Latest News

* SEDE Network Testifies at IRS Hearing on Opportunity Zones *

Mark Troppe testified on behalf of the SEDE Network at an IRS hearing on Opportunity Zones held on July 9, 2019. This second public hearing for the second round of Opportunity Zone proposed regulations showed that the program’s staunchest advocates are still hoping the federal government will make changes to the rules before they are finalized. The group testifying was made up largely of attorneys, accountants and developers who are trying to make use of the program. Many testified about specific language in the last set of regulations that creates barriers to achieving hoped-for objectives. For more on the hearing, click here. Specifically, the SEDE Network testimony, signed by 16 state executives, made 5 key points and expressed the Network’s desire for changes that enable the program to serve both real estate development and the fostering of operating businesses and attracting investment to both.

Read the SEDE Network Testimony to the IRS

State Economic Performance

Entrepreneurship in States: Fostering a Startup-Friendly Economy (National Governors Association). States are increasingly devoting more attention to an important, yet sometimes overlooked, tool for economic development: fostering entrepreneurship. Entrepreneurship can help overcome economic challenges – from growing global competition to lagging rural areas – as well as vocational barriers. There is an opportunity to spark entrepreneurship in young adults who are disconnected from the workforce, in mid-career adults and retirees seeking new opportunities, and in parents who desire flexible employment options. The National Governors Association (NGA) released a comprehensive report, Entrepreneurship in States: Fostering a Startup-Friendly Economy. In this report, NGA has provided cases highlighting state visioning, data collection, financial amenities, regulatory approaches, broadband needs, rural programming, targeting underserved communities and more. For instance, the report identifies that an important issue for the success of state entrepreneurship initiatives is determining how the state EDO can best function together with regional and local entrepreneurial support organizations to support entrepreneurial communities in the state. Successful entrepreneurial communities tend to have cultures that allow for the easy creation and existence of public-private partnerships (PPPs), so it is in a state’s interest to reach out to the private and nonprofit ESOs that operate entrepreneurial spaces and networks. Lack of a public-private culture can impede entrepreneurship and so must be addressed.

Topics and Trends

Industry Watch

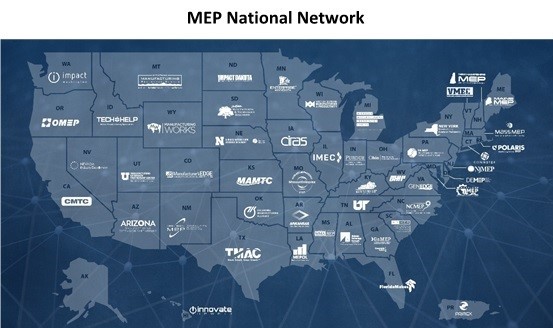

Types of Robots Every Manufacturer Should Know (National Institute of Standards and Technology). There is a lot of buzz these days in the manufacturing sector about robots — and how they can help manufacturers address challenges faced in today’s market, such as increased productivity and the scarcity of skilled workers. But what exactly do analysts and automation experts mean when they use the word “robot?” And how can different types of robots improve a manufacturing operation? This MEP blog post provides an overview of four types of industrial robots that every manufacturer should know. The MEP National Network is comprised of the National Institute of Standards and Technology’s Manufacturing Extension Partnership (NIST MEP), 51 MEP Centers located in all 50 states and Puerto Rico, and its over 1,300 manufacturing experts at over 400 service locations, providing any U.S. manufacturer with access to resources they need to succeed.

