Latest News

State Economic Development Officials Collaborate to Counter the Pandemic’s Impact (Pew Charitable Trusts). As states grapple with the unexpected and dramatic changes brought on by the novel coronavirus, economic development leaders are playing important roles in the emergency response. They are helping to ensure that health care workers have the equipment they need, while working to address the challenges facing companies, both in the short term and as they begin the long road to recovery. Working through the State Economic Development Executives (SEDE) Network, economic development secretaries, commissioners, and chief executives of state commerce authorities have been holding weekly strategy sessions to brainstorm and share information about how to respond to a national emergency that has brought great public health and economic challenges. For these officials, the need for multifaceted responses to the pandemic has altered the nature of their work and put a greater emphasis on the value of creative collaboration toward a common goal. For further information on the network, go to www.stateeconomicdevelopment.org.

* * *

– FYI –

House Passes $3 Trillion HEROES Act

On May 15, the U.S. House of Representatives approved a mammoth $3 trillion relief package designed to alleviate the health and economic fallout of the deadly coronavirus pandemic. The 208-199 vote was largely on party lines. The legislation includes hundreds of billions of dollars for medical equipment and coronavirus testing, a new round of direct cash payments for individuals and families and an expansion of unemployment insurance benefits. A third of the bill – almost $1 trillion – would go to state and local governments to shore up coffers battered by emergency spending and a loss of tax revenue. The Senate will not take up its version of the bill until sometime in June, with the expectation that a compromise bill would likely be enacted either before the July 4th recess or at some point in July.

* * *

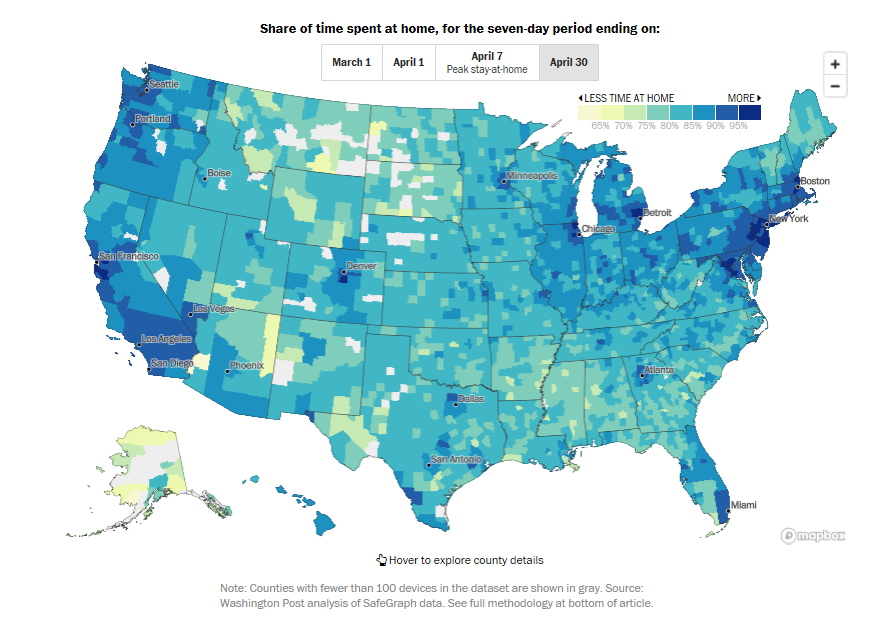

Where Americans are Still Staying at Home the Most (Washington Post). According to an analysis of cellphone location information, the peak period of our collective, coronavirus-induced lockdown was the seven-day period ending April 7. During that time, U.S. residents spent 93 percent of their time at home, up from the early March averages of roughly 70 percent. Since then, U.S. residents began to inch out of their homes, mostly going to parks and grocery stores. Workplace visits, however, have barely risen since mid-March. The data lines up with responses in a May 5 poll in which more than half of people said they were comfortable visiting grocery stores, but 78 percent said they would not be comfortable eating at a sit-down restaurant, 67 percent said they wouldn’t be comfortable shopping in a clothing store, and just 18 percent were in favor of reopening movie theaters. The data clearly shows that when Americans were told it was time to stay home, most people did. It also indicates that they are deciding for themselves when to go back out.

