Latest News

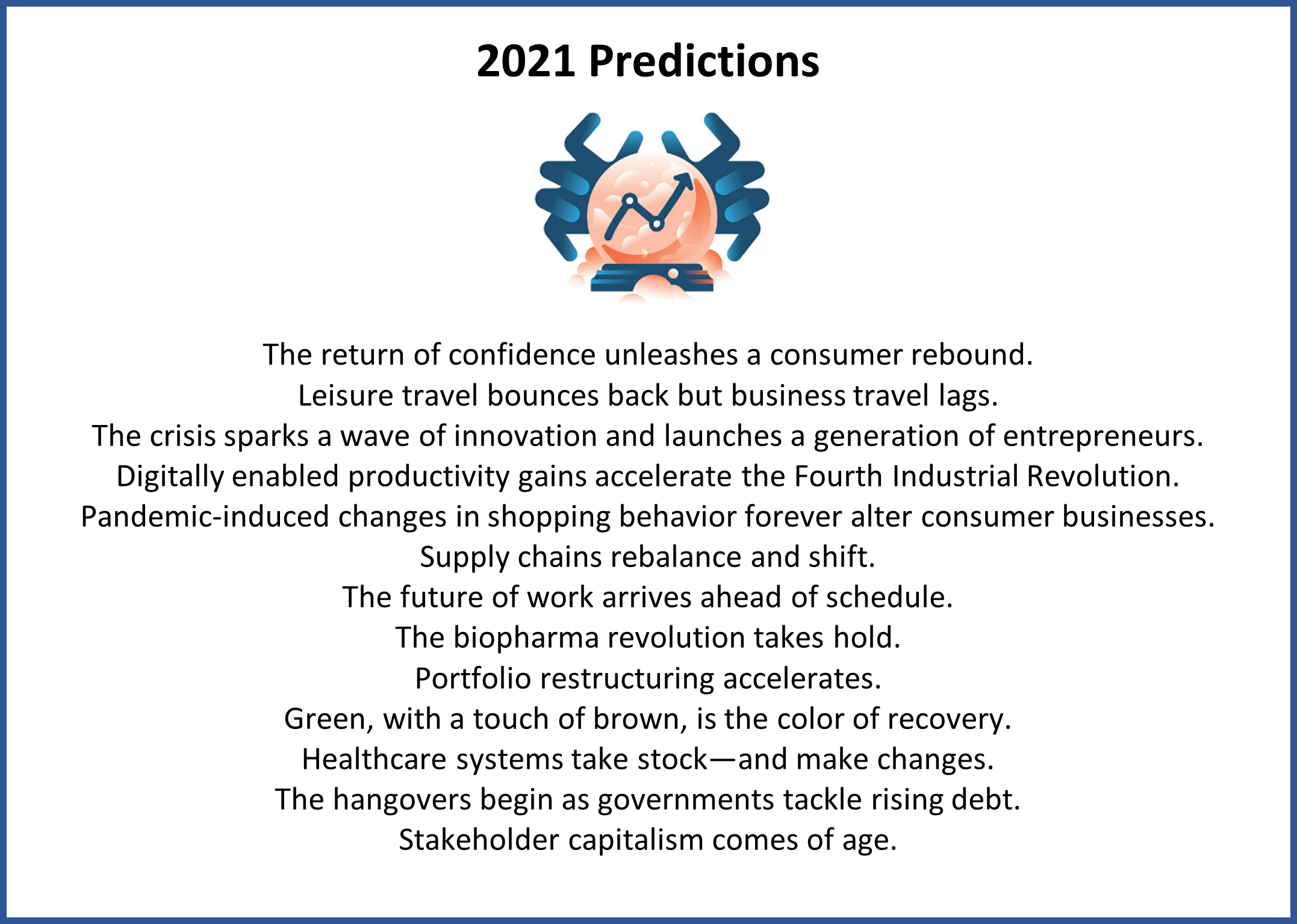

Trends for 2021—and Beyond (McKinsey & Company). Businesses have spent much of the past nine months scrambling to adapt to extraordinary circumstances. While the fight against the COVID-19 pandemic is not yet won, with a vaccine in sight, there is at least a faint light at the end of the tunnel—along with the hope that another train is not heading our way. 2021 will be the year of transition. Barring any unexpected catastrophes, individuals, businesses, and society can start to look forward to shaping their futures rather than just grinding through the present. The next normal is going to be different. It will not mean going back to the conditions that prevailed in 2019. Indeed, just as the terms “prewar” and “postwar” are commonly used to describe the 20th century, generations to come will likely discuss the pre-COVID-19 and post-COVID-19 eras.