Trade/Tariffs

Breaking Through Trade Barriers (International Trade Administration). Trade barriers are government-imposed policies, practices, or procedures that unfairly or unnecessarily restrict U.S. exports or investments. Examples include discriminatory tariffs, where higher tariffs and taxes are assessed unfairly to U.S. exporters compared to foreign competition. There’s also border barriers such as burdensome customs procedures, technical barriers such as unfair testing requirements, and many others. Careful export planning—such as practical advice from your nearest U.S. Commercial Service office of the International Trade Administration (ITA)—can help avoid or mitigate potential problems. Companies can also directly report a trade barrier by using an online form. ITA’s market access, country, policy and industry specialists can help with trade barrier issues. Experts will evaluate and determine whether a company’s case involves a trade barrier or provide referrals to other federal agencies. This video is part of ITA’s Export Basics Series focused on Managing Challenges in Foreign Markets.

Opportunity Zones

Navigating Opportunity Zones: Community Partners Playbook (Local Initiatives Support Corporation). Opportunity Zones promise to drive billions of dollars in long-term investment into low-income urban and rural census tracts across the country. The goal of this new incentive, part of the 2017 Tax Reform and Jobs Act, is to achieve a double bottom line: fueling inclusive local economies that benefit the people who live and work there and providing a solid return to investors. But to make that happen, community stakeholders, state and local government leaders, investors and developers must work together to engage responsibly with this powerful but untested tool. The Local Initiatives Support Corporation (LISC), Council for Development Finance Agencies (CDFA), and Ford Foundation developed a playbook for community partners on Opportunity Zones which lays out possible trajectories and best practices. For more information on Opportunity Zones, CDFA has extensive resources available, click here.

HUD Bets on Tech Innovation for Opportunity Zones (DS News). The U.S. Department of Housing and Urban Development (HUD) has announced that it will co-lead an Opportunity Zone-focused workforce challenge of the U.S. Census Bureau’s “The Opportunity Project (TOP)” initiative. TOP is an accelerator program that matches tech companies, universities, government, and communities to create useful digital products for the public. The Census Bureau’s Opportunity Project utilizes the expertise of professionals from across government, the technology sector, and private business to focus on a specific challenge during designated ‘sprints.’ For this challenge, HUD said that it will collaborate with the private sector so that stakeholders in Opportunity Zones, including communities and investors, can use technology to strengthen investments in underserved areas. The final products for the challenge will be shared in Washington, D.C. in December 2019.

Treasury Wrestles with How to Measure Success in Opportunity Zones (Politico).Opportunity Zones have been hailed as a boon for the poor, and lambasted as a boondoggle for the rich, but how would anyone know for sure? There are no requirements that people participating in the potentially lucrative economic development program detail what they are doing, where they are doing it, and why they are doing it. The Treasury Department is now considering filling that gap with reporting requirements and has asked the public for recommendations as to what sort of information it ought to be collecting. Many groups are pushing Treasury to not only track how many jobs are being created and whether the program is reducing poverty, they also want the department to monitor things like whether affordable housing is becoming scarce in the zones and if the program is pushing low-income people out of their communities. Some want to know the extent to which investors consulted with residents in developing their projects, data on how many people from disadvantaged groups are hired, and whether investors are putting money into minority-owned businesses. That sort of detailed reporting would allow analysts to better understand how the program is working.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

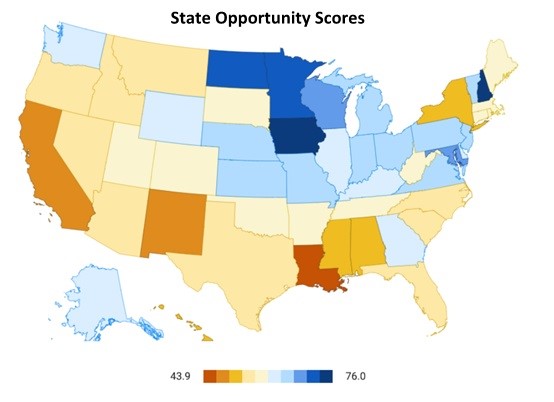

State Scores for Promoting Opportunity 2019 (U.S. News & World Report). New Hampshire is the top state for providing opportunity, according to U.S. News & World Report measures. It is followed by Iowa, Minnesota, North Dakota and Maryland to round out the top five. The states were ranked in their capacity for providing opportunities for all their citizens. The U.S. News & World Report methodology shows rankings for each of the 50 U.S. states in 71 metrics across eight categories. The data behind the rankings aim to show how well states serve their residents in a variety of ways. To determine opportunity, three measures were considered: Affordability, Economic Opportunity, and Equality. Affordability measures the cost of living and housing affordability by comparing median incomes to median home prices. Economic opportunity tracks income inequality, median household income, poverty rates and food insecurity rates. Equality measures gender parity, racial inequality in education rates, income and unemployment rates, and more.