State Economic Performance

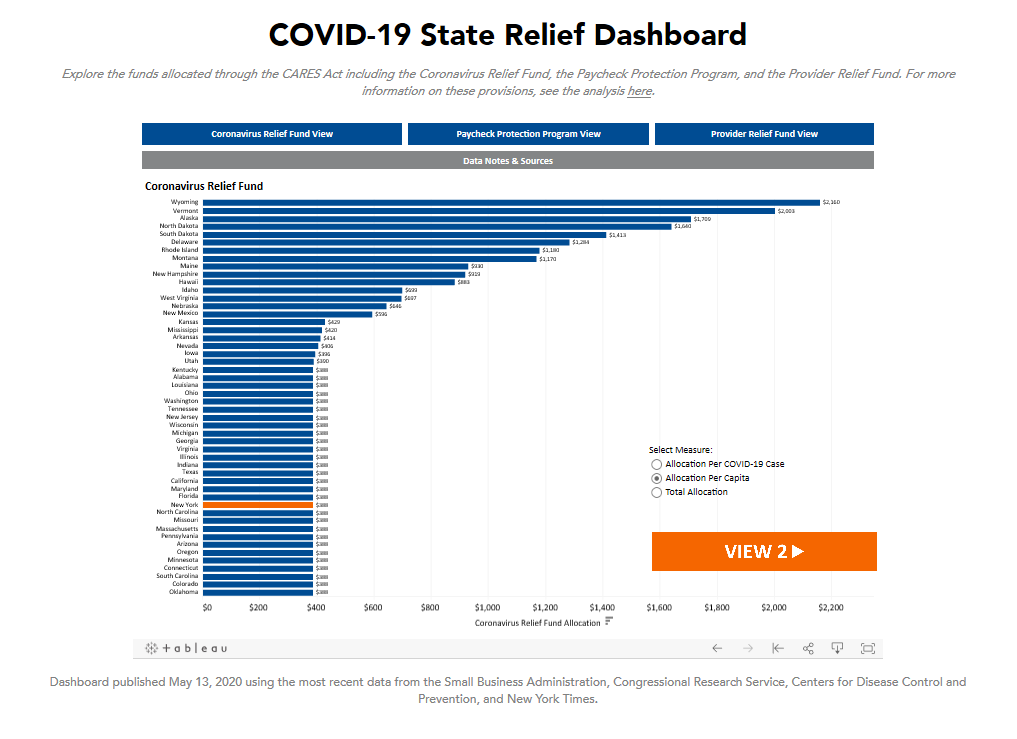

COVID-19 State Relief Dashboard (Rockefeller Institute). To date, the Federal government has allocated almost $2.5 trillion to individuals, businesses, state and local governments, schools, and healthcare providers to relieve the fiscal and economic costs of the COVID-19 pandemic. Data are now being released detailing the distribution of several of the CARES Act provisions. The Rockefeller Institute has created a data dashboard to track how Federal COVID-19 relief spending is being dispersed across the states. The dashboard includes data from three of the federal programs: Coronavirus Relief Fund, Paycheck Protection Program, and Provider Relief Fund. The dashboard will continue to be updated as data updates become available.

Topics and Trends

Industry Watch

Shipping Industry Must Adapt to Survive in Modern World (World Finance). Currently, shipping is the dominant mode of transporting goods, with more than 90 percent of world trade being seaborne. A host of technological, environmental, and geopolitical challenges will test the resilience of the maritime sector over the coming decades. Cheap, clean fuel is an asset that can make or break a shipping company’s balance sheet. Consequently, firms have increasingly turned to liquefied natural gas (LNG) to reduce their impact on the environment. However, the cost of installing the necessary equipment is often prohibitive and the heavy metallic tanks used to store the fuel reduce the volume of freight LNG-powered vessels can carry. In response, Ocean Finance is building a carbon-fiber tank that is up to 90 percent lighter than conventional tanks, borrowing technology and techniques from the aerospace industry. The transition to greener technology poses a conundrum to shipowners, though, as they are forced to make investment decisions without having a clear picture of the industry’s future needs and regulatory framework. A ship ordered in 2025 will still need to be operating in 2050, if the owner is not to face substantial losses. Companies that are fortunate enough to place their bets well will survive; the rest will struggle – or go under.

