Latest News

* SEDE Members Meet to Plan Providence RI Convening *

A group of over 20 SEDE Network members met for a working lunch in Washington, DC to discuss critical issues of importance to state economic development executives and to plan the agenda for our Sept. 8-9 meeting in Providence, Rhode Island in conjunction with the SSTI conference.

Pictured in the photo from left to right: Ken Poole (CREC); Steve Spence (WV); Elaine Bedel (IN); Sally Rood (NGA); Jeff Chapman (Pew); Kelly Schulz (MD); Jason El Koubi (VA); Stefan Pryor (RI); Erran Persley (KY); Andrew Deye (OH); Kevin McKinnon (MN). Not pictured but in attendance: Christopher Chung (NC); Mark Hogan (WI); Lindsay Kirchinger (MI); Margo Markopoulis (IL); Jeff Mason (MI); Don Pierson (LA); Manuel Laboy Rivera (PR); Marty Romitti (CREC); Jacqueline Rosen (RI); Mark Troppe (CREC)

State Economic Performance

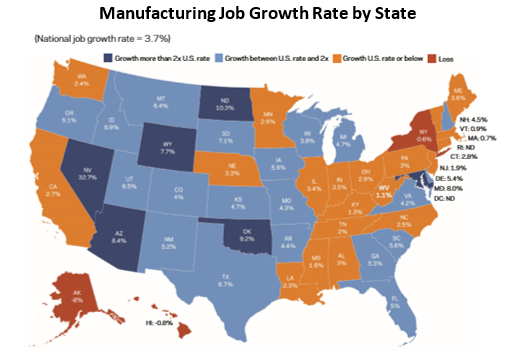

Manufacturing’s Real but Patchwork Rebound (Economic Innovation Group). Manufacturing’s rebound is real. After shedding manufacturing jobs relentlessly between the turn of the century and the Great Recession, the United States has now added them in 82 out of 100 months since January 2011. Growth has continued in 2019, and by May there were 12.8 million employees in manufacturing in the United States, the most since December 2008. Such a turnaround is remarkable in a sector in which employment shrunk by nearly one-third between 2000 and 2010. Manufacturing’s expansion has been broad-based across regions, with improving manufacturing growth rates in 57% of counties. On average, counties in western states saw the highest annual growth rates from December 2016 to December 2018. The South created the largest number of new manufacturing jobs over the past two years.

Topics and Trends

Industry Watch

Innovations Increase for Shrinking Agricultural Workforce (Farm and Dairy). A diminishing farm labor supply puts pressure on the agricultural sector to adopt new technologies for difficult-to-mechanize tasks. The competitiveness of U.S. agriculture, as well as the welfare of farm workers and the communities in which they live, depends on how the industry adapts to a new era of farm labor scarcity. Technologies that were relatively inexpensive to develop and adopt have been in commercial use for many years. The tightening of the farm labor supply today creates incentives to develop and adopt more challenging and more expensive labor-saving solutions. To address these challenges, engineers from academia and industry are developing “intelligent” robotic solutions, like automated lettuce thinners, integrated weed management systems and robotic apple harvesters.

Trade/Tariffs

Tariff Threat has Retailers Sounding Alarm (New York Times). Already battered by the e-commerce revolution, traditional retail stores are bracing for another blow — new tariffs on $300 billion worth of Chinese imports. Retailers and analysts warn the impact will be disastrous for an industry already tormented by vacant storefronts and deserted malls. The reason: Unlike earlier tariffs that mostly targeted industrial and commercial products, the next round is aimed squarely at consumer goods like footwear, toys and apparel. The National Retail Federation estimates that China supplies 42 percent of all apparel, 73 percent of household appliances and 88 percent of toys sold in the United States. So far in 2019, American retailers have announced plans to shut more than 7,000 stores, after announcing nearly 6,000 closings last year. By the end of 2019, announced closings could climb to 12,000 stores.

Opportunity Zones

EDA Prioritizes Applications for Projects Located in Opportunity Zones (U.S. Economic Development Administration). EDA evaluates all applications for funding to determine the extent to which they align with EDA’s investment priorities, address the creation or retention of high-quality jobs, leverage other resources both public and private, demonstrate the capacity to commence the proposed project promptly, and provide a clear scope of work with measurable project outputs. Adding OZs as a new investment priority will significantly increase the number of catalytic Opportunity Zone-related projects that EDA can fund to spur greater public investment in these areas. OZs join Recovery & Resilience; Critical Infrastructure; Workforce Development & Manufacturing; and Exports & Foreign Direct Investment as top federal economic development funding categories. To date, EDA has invested close to $30 million in 40 projects in designated Opportunity Zones to help communities and regions across the country build the capacity for economic development. For more information on Opportunity Zones, CDFA have extensive resources available, click here.

