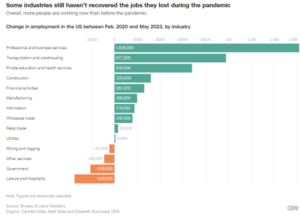

From Teachers to Waiters: The Industries that Haven’t Bounced Back from the Pandemic (CNN) Many industries such as transportation and warehousing have recovered, and even gained, workers since the pandemic. However, some industries are still struggling to recover lost workers. The four sectors employing fewer workers now compared to before the pandemic are leisure and hospitality, government, other services, and mining and lodging. Leisure and hospitality have the largest shortage of workers, losing 349,000 workers. Overall, more people are working now than before the pandemic, but may have switched industries due to pandemic closures; therefore, many of these industries have not been able to bounce back.

(CNN) Many industries such as transportation and warehousing have recovered, and even gained, workers since the pandemic. However, some industries are still struggling to recover lost workers. The four sectors employing fewer workers now compared to before the pandemic are leisure and hospitality, government, other services, and mining and lodging. Leisure and hospitality have the largest shortage of workers, losing 349,000 workers. Overall, more people are working now than before the pandemic, but may have switched industries due to pandemic closures; therefore, many of these industries have not been able to bounce back.

A Manufacturing Investment Supercycle is Starting (Axios) There is currently billions of dollars flooding into large megaprojects to manufacture batteries, solar cells, semiconductors, and more. This is due to allocated funds from the Biden Administration’s legislation: the Inflation reduction Act, Bipartisan Infrastructure Law, and CHIPS and Science Act. Since April, spending on manufacturing construction is at a $189 billion annual rate, triple the average rate of the 2010s. The construction sector has added 192,000 jobs over the last year, despite challenges in the housing sector. This investment typically involves much larger capital outlays than what has previously been seen, such as two European companies announcing an investment of $2 billion in Texas for a synthetic natural gas plant. These facilities tend to create high-wage jobs, which could put sustained pressure on wages.

DOD Enters $13.8 Million Agreement to Expand Domestic Manufacturing (U.S. DOD) The Department of Defense’s Office of the Assistant of Defense for Industrial Base Policy announces it has entered a $13.8 million agreement with the Timken Company to increase production of high-precision ball bearings in Keene, New Hampshire. Timken is also further investing $11 million to expand its facility. The funds will be used for operational and technological improvements at the facility, such as upgrading equipment and operator training. The supply of ball bearings is a constraint in increasing demand for advanced systems, so this investment will support important sectors and expand domestic supply chains.

How AI Will Accelerate the Circular Economy (Harvard Business Review) The Digital, Data, and Design (D^3) Institute at Harvard Business School hosted an event focused on the circular economy, which is when businesses recover or recycle resources used in their value chain to increase productivity. Entrepreneurs and business leaders are using artificial intelligence (AI) to remove barriers and create new business models. Three main ways were identified to achieve a more circular economy: increasing product utilization, material efficiency, and use of recycled materials. In order to fully invest in the development of a circular economy, barriers must be eliminated, most easily through investors finding innovative solutions to these methods and bridging the gap that exists in funding. By doing so, there is potential for increased productivity both through the development of a circular economy and the usage of AI to do so.

Workforce

The Post-Pandemic Workforce: New Data About the U.S. Labor Market After Coronavirus (Reuters)

The latest data from the BLS Occupational Employment and Wage Statistics program shows how the U.S. economy has adapted post-pandemic. Increases in work from home, expansions in the logistics industry, and technological changes led to an increase in managerial jobs and a decrease in office administration support positions. Transportation jobs especially grew, as demand for delivery services grew. Some smaller jobs have seen rapid growth, such as solar panel installers, counselors and therapists, and human resource specialists. However, some of these trends may be short-term due to demands resulting from pandemic recovery; tracking which of these workforce trends continue in the long-term will be important.

Why Americans Want Part-time Jobs Again (Time) More Americans are interested in part-time and freelance work, seeking greater flexibility. The number of people working part-time for non-economic reasons, or by choice, reached 21.8 million in May, which is greater by 5% from last year. Some of this rise in part-time workers is due to Baby Boomers who are still working but are mostly retired. However, many younger workers are also preferring part-time work to account for other responsibilities such as child-care or caregiving for aging parents. This growth in part-time work even during high inflation suggests this could be a long-term trend.