Trade/Tariffs

The U.S. and China’s Next Battle Won’t Be Won with Tariffs (Barron’s). No other country comes near China in terms of broad 5G investment and infrastructure deployment. The speed and low latency of 5G means that it is well suited to power the next wave of wireless communications like smart grids, self-driving cars, autonomous weapons, and robotic surgery. In the U.S., 5G progress has largely been limited to cities and sports stadiums. Factors holding U.S. 5G deployment back include a heavy reliance on private sector investment and a lack of wireless spectrum, or airwaves, devoted to 5G signals. While China has quickly reallocated its spectrum, the U.S. airwaves have been tied up in disputes between the military and other federal agencies fighting for allocations. U.S. efforts to catch up with China on 5G—and the inevitable Chinese pushback—could force the rest of the world to choose sides in a tech cold war. In May, the U.S. Commerce Department amended export rules, curtailing Huawei’s access to global chip makers that use U.S. technology. The move largely affects Taiwan Semiconductor Manufacturing (TSM), which makes advanced chips for 5G smartphones; Huawei is the largest customer for those Taiwan Semi chips. The move is a major blow to both Huawei, the privately held Chinese firm, and China’s 5G ambitions and will be consequential to the course of the U.S.-China relationship in the near term.

Opportunity Zones

Opportunity Zone Commitments Reach $10 Billion Mark, That We Know Of (Motley Fool). Opportunity Zones passed the $10 billion mark in commitments to qualified opportunity funds (QOFs) shortly before the COVID-19 pandemic. Novogradac – which oversees the Opportunity Zones Working Group of investors, community development financial institutions, and other stakeholders – said its list of such funds grew from 502 in January to 621 in mid-March and that 406 of them reported the amount of equity they have raised. The consultancy said the total raised and poised to help revive moribund local economies is perhaps double or triple the $10.1 billion it knows about in QOFs. Its list is a rolling survey that includes many funds that have not revealed their totals, and there are funds that are not part of the survey, including private pools formed by corporations and high net worth individuals. Anecdotal evidence since March 13 (the day President Trump declared a national emergency) suggests QOFs are seeing a pause in new investment as the nation struggles to react to the pandemic. To view the Final Regulations on Opportunity Zones issued by the U.S. Treasury Department and IRS, click here.

How Opportunity Zones Can Restore the Economy Post-COVID-19 (Milwaukee Community Journal). Opportunity zones can be an important and effective part of the recovery for a few reasons. For one, improvements to distressed communities will build on themselves. If businesses in the zones thrive, the communities will have more jobs and better salaries to offer. More people will want to relocate to these areas, which will increase real estate values and breathe new life into local shops and stores. Second, investors can make money as well as save on taxes. Those who invest can benefit from more than just the initiative’s capital gains tax breaks. They can also see a significant return off their investments. Third, investors can help improve people’s lives. The zones give investors who want to do more than just make money a chance to have a positive impact on low-income urban and rural communities, and the lives of many people. Therefore, opportunity zones can simultaneously channel economic help to distressed communities and create an outsized return for investors. Both these things will be critically important to bring back jobs and restore the economy coming out of the pandemic. For more information on Opportunity Zones, CDFA has extensive resources available, click here.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

