Latest News

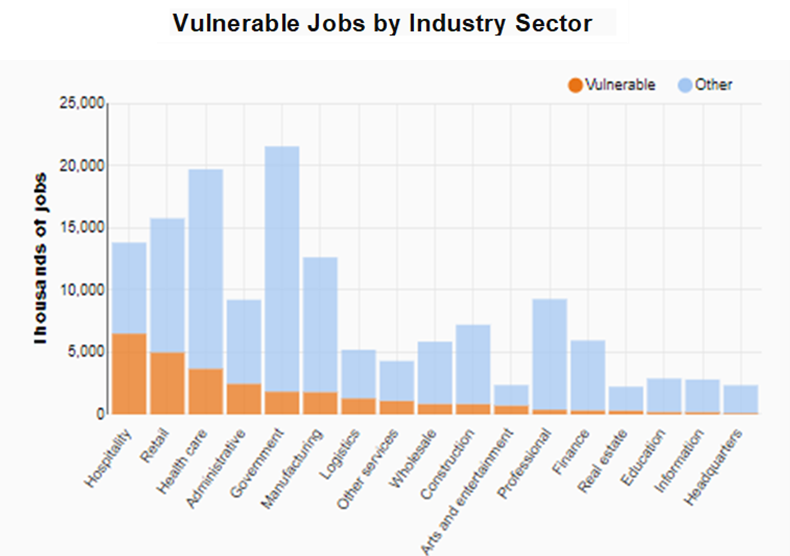

Visualizing Vulnerable Jobs Across America (Brookings). The Brookings Workforce of the Future initiative breaks down the number and dispersion of “vulnerable” jobs for 380 metropolitan statistical areas and all 50 states plus the District of Columbia. Vulnerable jobs are ones that pay low wages (less than the median wage, adjusted for location), and are not covered by employer-sponsored health care benefits. Under this metric, 19 percent of U.S. jobs are vulnerable. Workers in vulnerable jobs face the dual challenge of scraping by on low pay and managing their own health care—an issue thrown into sharp relief by COVID-19. Understanding vulnerability can give states and cities a sense of how exposed their workers are to the COVID-19 crisis in the short term and help them create long-term recovery strategies. The website tool allows users to select a city or state from the drop-down menu for a sector-by-sector breakdown of vulnerable workers in the economy, and to compare with other cities and states.

Paycheck Protection Program Crucial Lifeline Despite Fraud (The Guardian). Now that the paycheck protection program (PPP) has ended, there is a new story evolving. It seems like millions of dollars meant to prop up small businesses were fraudulently received by a bunch of bad people. The cases are something out of The Wolf of Wall Street. There’s money stolen to pay for Rolls-Royces, luxury yachts, homes, and visits to strip clubs. But despite these very real scandals these government programs worked. Millions of loans were extended to small businesses that really needed them. Billions of dollars were made available – quickly – to keep many companies afloat, or at the very least provide them with a cushion to operate through these very unprecedented times. The fraud – hundreds of millions – sounds like a lot. But as a percentage of the overall program it is not. And let’s hope this doesn’t stop Congress from doing another round of PPP or some other type of stimulus for those businesses that really need it.

* Upcoming SEDE Training Opportunity *

Designing and Managing Business Incentive Compliance Efforts

November 9, 10, 16, 17, 2020

2:00 PM – 4:30 PM ET

Consult the SEDE Network Updates section at the end of this month’s Bulletin for more details or click on the link above and check it out!