SBA and Treasury Announce PPP Re-Opening (U.S. Small Business Administration). The U.S. Small Business Administration (SBA), in consultation with the Treasury Department, announced that the Paycheck Protection Program (PPP) will re-open beginning the week of January 11, 2021 for new borrowers and certain existing PPP borrowers. To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13. The PPP will open to all participating lenders shortly thereafter. Updated PPP guidance outlining Program changes to enhance its effectiveness and accessibility was released in early January 2021 in accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act.

State Economic Performance

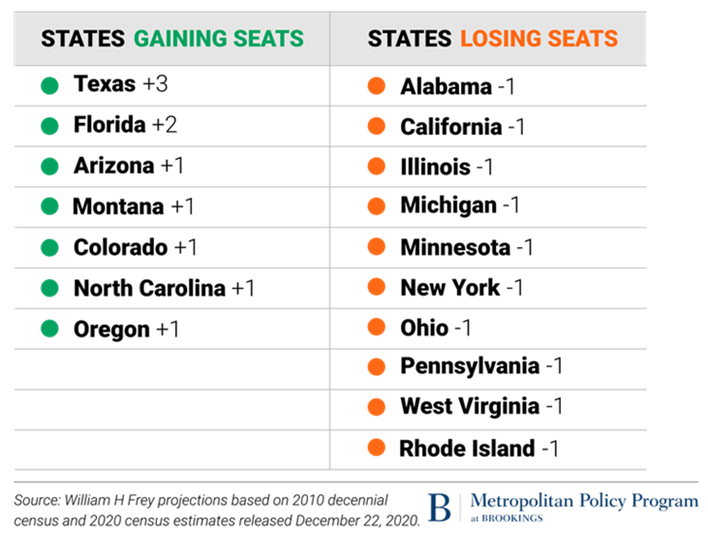

Lowest Population Growth in U.S. History Recorded (Brookings). Newly released Census Bureau population estimates through mid-year 2020 reveal record lows in U.S. population growth, both annually and for the 2010-to-2020 decade. The new estimates indicate that over the period from July 1, 2019 to July 1, 2020, the nation grew by just 0.35%. This is the lowest annual growth rate since at least 1900. The new data also shows that when the 2020 census numbers are announced, the 2010-to-2020 decade growth rate could be the lowest in any decade since the first census was conducted in 1790. These statistics paint a portrait of a nation that is experiencing unprecedented growth stagnation, even before the COVID-19 pandemic hit. The exceptionally low growth rate from 2019 to 2020 reflects the pandemic’s impact over part of that year. The new statistics also provide estimates of state-level population growth between 2010 and 2020. With this, the projected Congressional reapportionment shows two states—Texas (+3) and Florida (+2)—would gain multiple seats. Five others—all in the West (Arizona, Colorado, Oregon, and Montana) and South (North Carolina)—gain one.

* Fact Sheet *

President Biden Announces American Rescue Plan

President Joe Biden unveiled a $1.9 trillion coronavirus plan to speed up vaccines and deliver help to those struggling with the pandemic’s prolonged economic fallout. Called the “American Rescue Plan,” the legislative proposal would meet Biden’s goal of administering 100 million vaccines by the 100th day of his administration and advance his objective of reopening most schools by the spring. It also delivers another round of aid to stabilize the economy. Under Biden’s multipronged strategy, about $400 billion would go directly to combating the pandemic, while the rest is focused on economic relief and aid to states and localities. Presidential Inauguration Day marks the anniversary of the first confirmed case of COVID-19 in the United States. To read the full AP story, click here

* * *

Topics and Trends

Industry Watch

Deep Aviation Industry Losses to Continue (International Air Transport Association). Airline financial performance is expected to see a significant turn for the better in 2021, even if historically deep losses prevail. The expected $38.7 billion loss in 2021 will be second only to 2020 performance. On the assumption that there is some opening of borders by mid-2021 either through testing or growing availability of a vaccine, overall revenues are expected to grow to $459 billion ($131 billion above 2020 but still 45% below 2019). In comparison, costs are only expected to rise by $61 billion, delivering overall improved financial performance. Passenger numbers are expected to grow to 2.8 billion in 2021. That would be a billion more travelers than in 2020, but still 1.7 billion travelers short of 2019 performance. Airlines will still lose, however, $13.78 for each passenger carried. By the end of 2021 stronger revenues will improve the situation, but the first half of next year still looks extremely challenging. North American airlines are expected to benefit from an earlier recovery in the U.S. domestic market (the largest domestic market in the world) and have already restructured more extensively than other regions of the world which supported their pre-crisis industry-leading financial performance.