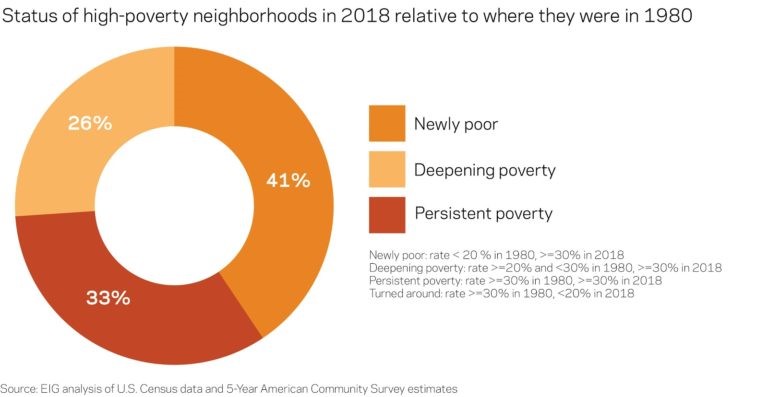

The Persistence of Neighborhood Poverty (Economic Innovation Group). The Economic Innovation Group (EIG) recently launched the Neighborhood Poverty Project by analyzing the spread and evolution of high-poverty neighborhoods throughout the United States over the last four decades. While the last national economic expansion brought growth and prosperity to many areas, it failed to reverse the spread of high-poverty neighborhoods the country has experienced going back to 1980. The research reveals that it is much more common for neighborhoods to fall into and remain in poverty than to climb out of it. In total, 64 percent of neighborhoods that were high poverty in 1980 were still high poverty in 2018, 38 years later. Only 14 percent had experienced a meaningful turnaround—most of which were on the suburban/exurban fringe of metro areas, immediately adjacent to downtowns, or in New York City, which accounts for 22 percent of the national total of turnaround neighborhoods. In some cities, the rate of downward neighborhood mobility over the last several decades has been alarming. While Rust Belt cities have been the hardest hit by this trend, even in Sun Belt growth poles such as Houston and Phoenix, about one in five neighborhoods that were low poverty in 1980 were high poverty in 2018.

Innovation

Creating Antivirals like Remdesivir is a Biological and Economic Challenge (Smithsonian Magazine). Antivirals that work against many diverse viruses, broad-spectrum drugs, would help us prepare for new diseases but creating them is a big biological challenge. Viruses are more slippery targets than bacteria. They are often a hundred times smaller and consist only of bare-bones cellular machinery. Their tiny footprint creates a conundrum for researchers: There are simply fewer targets at which to aim antivirals, especially for drugs that would shoot for the rare viral components that remain common across diverse types of viruses. Hepatitis C, for example, is caused by HCV viruses from Flaviviridae, a family that also includes the virus behind yellow fever. Some Hepatitis C treatments are so targeted that they combat only some of the six main types of HCV, and certainly not yellow fever. Scientists call this virus-pinpointing model the “one drug, one bug” approach. On top of the biological challenge of finding new broad-spectrum antiviral drugs lies an economic one. Pharmaceutical companies have little financial incentive to develop broad-spectrum drugs against emerging diseases since they have no guarantee they will recoup the costs of research. While federal funds have bankrolled research in this area, Congress has historically been more apt to spend money on already-here crises like Ebola than on preparedness measures. A better model would be to push research and industry toward a “one drug, many bugs” concept.

Infrastructure

Let States Take the Wheel on Infrastructure (Fox News). The federal government has been at the center of the national infrastructure issue since President Eisenhower led the charge to build the national interstate system in the 1950s. But there are some who would like states – which have been thrust into a leading role in the coronavirus crisis – to take the lead. When Maryland Governor Larry Hogan assumed the chairmanship of the National Governors Association (NGA) in 2019, he started pushing for just that. In particular, the NGA effort focuses on four main areas: relieving congestion to boost economic competitiveness, eliminating red tape and integrating smart technology, protecting America’s critical infrastructure, and leveraging private sector investment. The ideas being raised are not all about raising taxes at the federal level. There are plenty of private sector investment dollars, public-private partnerships, P3’s, that have been successful in other places around the world. Ultimately, the plan is to share ideas among and between the governors, but also for the governors to get that input from the private sector and make proposals to Congress and in the administration.

* Check out the SEDE Website *

The SEDE Network engages in regular activities and events throughout the year. You can stay up to date on all these activities via the SEDE Network website. The newest addition to the site includes a collection of websites and other communication resources used by states to address the Coronavirus Challenge.

Click the link above and check it out!