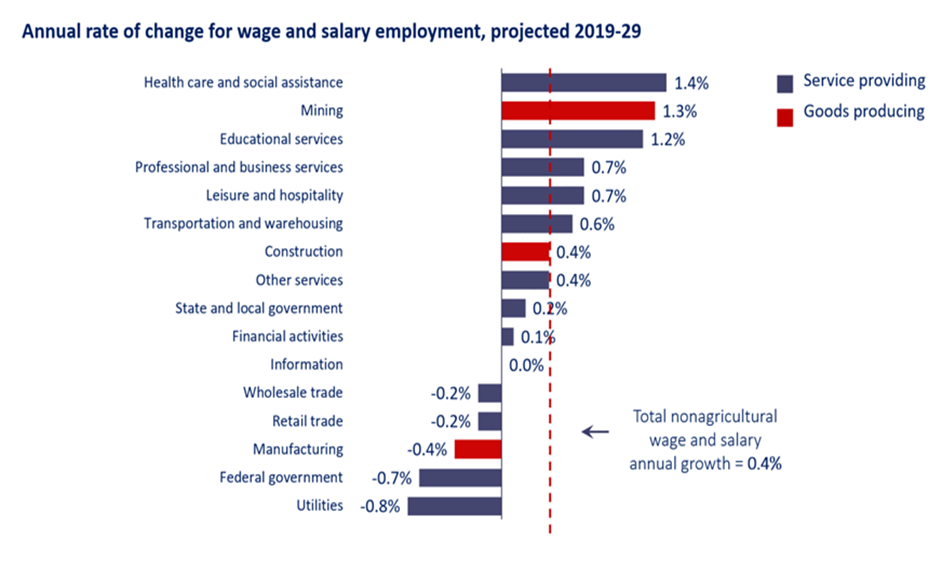

State Economic Performance

Fastest-Growing Industry from 2019 to 2029 is Healthcare and Social Assistance (Bureau of Labor Statistics). Employment is projected to grow from 162.8 million to 168.8 million over the 2019–29 decade, an increase of 6.0 million jobs. This reflects an annual growth rate of 0.4 percent, slower than the 2009–19 annual growth rate of 1.3 percent. Healthcare and social assistance is projected to be the fastest growing industry sector in the economy. Factors that are expected to contribute to the large increase include increased demand from caring for the aging baby-boom population, longer life expectancies, and continued growth in the number of patients with chronic conditions. Manufacturing is projected to lose 444,800 jobs from 2019 to 2029. Factors contributing to the loss of manufacturing jobs include the adoption of new productivity-enhancing technologies, such as robotics and international competition. BLS is developing alternate scenarios for the 2019–29 projection period that encompass possible impacts from the pandemic. An analysis of these scenarios will be released in a Monthly Labor Review article later in 2020.

* Economic Outlook *

Household Use of Covid-19 Stimulus Payments

Under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, American households received stimulus payments of up to $1,200 per adult for individuals whose income was less than $99,000 (or $198,000 for joint filers) and $500 per child under 17 years old or up to $3,400 for a family of four. In a first look at results from consumer spending questions in the federal government’s Household Pulse Survey, a majority of respondents (59 percent) who received a stimulus check used the stimulus payment to mostly pay for expenses, particularly food purchases. For the respondents who experienced a loss of income since March 13, or who were sick or caring for someone else, the stimulus payment helped them meet their expenses. The survey also finds that respondents in Generation X were more likely to use the stimulus for expenses, whereas older respondents, such as those in the Silent generation, were more likely to save the stimulus payment.