Trade/Tariffs

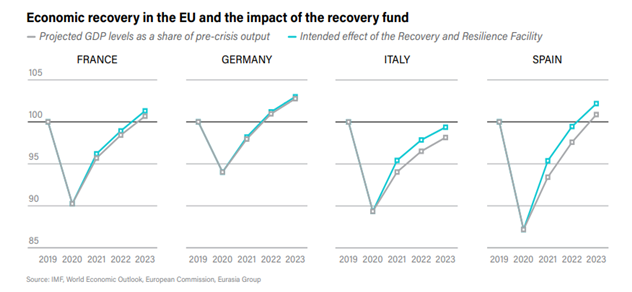

Europe after Germany’s Merkel (Eurasia Group). Without German Chancellor Angela Merkel’s deft political skills, the European Union (EU) would have faced an unprecedented internal split between Poland and Hungary on the one hand, and the remaining 25 member states on the other. The continent’s economic recovery would have hung in the balance, with far more pressure on the European Central Bank. Merkel set the stage for the EU to secure its landmark €750 billion recovery fund, a game-changing development that represented the best (and perhaps only) use of the pandemic as a political opportunity for strengthening multilateralism. She also managed to conclude a trade agreement with the U.K. and an investment deal with China, both of whose real value is the framework and basis for broader political and strategic cooperation they provide. In short, Merkel has been Europe’s most important leader. Her departure later in 2021 after 15 years as chancellor drives the continent’s top risk with potential impacts on U.S. relations and trade as well.

Opportunity Zones

Opportunity Zones Could Boom In 2021 (Forbes). While the Opportunity Zone program was created by the Tax Cuts and Jobs Act of 2017, which passed without any Democratic support, the opportunity zone idea has bipartisan roots. That crucial cross-aisle appeal, combined with the potential for increased regulatory clarity, possible tax rate increases, the massive gains of the unprecedented bull market of the last decade-plus, and the economic devastation in cities from Covid-19 have all set the stage for what could be a long-anticipated rush to opportunity zones. President Biden was vocal on the campaign trail about looking to rein in the program, with critics seeing it as having lax regulations and being poorly targeted. But the President has also signaled support for the program, including bringing into his administration members of the previous two administrations who were some of the original architects of the program. In other words, the potential exists for a more regulated, targeted, and monitored version of opportunity zones to take off in 2021. To view the Final Regulations on Opportunity Zones issued by the U.S. Treasury Department and IRS, click here.

Experts Share Perspectives on OZ Program Performance (Multi-Housing News). Opportunity Zones are a good idea today more than ever because they allow investors to “do well by doing good,” making an impact while seeing a return. There is a misperception that geography drives outcomes and certain locations are “bad places” to invest money. Opportunity Zones show that good projects can be viable investment opportunities regardless of the location. Successful projects must be carefully planned and well thought-out, like any venture. Some of the nonmajor metro centers, such as Birmingham (AL), Baltimore and Cleveland to name a few, have the most potential impact from the Opportunity Zones program and have garnered interest from investors. Some grew up in the region and are personally invested in giving back. These are among the observations by Ira Weinstein and Steve Glickman, co-authors of “The Guide to Making Opportunity Zones Work.” For more information on Opportunity Zones, CDFA has extensive resources available, click here.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