Deal Makers

Incentives in Action

Arkansas Bridge Loans Help Save an Estimated 3,500 Jobs (KATV Little Rock). Bridge loans to Arkansas businesses from a program created to stem job losses caused by the COVID-19 pandemic have helped retain almost 2,500 full-time jobs and about 1,000 part-time jobs. The governor is adding another $1 million to the Quick Action Loan Guaranty Program from his Quick Action Closing Fund that is used to recruit and retain jobs. He announced the program March 18 for small businesses needing help with payroll and other essential costs. The 0% interest loans can be up to $250,000 and allow for no payments for up to 12 months. Arkansas Secretary of Commerce Mike Preston said 246 bridge loans were made before exhausting the $8 million set aside for the program. He said the $1 million added Friday will fund about 100 pending applications.

Coronavirus Small-Business Loans Over $2 million will be Audited (New York Post). The federal government plans to audit all large coronavirus relief loans amid an outcry over big companies getting help at the expense of struggling small businesses. The U.S. Small Business Administration will review all Paycheck Protection Program loans worth more than $2 million before forgiving the debt. Loans from the $659 billion program can be forgiven if the recipients do not lay off workers. Some 248 publicly traded companies have received taxpayer-funded loans valued at $905 million. While several big companies such as Shake Shack, Nathan’s Famous, and the Los Angeles Lakers have pledged to return their loans, those that keep them could face “criminal liability” for falsely claiming they needed the money.

* SEDE Network Resource *

SEDE Network Framing Questions for Existing Incentive Agreements

CREC and Smart Incentives worked with SEDE Network members to develop a list of principles and framing questions to help states determine possible adjustments to existing incentive performance agreements in response to the current economic crisis. This document addresses issues to consider when adjusting the terms of existing incentive agreements for discretionary incentives that have already been provided to companies.

Nebraska Taxpayers Won’t Have to Repay Incentives Due to Virus (Law 360). The Nebraska Department of Revenue has said that taxpayers receiving tax benefits as a part of the state’s economic development incentive program will not have to repay those benefits if they fail to meet certain requirements due to COVID-19. Under the Nebraska Advantage Act, businesses must repay all or a portion of tax incentives earned if the project-holder does not meet the required employment or investment levels or fails to maintain those levels during the entitlement period. Exceptions are if the failure to maintain those levels results from an act of God or national emergency. To avoid repaying the incentives, project-holders must demonstrate that they failed to maintain employment and investment requirements as a result of the national emergency declared on March 13 in response to the coronavirus pandemic. However, a project-holder will not be eligible for relief if a decision is made to reduce the workforce rather than use a paid ready-to-work program, nor will it be sufficient to demonstrate that the emergency declaration simply made maintaining requirements less profitable. The length of time the relief applies will depend on the project-holder’s ability to show that the pandemic continued to prevent it from maintaining employment and investment levels.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

* Thank You EDOs *

EDOs Bridge Gap Between Relief Packages and Businesses

Economic Development Organizations (EDOs) are now on the front lines acting as “economic first responders” helping companies navigate the economic fallout of the public health crisis. Mandatory shutdowns are requiring businesses in sectors such as tourism, hospitality, retail, and personal services to hibernate, and companies that have been deemed to be providing essential services are still operating but are facing challenges including supply chain disruptions and the implementation of new health and safety regulations. Governments at all levels are rolling out assistance programs designed to help businesses survive the crisis and companies of all types are turning to EDOs to help them navigate these newly established programs. In response, EDOs have taken on three new duties: providing up-to-date information; offering pivot assistance to companies working to meet COVID-related demand; and strategic planning for the post-COVID-19 recovery period. EDOs have become critical information sources, disseminating information on relief programs, state and local regulations, and funding opportunities through their websites, email lists, and social media accounts.