* * *

Topics and Trends

Industry Watch

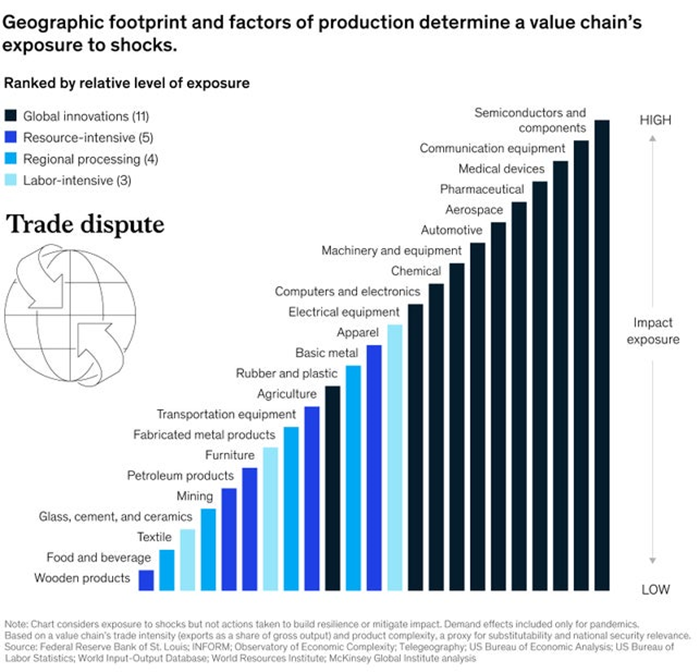

Five Myths about Manufacturing (Washington Post). The pandemic has brought fresh urgency to the discussion of whether the United States should bring more of its manufacturing back home (particularly for drugs and medical equipment). Yet myths about this sector persist — and they can lead to expensive subsidies, friction between nations, and higher prices for consumers. One hope is that trade wars and the pandemic will bring manufacturing back to the United States. However, there is no evidence of any coronavirus-induced rush by companies to return operations to the United States, and if China tariffs have had an effect, it’s mainly to encourage companies to move plants to places in Southeast Asia, like Vietnam. According to a Fraunhofer Institute study, for every company that reshored production, three offshored factories. Far from retracting their manufacturing presence abroad, U.S. companies are likely to expand it — in part to meet demand from the millions of Asians who are entering the middle class. Companies need factories close to these consumers so they can respond to the desire for ever-faster deliveries. Other manufacturing myths include most new factories are built in low-cost countries; most factories will soon be fully automated; China makes everything now; and 3-D printing will soon change all the rules in manufacturing.

Trade/Tariffs

Chinese Chip Giant SMIC ‘In Shock’ after U.S. Trade Ban Threat (BBC News). China’s largest chip manufacturer’s stock sank after the U.S. revealed it could be its next trade ban target. Semiconductor Manufacturing International Corporation (SMIC) said it was “in complete shock and perplexity” after the Pentagon revealed it had proposed the firm be added to a government blacklist. This would restrict suppliers from providing it with American-based tech without special permission. The move against SMIC continues a trade clash that has already threatened Chinese tech firm Huawei’s survival and forced Bytedance to negotiate the sell-off of video-sharing app TikTok’s American operations. SMIC has a less advanced production line than some of its rivals – it cannot make transistors as small as they can, limiting its ability to produce some of the cutting-edge chips featured in the latest smartphones. Even so, the firm is an important semiconductors provider to Chinese companies, including Huawei, while also serving international clients including Qualcomm. Semiconductors and components are ranked as the industry most vulnerable to trade dispute disruptions, according to the McKinsey Global Institute.

Opportunity Zones

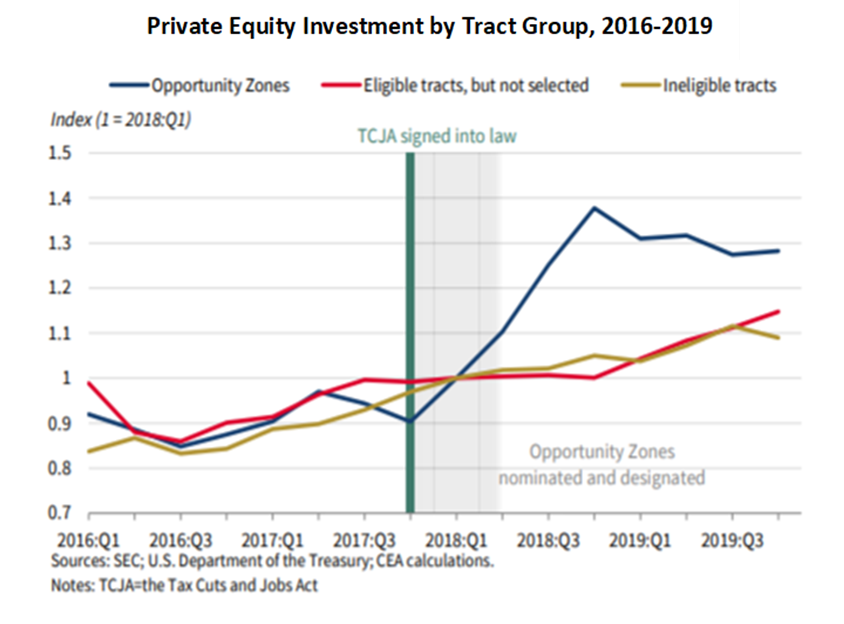

White House Releases Assessment Report of Opportunity Zones (Council of Economic Advisors). While the COVID-19 pandemic slowed investment everywhere in the second quarter of 2020, including in Opportunity Zones, an initial assessment released by the President’s Council of Economic Advisors (CEA) suggests that the OZ model has the power to mobilize investors; engage state, local, and tribal stakeholders; and improve the outlook for low-income communities—all with limited prescription from the Federal Government. The CEA finds that the OZ tax cuts have spurred a large investment response, including estimates that Qualified Opportunity Funds raised $75 billion in private capital by the end of 2019, most of which would not have entered OZs without the incentive. This new private equity investment in OZ businesses grew 29 percent higher relative to the comparison group of businesses in eligible communities that were not selected as OZs. The growth in investment has also made OZs more attractive to their residents, as reflected in rising home values along with greater amenities and economic opportunity. To view the Final Regulations on Opportunity Zones issued by the U.S. Treasury Department and IRS, click here.