Innovation

Universities Search for New Funding to Make Up for Decreasing State Aid (State Science & Technology Institute). A decade since the Great Recession hit, state spending on public colleges and universities remains well below historic highs, despite recent increases. Overall state funding for public two- and four-year colleges is nearly $9 billion below the 2008 level, after adjusting for inflation. While highly ranked research universities have been able to adapt to declining subsidies by raising tuition, attracting out-of-state and international students, and sometimes raising funding from philanthropic sources, public universities outside of this top tier have not been able to replace lost dollars. Research from the National Bureau of Economic Research (NBER) examines the impact of declining state support for public research universities on their educational and research functions. The report notes that the quantity of undergraduate and graduate degrees awarded has been affected by budget cuts, and expresses concern that continued stagnation of state support for public universities will adversely impact both the supply of skilled workers with undergraduate and graduate degrees to the workforce and the long-term research capacity which contributes to economic growth.

Infrastructure

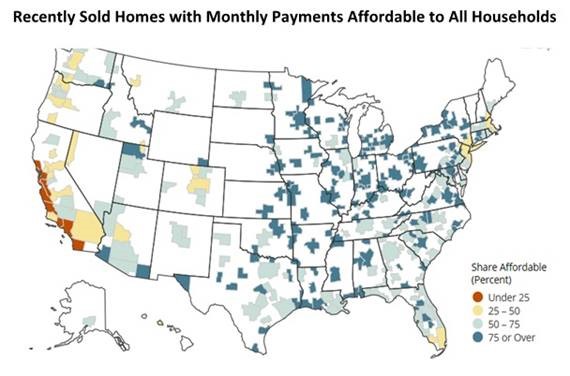

The State of the Nation’s Housing 2019 (Harvard Joint Center for Housing Studies).Although household growth is returning to a more normal pace, Harvard’s Joint Center for Housing Studies report on the State of the Nation’s Housing shows that housing production still falls short of what is needed, which is keeping pressure on housing prices and rents and eroding affordability. While demographic trends alone should support a vibrant housing market over the coming decade, realizing this potential depends heavily on whether the market can provide a broader and more affordable range of housing options for tomorrow’s households. Affordable payments are defined as requiring less than 31% of monthly household income. Concern about a rental affordability crisis has increased especially as cost burdens have moved up the income scale in many areas of the country. Households with incomes under $15,000 continue to have the highest burden rates, with 83 percent paying more than 30 percent of income for housing, including 72 percent paying more than 50 percent. Meanwhile cost-burden rates climbed 4.6 percentage points among households earning $30,000–44,999 and nearly 2.9 points among those earning $45,000–74,999.

Deal Makers

Incentives in Action

Missouri and Kansas Near Cease-Fire Over Incentives (Wall Street Journal). Tired of fighting to attract business, Missouri and Kansas are nearing a truce in an economic border war that has cost hundreds of millions of dollars and created barely any new jobs. The agreement aims to ban tax breaks for companies that change addresses in greater Kansas City. Missouri Governor Mike Parson, a Republican, has signed legislation that would prohibit companies from receiving tax incentives for jumping the state’s border within the Kansas City region. Kansas Governor Laura Kelly, a Democrat, said she was prepared to sign an executive order agreeing to the truce. The legislation takes effect only if both parties agree.