New Growth Opportunities

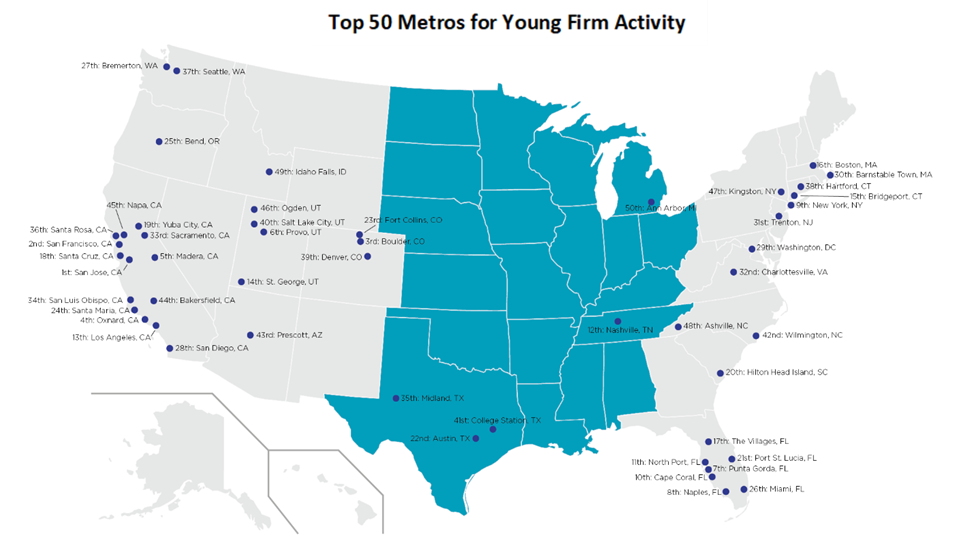

Young Firms and Regional Economic Growth (Heartland Forward). New research finds a strong link between entrepreneurship and cities’ long-term economic success. The study by Heartland Forward, an institute for economic renewal based in Bentonville, Arkansas, suggests the key to long-term economic success lies in developing environments that are conducive for entrepreneurs to start and scale up their firms. The research analyzed two main factors to rank cities across the U.S. on the strength of their entrepreneurial ecosystems. The first is the share of employment at young firms, and the second is the share of that employment with a bachelor’s degree or higher. Communities can expect 15 percent faster employment growth with higher young firm employment and 34 percent faster growth with higher knowledge intensity. The report presents specific recommendations for how policymakers and civic leaders can foster entrepreneurship in their own communities. Among the solutions: Establish support organizations and incubators; Build the amenities required to attract and retain entrepreneurs; Ensure entrepreneurship is part of the core mission of economic development organizations; and Encourage universities to focus on entrepreneurship education and commercializing innovation.