Potential Legislative Improvements to Opportunity Zones (OpportunityDb). This podcast episode discusses why Opportunity Zones are important and what legislative changes are being considered to improve the impact with Emily Lavery, legislative analyst for Senator Tim Scott (R-SC), one of the original co-sponsors of the OZ legislation. The episode covers when potential legislative changes to OZ reporting might get introduced into Congress, a summary of Senator Scott’s 10-point letter to Treasury and how it resulted in several deadline relief measures for OZ funds and investors, the potential for OZs to be a key component in the push for supply chain re-domestication and manufacturing onshoring, and the need for extending the December 31, 2026 capital gain recognition deadline. It also asks how a potential change in the Presidency may affect the Opportunity Zone incentive. For more information on Opportunity Zones, CDFA has extensive resources available, click here.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Equality in the U.S. Starts with Better Jobs (Harvard Business Review). Even in the pre-Covid world of low unemployment, 32% of the U.S. workforce — 46.5 million people — worked in occupations with a median wage of less than $15 an hour. With Covid-19, we started calling many of these workers “essential.” Yet one wouldn’t know it from their wages. The median wage for a meatpacker is $14 an hour; only $12 for a health aide. Future job growth is also expected largely in low-wage jobs such as health aides, food and cleaning services, and laborer occupations. This problem won’t be solved by upskilling or improving education alone. To address this critical moment, we need business leaders to emulate the business leaders who, as in World War II, committed to creating good jobs. This includes recognizing the problem and making a collective pledge to address it; committing to raise low wages; providing career paths for low-wage workers; disclosing pay and turnover data; involving workers in technology decisions that affect their work; and driving public policies that improve workers’ well-being.

Innovation

To Take Off, Flying Vehicles First Need Places to Land (McKinsey & Company). With more than 250 businesses planning to build, operate, or manufacture urban-air-mobility (UAM) vehicles, all at different stages of development, a growing assortment of industry players is working across the value chain to make this dream a reality. Enabled by vertical-takeoff and -landing (VTOL) systems, electric propulsion, and advanced flight-control capabilities, these vehicles could eventually reach price points rivaling today’s taxi services. The resulting flying vehicles will be energy efficient, quiet, environmentally friendly, and eventually pilotless. Although some question the projected costs involved, adding new transportation capacity in most cities is extremely expensive. The cost of building a subway in a city can exceed $500 million per mile. UAM may thus represent a more cost-effective method, in some cases. To succeed, trip costs must fall around 80 percent from current helicopter levels for UAM to compete with ground travel. The UAM market can evolve with the right enablers present to develop infrastructure—places to take off and land, unmanned air-traffic control, charging and refueling, and connectivity.

Infrastructure

How States Use Broadband Surveys to Fight for Better Funding (Government Technology). When federal and state entities spend money on broadband infrastructure, they want a good return on investment, and they want to know they are helping people in need. As such, accurate data on Internet access and quality is crucial for decision-making. It is well known that the Federal Communications Commission’s Form 477 data, which helps direct billions of dollars, overestimates high-speed Internet access. But this data can be challenged if a state can show with another set of data that a local area lacks sufficient broadband service. Wyoming, for example, was able to successfully challenge the FCC’s data and help a carrier win USDA money to bring high-speed Internet service to Sweetwater County. In Washington, the state has estimated that it would take more than $3 billion to get fiber infrastructure to every home without broadband service. The state recently launched its own survey to help identify homes where people cannot afford high-speed Internet despite being in an area with good broadband infrastructure. Washington wants the broadband discussion to be a “community up” rather than “provider down” conversation, and communities willing to take surveys and quantify their issues have more power.

* Check out the SEDE Website *

The SEDE Network engages in regular activities and events throughout the year. You can stay up to date on all these activities via the SEDE Network website. The newest addition to the site includes a collection of websites and other communication resources used by states to address the Coronavirus Challenge.