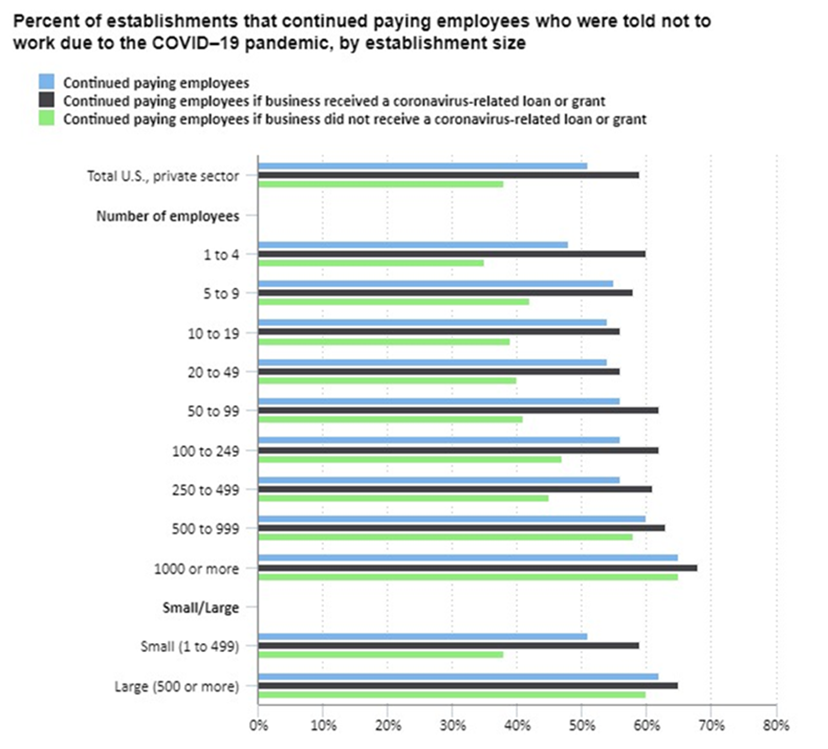

Many Businesses Paid Non-Working Employees during COVID–19 (Bureau of Labor Statistics). About half of U.S. business establishments continued to pay at least some of their employees told not to work due to the COVID–19 pandemic. When employers who told employees not to work received a loan or grant tied to rehiring or maintaining employees on their payroll, 59 percent continued to pay employees who were told not to work. Only 38 percent of businesses that did not receive a loan or grant continued to pay employees told not to work. Larger businesses were more likely to continue paying employees told not to work than were smaller businesses. These data are from the Business Response Survey to the Coronavirus Pandemic, a new BLS survey that asks questions on business experiences and responses to the COVID-19 pandemic.