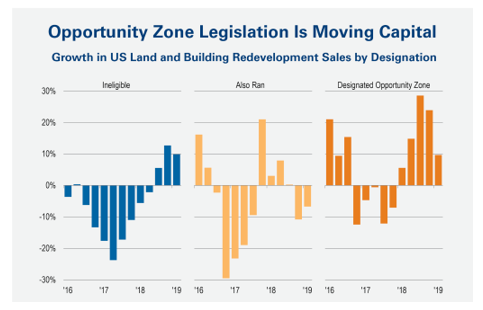

US Opportunity Zone Legislation Is Moving Capital (Real Capital Analytics). In business and economics there are few experiments available to show us that a policy goal is having an impact. Measuring capital flows based on tax changes is difficult because there are so many other variables which are not always observable. The U.S. opportunity zone program, however, provides a natural experiment to gauge the impact of new policy. For every low-income census tract that was selected for the opportunity zone designation, another three or so were left behind. The chart shows that in 2018 the sale activity for development-oriented type projects was falling in the non-OZ areas even as it grew in the Designated Opportunity Zones. The fact that development-related sales are growing in OZs as such activity is shrinking in the Also Rans is evidence that this program is not just a buzz item.

Five Credits and Incentives that Can Boost the Value of Qualified Opportunity Zone Projects (Orlando Business Journal). Opportunity zones are an important addition to the economic development toolbox, but they should not be viewed in a vacuum. There are ways that state and local incentives can increase the total benefits to QOZ projects, increasing project feasibility and improving return on investment. Important potential credits to incentives to complement OZ investments include: 1. New markets tax credits (NMTC); 2. Tax increment financing (TIF); 3. State job and investment credits; 4. Work opportunity tax credit (WOTC); and 5. In-kind contributions.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Can Place-Based Incentives Help Poor Residents? (Smart Incentives). Place-based investment tax incentives have traditionally enjoyed significant bipartisan support, yet the empirical evidence is often disappointing to anti-poverty advocates when these incentives lack safeguards to protect poor communities. If the idea behind place-based incentives is that struggling individuals should be better off as a result, then it is necessary to build their needs into the process, specify the mechanisms for addressing those needs, and monitor and report on results. Among the ways to ensure more equity for residents is to link place to community by encouraging firms to engage more directly with communities through, for example, hiring members of the community or improving neighborhood conditions for the benefit of the community.

Innovation

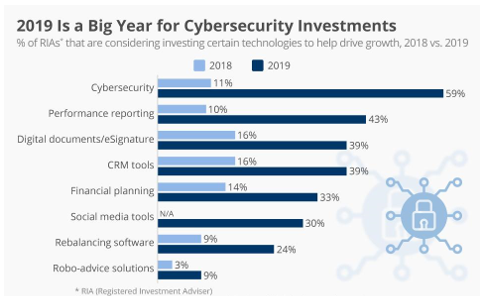

Top Cybersecurity Companies to Watch in 2019 (Forbes). The top ten cybersecurity companies reflect the speed and scale of innovation happening today that are driving the highest levels of investment this industry has ever seen. Worldwide spending on information security products and services is projected to reach $124B in 2019, growing 8.7% over the $114B invested in 2018. The threatscape every business operates in today is proving the old model of “trust but verify” obsolete and in need of a complete overhaul. To compete and grow in the increasingly complex and lethal threatscape of today, businesses need more adaptive, contextually intelligent security solutions based on the Zero Trust Security framework. Zero Trust takes a “never trust, always verify, enforce least privilege” approach to privileged access, from inside or outside the network.

Infrastructure

States Losing Gas Tax Revenue on Electric, Hybrid Cars (National Conference of State Legislatures). Current electric vehicle sales only represent about 1 percent of all light-duty car sales in the United States, but as sales continue to climb, there are concerns this may lower gasoline tax revenues. Electric vehicles do not require gasoline to operate, so they don’t contribute to the upkeep of highways through a gas tax. Meanwhile, several major automakers, including General Motors, Ford, Volvo and Volkswagen, are making announcements to expand the development and production of plug-in and all-electric cars. In response, some states are seeking to raise registration fees for hybrid/electric vehicles (EVs). Over the past three years, 14 states have enacted annual fees for hybrid/electric vehicles (EVs) ranging from $50 for plug-in hybrids to $200 for fully electric cars. All total, 20 states currently have some sort of EV fee above and beyond normal car registration costs.