Commerce Invests $1.7 Million to Expand Truck Driver Workforce Training in NC (EDA) The Guilford Technical Community College in Jamestown, North Carolina will receive a $1.7 million grant from EDA to construct a truck driver training facility on the East Greensboro campus. This investment will be matched with $2.6 million in state funds and is expected to create 1,782 jobs. The funds will be used to create an asphalt training pad, parking, lot, and other infrastructure upgrades in order to efficiently provide training. This investment will create pathways to professional growth by increasing training opportunities in an underserved area.

Finance and Incentives

GM, SDI Will Build a $3 Billion Battery Manufacturing Plant in Indiana (Reuters) Scheduled to begin operations in 2026, General Motors (GM) and Samsung SDI will build a more than $3 billion electric vehicle battery cell plant in Indiana. The U.S. Energy Department finalized a $2.5 billion loan to the joint venture late last year. This plant will be near New Carlisle, Indiana and aims to create 1,700 jobs. GM predicts to build 400,000 electric vehicles in North America through mid-2024 and is considering building at least two additional plants to meet demand.

Company Secures $850M Loan for Battery Manufacturing Plant in Arizona (VTDigger) The U.S. Department of Energy announced plans to loan KORE Power Inc., a battery manufacturing company, $850 million to fund construction of a new manufacturing facility in Buckeye, Arizona. This funding, administered through the Advanced Technology Vehicles Manufacturing Program, will be used to construct a 1.3 million square foot facility, and will employ over 1,250 people.

Energy Tax Credits, Meant to Help U.S. Suppliers, May Be Hard to Get (The New York Times) The Inflation Reduction Act offers tax credits that can cover up to 70% of a renewable energy project’s cost if it meets criteria. However, in the short-term, many of these credits may be challenging to use due to new rules for eligibility. Manufacturers are concerned that in order to qualify for credit with 40% of the product being U.S. produced content, they may need to calculate each individual component in order to reach the threshold. The Inflation Reduction Act is overall a benefit for decarbonization and provides a strong incentive to utilize them. The Treasury Department is still accepting comments on the rules to be used for administering the credits.

Oregon Lawmakers Advance $255M in Additional Chip Industry Tax Incentives (OregonLive) Lawmakers in Oregon approved $255 million in tax credits for semiconductor research in the state for over five years. A robust tax credit in research and development will assist in attracting investment to revive the state’s computer chip industry and semiconductor manufacturing. However, the bill requires companies receiving enterprise zone incentives to negotiate a fee with local school districts to offset the loss in portion of property tax revenue.

Ultra Safe Nuclear Corp. Plans $232M Micro-Reactor Assembly Plant in Alabama (Al.com) Seattle-based company Ultra Safe Nuclear Corp. will build a $232 million micro-modular reactor assembly plant in Gadsden, Alabama. The plant will have 250 employees, both professional and technical workers. The facility will begin operations in 2027 and will manufacture, assemble, and test non-radiological modules to construct the reactor. Gadsden competed against other locations, but the unique facility will support Alabama’s interests in advanced manufacturing operations.

Nevada Introduces State Incentives for Electric Trucks and Buses (Electrek) The Nevada Clean Trucks and Buses Incentive program was signed into law, which provides incentives for Nevada-based businesses and organizations that own gas or diesel-powered trucks and buses to switch to electric vehicles. The base incentive is determined by the gross vehicle weight rating class; incentives range from $20,000 for the lowest weight class to $175,000. Additional incentives can be combined with base incentives for independent truck owners, school districts, or disadvantaged small businesses.

The State Economic Development Executives (SEDE) Network engages in regular events throughout the year. State Economic Development.org lists these activities and offers an interactive forum for discussion among peers.

The SEDE Steering Committee includes: Sandra Watson (AZ), Chair; Don Pierson (LA), Vice-Chair; Kurt Foreman (DE); Kevin McKinnon (MN); Christopher Chung (NC); Alicia Keyes (NM); Andrew Deye (OH); Sophorn Cheang (OR); Adriana Cruz (TX); Joan Goldstein (VT); and Mike Graney (WV).

Leif Olson of the Center for Regional Economic Competitiveness (CREC) led the development of this Bulletin; for questions on the content in this Bulletin or for information on the SEDE Network contact Bob Isaacson, CREC Senior Vice President.