Innovation

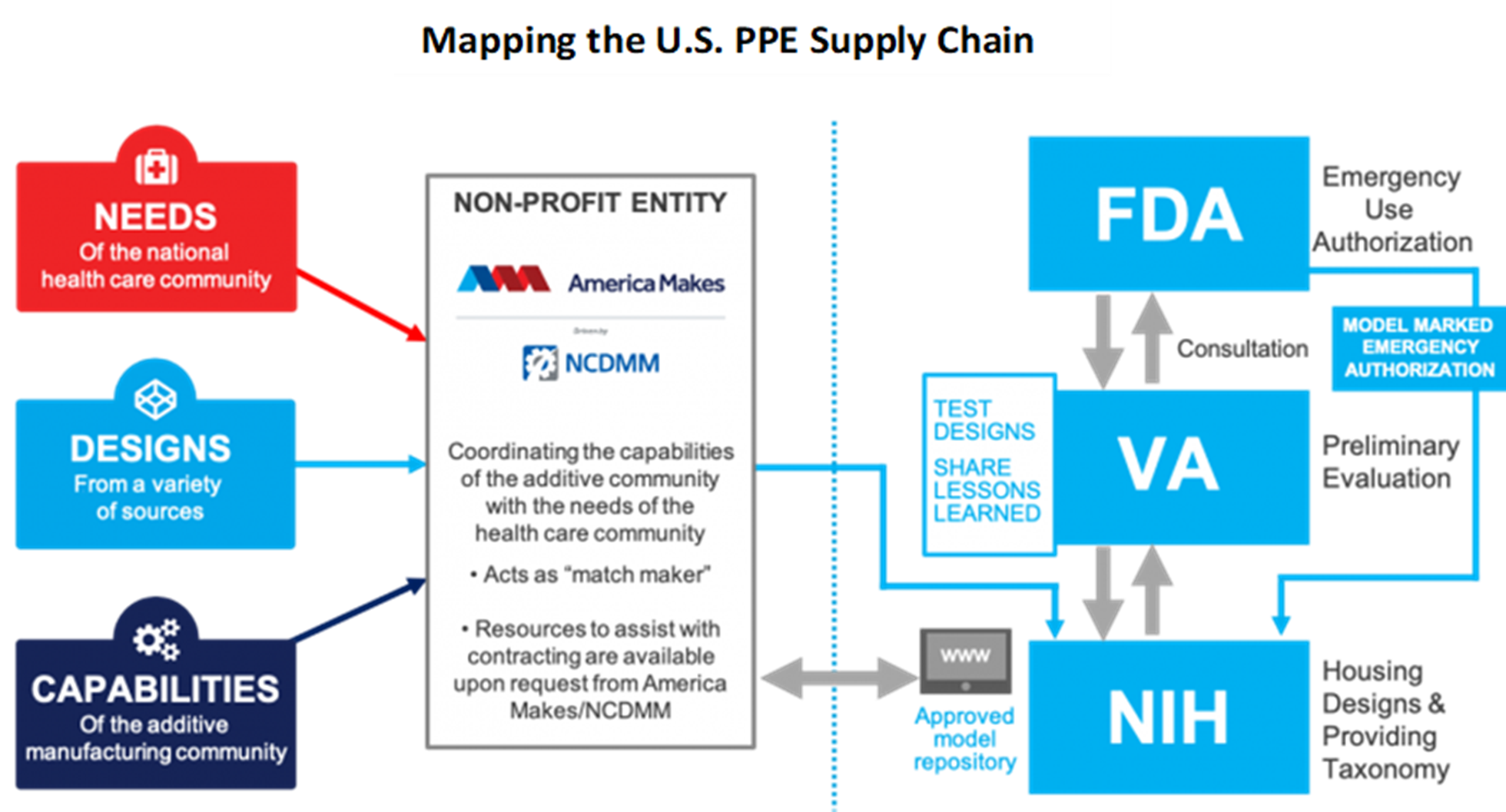

Reinventing the PPE Supply Chain in the Face of COVID-19 (Manufacturing USA). With so much production of personal protective equipment (PPE) focused in Asia, when the pandemic started it created a ripple effect on U.S. manufacturers that revealed issues in the supply chain. It particularly showed a lack of redundancy and transparency in the supply chain, and that the PPE supply chain in the U.S. would need reinventing. This article highlights the work by Manufacturing USA, a network of 16 institutes and their sponsoring federal agencies — the Departments of Commerce, Defense and Energy, in strengthening domestic PPE manufacturing. Mapping the PPE Supply Chain was one effort, among others. The conclusion from the network’s research is that there is a clear ROI for manufacturing PPE in the U.S. both economically and for society. Manufacturers already were dealing with risks of cost-driven outsourcing — such as poor quality, theft of IP, shipping delays and a lack of control — so the pandemic may prove to be a tipping point for reshoring. Emerging technologies are also converging with this demand to create new possibilities for domestic manufacturing.

Infrastructure

States Prioritized Broadband as COVID-19 Took Hold (Government Technology). COVID-19 forced government to leave behind its offices, schools to close their doors and citizens to isolate themselves at home. In doing so, the pandemic more than underlined the digital haves and have-nots, as a large segment of the American population has had to grapple with the demands of telework, distance learning and accessing online services. State leaders, no matter their political affiliation, acknowledged the digital divide more than ever before in 2020 and took different steps to facilitate more broadband. Mississippi awarded $65 million of its CARES Act money to electric cooperatives working on fiber buildouts, Indiana dedicated $51 million to its Next Level Connections Broadband Grant Program and Delaware is using $20 million of its CARES Act funding to address multiple digital equity concerns. Moreover, several states, including Alabama and Washington, began conducting surveys to gauge broadband levels within their borders. Continued action at the state level is likely, though the funding picture going into 2021 means the work will depend on additional federal support. The private sector will also play a significant role in the ongoing broadband movement.

Deal Makers

Incentives in Action

* New SEDE Incentives Report *

Addressing Remote Work in State Business Incentive Programs

As remote work became a more important part of the economic landscape in 2020, state economic development leaders considered adjustments to incentive programs to acknowledge this shift. Several states are addressing remote work in existing incentive performance agreements as companies strive to remain compliant with the terms of their contracts. Others are making permanent changes to their incentive policies as a strategic response to the expectation that remote work will become more widespread. Many more states are still sorting through the implications of remote work for their companies and communities. This paper addresses the issues state economic development organizations should consider as they determine whether or how to adjust their incentive programs to accommodate remote work. This is the fifth report in a series of timely papers on state incentives management completed by CREC and Smart Incentives for the SEDE network. The entire series is available on the SEDE website, click here.

Michigan Reinstates State Historic Tax Credit (Upper Peninsula MI Matters). Michigan Governor Whitmer signed legislation that reinstates the state historic tax credit (HTC) through the end of 2030. S.B. 54 grants a state HTC for 25% of qualified rehabilitation expenses, with an annual statewide cap of $5 million and a per-taxpayer cap of $2 million. The legislation sets aside $2 million annually for large nonresidential historic resources, $2 million for small nonresidential historic resources, and $1 million for residential historic resources. The credit is effective for taxpayers who receive a certificate of completed rehabilitation after Dec. 31, 2020. Michigan’s previous state HTC expired in 2012. The tax credit comes back to eligible taxpayers when they file their income taxes for the year. If it is not used in the first year after they complete their restoration, it can be used up to ten years. One user of the incentive indicated the tax credit was enough to impact whether they chose new shingles with a longer lifespan or not.