Deal Makers

Incentives in Action

Use “Sunrise Analysis” for Designing Economic Development Tax Incentives (The Pew Charitable Trusts). When state legislators consider proposals for new economic development tax incentives, they face hard choices. Subtle differences in the design of business incentives can have a large impact on their effectiveness. By asking key questions at the outset through a “sunrise” process, policymakers can create programs that are more likely to achieve their goals. A sunrise process would address such questions as: Is there a clear rationale for the program? Is the incentive designed to achieve its stated goals? Does it minimize negative economic impacts? Does it include fiscal protections? Is it structured to be adequately and efficiently administered? The Pew Charitable Trusts discusses these questions and makes suggestions for how Rhode Island could create such a process in a recent memo. This practice would augment the state’s existing tax incentive evaluation process, which studies the effectiveness of tax incentive programs once they have been implemented.

Alabama Provides State Incentive for OZ Investments (Opportunity Alabama). Alabama Gov. Kay Ivey recently signed the Alabama Incentives Modernization (AIM) Act giving state taxpayers a capital gains tax reduction for opportunity zones (OZ) investments, conforming the Alabama tax code to the Internal Revenue Code on OZs. The AIM Act also allows the state’s Department of Economic and Community Affairs to reach agreements with qualified opportunity funds (QOFs) to offer impact investment tax credits to investors in case the projects undertaken by the QOF don’t produce expected returns by the fifth year, with the provision that “extraordinary returns” are allocated back to the state. There is a $50 million annual cap on the credits.

Indiana Makes Tax Credit Change to Boost Out of State Venture Capital (Indianapolis Business Journal). Indiana has offered its venture capital investment tax credit since late 2003 as a way to make investing in startups less risky, but it only benefited Indiana residents because it applied to an individual’s state tax liability. That meant investors who didn’t pay Indiana taxes were left out. Starting in 2020, investors will be allowed to transfer the tax credit, which means out-of-state investors can essentially sell the credit to someone in state who can take advantage of it. Leaders in the tech community say that is a big win for their industry, because it will help motivate out-of-state individuals—who regularly ask about the tax credit—to invest in Indiana startups.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database click here.

New Growth Opportunities

AI, Blockchain will have ‘Transformational’ Impact for Healthcare in Next 3 Years (Accenture). The healthcare industry is among the most labor dependent. Technology offers a new opportunity for the workforce to operate at a new level of efficiency. The possibilities in healthcare are vast. Imagine AI helping to scan structured data, such as medical claims; semi-structured data, such as XML; and unstructured data (e.g., medical records, email) in seconds to perform a clinical review which would otherwise require a human to read hundreds to thousands of pages. Extended reality and artificial intelligence can help surgeons with pre-surgical planning and provide a critical overlay of information during a procedure. The majority of healthcare organizations are now experimenting with at least one of these emerging technologies: distributed ledgers, artificial intelligence, extended reality or quantum computing. A larger majority (68%) of healthcare executives believe the combination of these technologies will have a “transformational” or “extensive” impact on their organizations in the next three years; and nearly all (94%) of the surveyed healthcare executives said they believe emerging technologies have accelerated the pace of innovation in the industry.

Talent Development/Attraction

Empowering the New Mobility Workforce: Learning from Past Transformations (UC Davis Greenlight Webinar). New transportation technologies will change the way we travel, live, and work. It is estimated that transportation employers will need to hire 4.6 million workers—1.2 times the current transportation workforce—in the next decade. Driving these changes are new technologies – such as vehicle automation and new mobility services – but this is far from the first time that automation and new technology have changed a sector of the economy. The webinar, hosted by the UC Davis Institute of Transportation Studies, explores past technological transformations and what they can teach us to expect for the next one. The webinar also discusses the new book, Empowering the New Mobility Workforce: Educating, Training, and Inspiring Future Transportation Professionals, and how leaders in education, industry and government can work together to create an ecosystem that facilitates learning and upskilling for emerging and incumbent transportation workers.

Manufacturing as a Career Path: Opportunities and Insights for State Legislators (NCSL Webinar). We have all seen reports about millions of good manufacturing jobs going unfilled. These jobs frequently provide high wages with benefits, yet many regions struggle to find qualified candidates. Advocates are working hard to illustrate how manufacturing jobs provide access to good careers with opportunities for creativity, engagement with new technology, and innovative and rewarding work. This webinar, hosted by the National Conference of State Legislatures, engages thought leaders in workforce and talent development to discuss trends and opportunities in manufacturing careers and steps that legislators and other state leaders can take to raise awareness and stakeholder engagement.