Michigan Reorganizes Workforce and Economic Development Department (Crain’s Detroit Business). Michigan Governor Gretchen Whitmer signed an executive order which consolidates and reorganizes the state’s workforce and economic development department to meet Michigan’s business and labor needs. The E.O. combines the state’s workforce and economic development functions into the Labor & Economic Opportunity Department (LEO), formerly the Department of Talent and Economic Development (TED). In addition to the reorganization and renaming, the governor appointed Jeff Donofrio as the new director to lead the agency. The reorganized department will house the state’s leading economic development programs, including the Michigan Economic Development Corporation and the Michigan Strategic Fund. Whitmer said her changes will place an emphasis on workforce readiness and the traditional job-wooing and retention work of economic development.

Movie Making Returns to Mississippi with Expansion of Incentive Program (WLOX Jackson). The Mississippi legislature approved the revival of a film incentive package that expired in 2017, and it’s already drawing new movies to the state. Senate Bill 2603 allows Mississippi to offer rebates to motion picture production companies that work in the state. It allows for 25 percent tax rebates for non-resident cast and crew on films. Part of the incentives includes a commitment to hiring at least 20% locals and training them, a welcome opportunity for those who thought they would have to move off to live their filmmaking dream. One production impacted by the new incentive, Breaking News in Yuba County, was scheduled to shoot in Baton Rouge. It is being directed by Mississippi-native Tate Taylor who is now shooting the movie in Natchez and plans to keep making films in the state.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

Development Finance for Food Systems (Council of Development Finance Agencies). CDFA’s Food Systems Finance White Paper Series demonstrates how traditional development finance tools can be used to support the growth of area food systems in order to demonstrate their viability as an asset class. The first publication in the series introduced food systems and development finance, while the second publication showed how efforts within the food system can gain access to capital to support the growth and expansion of businesses and projects. This latest release, Food Systems & Bonds, focuses on the ‘bedrock tool’ of development finance – bonds – and how this kind of financing can be applied to local and regional food systems. The paper provides an overview of bonds including the basic categories and types, as well as the players and processes involved in bond deals. The case studies section showcases numerous examples of bonds being used for food-related work.

Talent Development/Attraction

What People Look for in Jobs and Locations (Development Counsellors International). By understanding how people choose jobs and locations, communities can strategically market themselves to attract talent and win the war for talent. Most people are willing to move for the right reasons. In fact, nearly 85% said they would describe themselves as willing to relocate, either for a new job (48%) or for a better quality of life (34%). When assessing a location, talent prioritizes practical matters like housing cost, cost of living, healthcare and housing availability. While communities may not be able to “change” proximity to friends and family, what they can do is highlight their welcoming and friendly residents—which is the fifth most important factor for talent. Healthcare also remains a top factor for talent across all of DCI’s talent research. First-hand experience and word of mouth remain the dominant factors for forming community impressions, underscoring the importance of tourism. Internet research is also extremely important and is likely leaned on when there is no first-hand experience or word of mouth.

Best Cities for Jobseekers 2019 (Indeed). Choosing where to live and work is a complex decision. Personal preferences are certainly important, such as warm or cold weather, coastal living versus inland and proximity to friends and family. But there are some considerations that can make certain areas seem more desirable than others. These include cities where job seekers: face the least competition for jobs; command the highest salaries; work at the highest-rated companies; and face a low likelihood of unemployment. Based on these criteria, Indeed, one of the largest job sites in the world, reviewed its job-search and posting data to create this year’s list of the best cities for job seekers. Two California cities, San Jose and San Francisco, top the overall scores. Beyond that, every region of the U.S. made an appearance in the top 10. In the West, Salt Lake City ranks at number 10. Boston (number three) and Washington, DC (number nine) are the best cities for job seekers on the East Coast. Birmingham, Alabama (number four); Nashville, Tennessee (number five) and Oklahoma City (number eight) are the best Southern cities for job seekers, with Minneapolis-St. Paul (number six) and Milwaukee (number seven) representing the Midwest.