Talent Development/Attraction

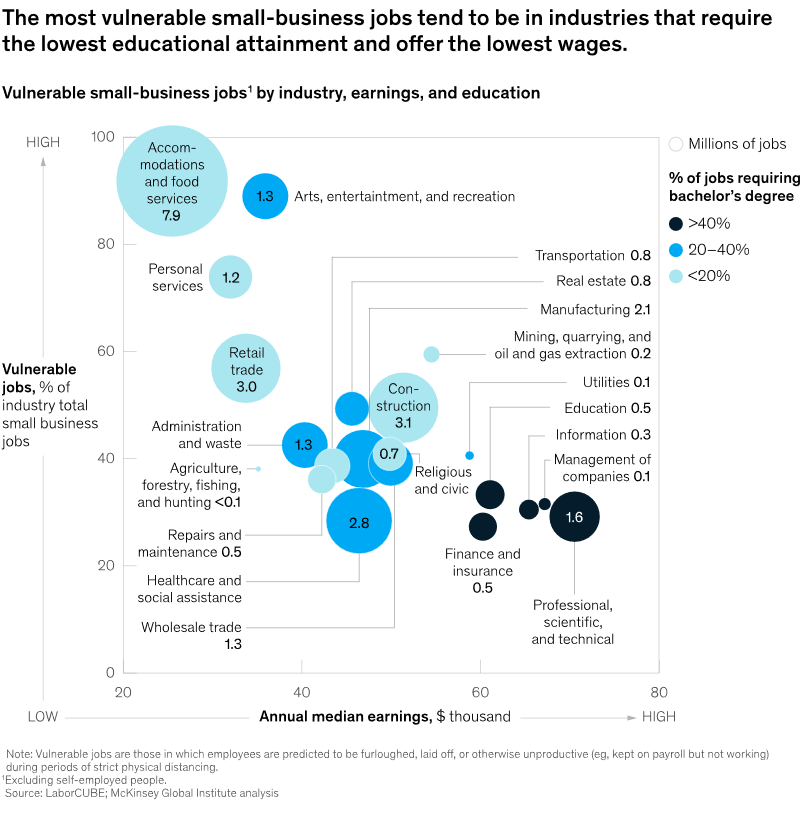

COVID-19’s Effect on Jobs at U.S. Small Businesses (McKinsey & Company). Before COVID-19, small businesses provided nearly half of all US private-sector jobs, yet they account for 54 percent (30 million) of the jobs most vulnerable during COVID-19. Specifically, half of jobs at firms with fewer than 100 employees are vulnerable, compared with 40 percent of those at large private-sector employers. That estimate is based on an analysis of whether jobs are typically deemed essential and whether they require close proximity to others. Vulnerable jobs in small businesses largely mirror those in larger ones. Nearly half of these jobs are concentrated in a handful of industries, especially accommodations and food services, construction, retailing, and healthcare and social assistance. Two occupational categories—food service and customer service and sales—account for more than four in ten vulnerable small-business jobs. There is a serious danger that the loss of work will disproportionately affect those who can least afford it, since workers in these occupations have lower wages and educational attainment, on average. A challenge for policy makers and executives is figuring out how to get these employees back to work.

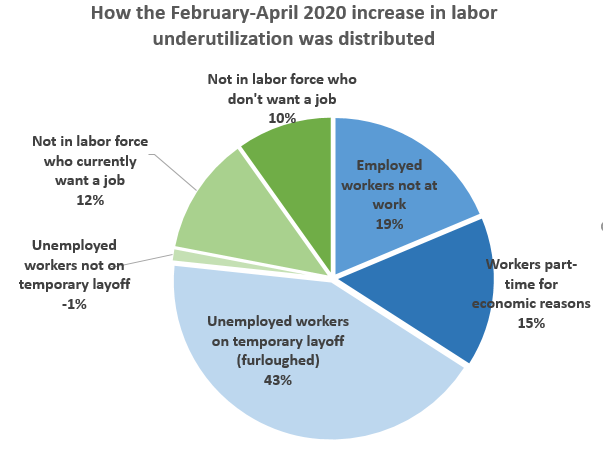

What the April 2020 Jobs Report says about COVID-19’s Impact (Cornell ILR School). According to the Bureau of Labor Statistics, April’s unemployment rate was the worst since the Great Depression. Last month, 20.5 million people lost their jobs with the unemployment rate increasing by 10.3 percentage points since March to 14.7 percent. This is the highest rate and the largest over-the-month increase in the history of the series (seasonally adjusted data are available back to January 1948). The COVID crisis has suspended or curtailed about 23.4 percent of U.S. employed workers. Of those, 79 percent maintained a tie with their employer, while the remaining 21 percent did not and exited the labor force. The high share of maintained relationships with employers should be helpful for speeding the recovery when restrictions are lifted. However, this alone cannot guarantee a rapid recovery because ties can weaken over time, some employers will not survive long enough to recall their workers, and other employers may need a new business model with different staffing requirements.

![]()

* * *

SEDE Network Updates

* Upcoming SEDE Event Postponed *

The previously scheduled

May 31, 2020

In-Person SEDE Meeting before the SelectUSA Summit

in Washington, DC

POSTPONED Due to the CORONAVIRUS TRAVEL RESTRICTIONS

and Cancellation of the SelectUSA Summit

We are currently considering alternatives for continuing to share information and support the network. Please check the events page at www.stateeconomicdevelopment.org for the latest updates.

* * *

The SEDE Network Steering Committee includes: Stefan Pryor (RI), Chair; Val Hale (UT), Vice Chair; Julie Anderson (AK); Dennis Davin (PA); Jennifer Fletcher (SC); Kurt Foreman (DE); Joan Goldstein (VT); Manuel Laboy Rivera (PR); Kevin McKinnon (MN); Don Pierson (LA); Mike Preston (AR); Sandra Watson (AZ).

For further questions on the content in this Bulletin or for information on the SEDE Network contact Marty Romitti, CREC Senior Vice President, at mromitti@crec.net