Click the link above and check it out!

Deal Makers

Incentives in Action

Covid-19 Loan Programs Reached Businesses Across New Mexico (New Mexico EDD). The New Mexico Economic Development Department has closed its COVID-19 Business Loan Guarantee (CBLG) program after assisting with $1.77 million in lending to 47 businesses with 344 full-time and 117-part time employees. Most support went to industries affected most by the pandemic, including hospitality, food service, retail-service, healthcare, and entertainment. The program offered a state guarantee to lenders to pay up to 80% of a loan principal or up to $50,000 in case of a default, for a period of up to two years. As federal programs through the Small Business Administration have become available, including the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL), applications to this program tapered off. A second relief measure that granted almost $6 million in no-interest loans to nine manufacturers to help maintain 432 jobs is also no longer taking applications. While these programs end, New Mexico has other assistance programs available and the department provides a weekly financial resources email on grants and financial opportunities for businesses and nonprofits.

New Jersey Announces Phase 2 of Small Business Loan Program (ROI-NJ). The New Jersey Economic Development Authority will be able to expand its Small Business Emergency Assistance Loan Program by $10 million, thanks to a grant received from the U.S. Economic Development Administration’s CARES Act appropriation. The money will allow the New Jersey EDA to create Phase 2 of its loan program — one that will offer up to $100,000 in low-cost financing to eligible New Jersey small businesses and nonprofits to help with recovery and reopening efforts as a result of COVID-19. The funding can be used to pay rent or mortgage, payroll, and utilities. It can also be used to purchase inventory, personal protective equipment, furniture, and equipment. To ensure equity, $3.5 million of the funding will be reserved for businesses in Opportunity Zone-eligible census tracts. In line with the terms of Phase 1 of the program, which launched in April 2020, Phase 2 loans will have 10-year terms with zero-percent interest for the first five years, then resetting to the EDA’s prevailing floor rate for the remaining five years, with a 3% cap. To be eligible, small businesses and nonprofits must be in operation for at least one year, less than $5 million in annual revenue, a commercial location in New Jersey, and show a negative impact resulting from the COVID-19 outbreak.

Oklahoma Launches New Programs to Spur Economic Recovery (Site Selection). Businesses and industry leaders can access the Oklahoma Department of Commerce’s weekly roundtable calls online or over the phone, where they are able to learn the latest COVID-19 guidelines and information regarding the state’s economic recovery. Additionally, the Oklahoma Manufacturing Reboot Program was launched in April 2020 to assist the state’s manufacturers as they retool to develop new products or expand their current capabilities. The program draws from the Governor’s Quick Action Closing Fund, a $5 million fund to assist manufacturers as they retool to develop new products or expand current capabilities, including those pivoting to make PPE for first responders and health care workers. Within a week of its start, more than 300 businesses applied for the program. The state’s Bounce Back Assistance Program was then developed by Commerce as a direct result of the high level of interest and quality of projects submitted in the Manufacturing Reboot Program. This new assistance program supports high-impact new capital investment across a broader range of industries. The program uses funds set aside by the Oklahoma Economic Development Pooled Finance Act and makes monthly cash payment awards in the form of payroll tax rebates. To be eligible, a company must have a minimum annual payroll of $1.25 million. Awards range from $50,000 to $150,000.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

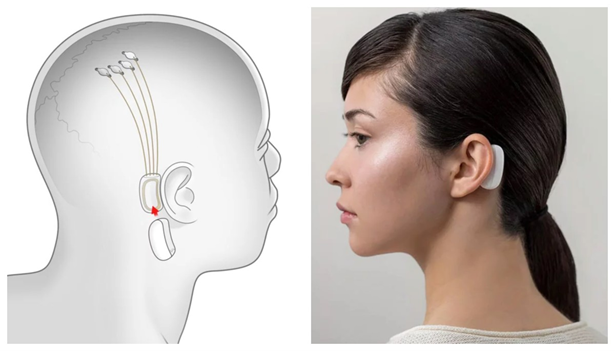

The Merging of Human and Machine (Forbes). Neuromorphic computing is the integration of systems containing electronic analog circuits to mimic neuro-biological architectures present in the biological nervous system. In 2018, research funded by the Defense Advanced Projects Agency (DARPA) demonstrated that a person with a brain chip could pilot a swarm of drones using signals from the brain. The possibilities and implications of this neuromorphic technology are mind-boggling, including allowing paralyzed people the ability to communicate and the potential to read human thoughts via cognitive imaging. More recently, Elon Musk announced that his neuroscience company, NeuraLink, created to develop cranial computers that can rapidly upload and process information, will demonstrate a device that would let humans control computers with their mind via surgically implanted electrodes. Linking brains to computers is no longer the stuff of science fiction.