New York Creates Restaurant Survival Loan Fund (Empire State Development). The Raising the NYS Bar Restaurant Recovery Fund offers approximately $3 million in reimbursement grants for up to $5,000 to eligible businesses. The program is intended to support full-service restaurants – the industry hit hardest by the pandemic – during the winter months when outdoor dining is limited and as restaurants adjust to New York State’s COVID-19 safety restrictions and new mandates. The fund is a partnership between New York State, Diageo Wine & Spirits, Southern Glazer Wines & Spirits and The National Development Council (NDC). NDC will manage the grant funding. Grants are supplied on a reimbursement basis to restaurants operating in the state on or before March 1, 2019 and classified in NAICS code 722511, or establishments engaged in providing food services and meals prepared on-premises to patrons who traditionally order and are served while seated (i.e., waiter/waitress service), those licensed through the State Liquor Authority (SLA), and those providing take out or grab and go food services due to COVID-19 restrictions. Franchises are not eligible.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

Wisconsin Releases Rural Prosperity Report with Actions (Wisconsin Economic Development Corporation). The Wisconsin Governor’s Blue Ribbon Commission on Rural Prosperity has released “Rural Voices for Prosperity,” which calls for coordinated measures across state government to meet the needs of Wisconsin’s rural communities. The report features 10 overarching recommendations that, taken together, would commit state government to a comprehensive approach to rural prosperity, create new partnerships with rural and tribal communities in designing and delivering state services, and investing more thoughtfully to address rural Wisconsin’s critical challenges and most promising opportunities. Among the recommendations is for the state to partner with UW-Extension to help regions understand assets and craft development strategies that incorporate rural realities; continue to support the work of WEDC’s Office of Rural Prosperity, and to look beyond Wisconsin’s borders for good ideas.

Talent Development/Attraction

Talent Attraction Strategies for 2021 (EMSI). Talent attraction and development is driven by a few core principles: coordinate and collaborate, follow the lead of business, and focus on skills. While the COVID-19 pandemic altered life and the economy in 2020, and will have lasting impacts, these principles of talent attraction and development remain unchanged. To address immediate needs and capture current opportunities, near-term strategies can be adapted to current market trends. Likewise, long-term strategies can be tweaked to reflect the realities of a post-COVID world. While enticing working-age adults to a region gets the limelight in talent attraction and much of talent development is focused on the certificate and degree programs, to cultivate a healthy stream of talent you need to start earlier than either of these phases. This means thinking about students at each stage of their education and training. The fruits of these labors will take time to reap but are the necessary foundation for a resilient workforce over the long term.

Lessons Earned: Putting Education to Work (Strada Education Network). In the not-so-distant future, workers will make dozens of career changes over a working life of 75 or even 100 years. Michelle Weise, an expert on the future of work and author of “Long Life Learning,” says human skills like creativity, communication, and teamwork will remain critical in an era when robots and automation take over routine jobs. What is more, workers increasingly will need to learn new skills rather than assuming a degree early in life will carry them through. This podcast is part of a series on Lessons Earned hosted by the Strada Education Network. In each episode, the podcast host sits down with educators, employers, and policymakers who are challenging the status quo and exploring bold new ideas to help millions of Americans navigate between learning and earning.

* * *

SEDE Network Updates

* Check out the SEDE Website *

The SEDE Network engages in regular activities and events throughout the year. You can stay up to date on all these activities via the SEDE Network website. The site includes a collection of websites and other resources used by states to address the Coronavirus Challenge.

Click the link above and check it out!

* * *

The SEDE Network Steering Committee includes: Stefan Pryor (RI), Chair; Sandra Watson (AZ), Vice Chair; Julie Anderson (AK); Mike Preston (AR); Kurt Foreman (DE); Don Pierson (LA); Kelly Schulz (MD); Kevin McKinnon (MN); Chris Chung (NC); Alicia Keyes (NM); Michael Brown (NV); Andrew Deye (OH); Dennis Davin (PA); Jennifer Fletcher (SC); Adriana Cruz (TX); Joan Goldstein (VT); Mike Graney (WV).

For further questions on the content in this Bulletin or for information on the SEDE Network contact Marty Romitti, CREC Senior Vice President, at mromitti@crec.net