Talent Development/Attraction

South Carolina Highlights Skilled Labor Careers through Hands-On Experiences (Aiken County Standard). State leaders are turning to a new interactive learning experience to boost South Carolina’s skilled labor workforce. Be Pro Be Proud SC takes a unique, targeted approach to remove the stigma from “blue-collar” jobs by educating students and the public on the appeal and the importance of these jobs. A custom-designed 53-foot, double-expandable custom semi-trailer is part of a mobile workshop that showcases skilled trades, including welding, truck driving, heaving equipment operation, lineman and more, through hands-on, interactive stations representing on-the-job experiences. The workforce development effort is especially marketed toward students by emphasizing the cost of job certifications, which are often less costly than a four-year degree. The mobile workshop will begin its 48-week statewide tour this fall and is expected to engage over 50,000 students at schools and special events.

The Workforce Is About to Change Dramatically…Maybe (The Atlantic). When the pandemic is over, one in six workers is projected to continue working from home or co-working at least two days a week, according to a recent survey. Another survey of hiring managers found that one-fifth of the workforce could be entirely remote after the pandemic. If white-collar workers are told the downtown office is forever optional, some will take their superstar-city jobs out of superstar cities. These shifts, even if they are initially moderate, could lead to more surprising and significant changes to America’s cultural, economic, and political future. For instance, a more homebound life potentially creates less work for others. If business travel falls off by 10 or 20 percent, it could mean fewer jobs across airlines, hotels, and restaurants, as business travel drives a lot of leisure and hospitality spending. But face-to-face meetings might feel even more valuable in a post-pandemic world, restoring business travel with surprising speed. If more families decamp from expensive cities like San Francisco and New York to smaller cities, they could stimulate the growth of new restaurants and shops in less affluent parts of the country. Or maybe not. If a vaccine arrives by early 2021, we could quickly revert to a status quo ante coronavirus.

* * *

SEDE Network Updates

* Upcoming SEDE Training Opportunity *

Designing and Managing Business Incentive Compliance Efforts

November 9, 10, 16, 17, 2020

2:00 pm – 4:30 pm EDT

This training workshop provides state agency staff with the skills and insights to implement best practices in incentives monitoring and management. The workshop reviews common operating procedures, identifies critical issues, and explores options and tradeoffs to help staff make intentional choices to protect taxpayer investments in business incentives. Agency staff will be able to review and redesign operating procedures, confident their approach will be effective, but not overly burdensome, in leveraging reliable data for monitoring business compliance and program performance.

Instructors will provide guidance and best practices to state agency staff in incentives compliance procedures, especially related to:

- Clarity on the rules for companies using incentives. By and large, companies are willing to comply if they know the rules and they are easy to follow.

- Public sector data collection, validation, and management procedures

- Working with the company for successful compliance

- Dealing with noncompliance

- Reporting compliance and performance impacts to decision makers

Target Audience:

This training program is targeted to state agency economic development professionals assigned to manage or implement compliance procedures. It may also be valuable to local EDO staff or leadership that oversee compliance personnel or activities or want to learn more about the mechanics of business incentive compliance.

Meet the Instructors:

Ellen Harpel, President, Business Development Advisors/ Smart Incentives

Jane Vancil, CEO, Incentilock

* * *

The SEDE Network Steering Committee includes: Stefan Pryor (RI), Chair; Val Hale (UT), Vice Chair; Julie Anderson (AK); Dennis Davin (PA); Jennifer Fletcher (SC); Kurt Foreman (DE); Joan Goldstein (VT); Manuel Laboy Rivera (PR); Kevin McKinnon (MN); Don Pierson (LA); Mike Preston (AR); Sandra Watson (AZ).

For further questions on the content in this Bulletin or for information on the SEDE Network contact Marty Romitti, CREC Senior Vice President, at mromitti@crec.net