Latest News

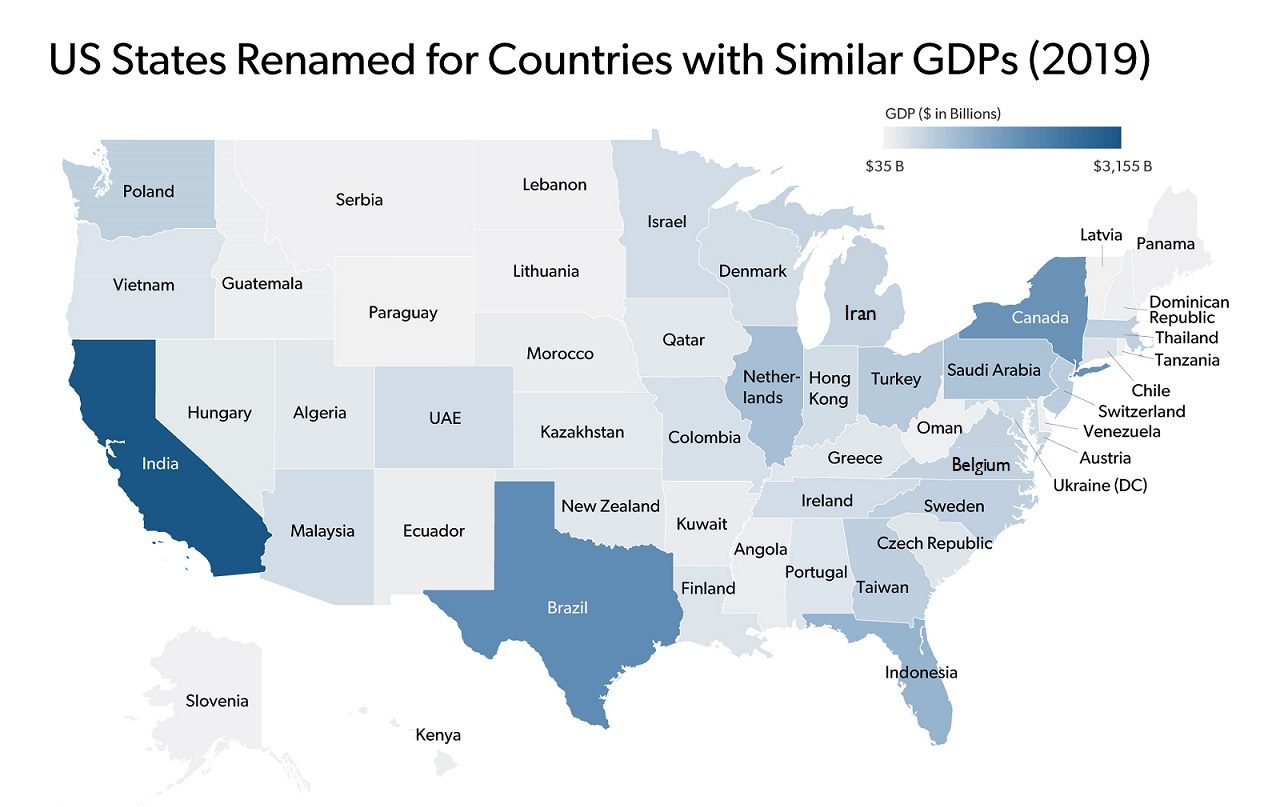

Comparing State GDPs to Entire Countries (American Enterprise Institute). The U.S. produced nearly 25 percent ($21.5 trillion) of world GDP ($87.2 trillion) in 2019, with only about 4.3 percent of the world’s population. Four of America’s states (California, Texas, New York and Florida) produced more than $1 trillion in output and as separate countries each would have ranked in the world’s top 17 largest economies. Adjusted for the size of the workforce, there might not be any country in the world that produces as much output per worker as the U.S., thanks to the world-class productivity of the American workforce. The map matches the economic output (Gross Domestic Product) for each U.S. state and DC to a foreign country with a comparable nominal GDP last year, using data from the BEA for GDP by state and data for GDP by country from the International Monetary Fund.

State Economic Performance

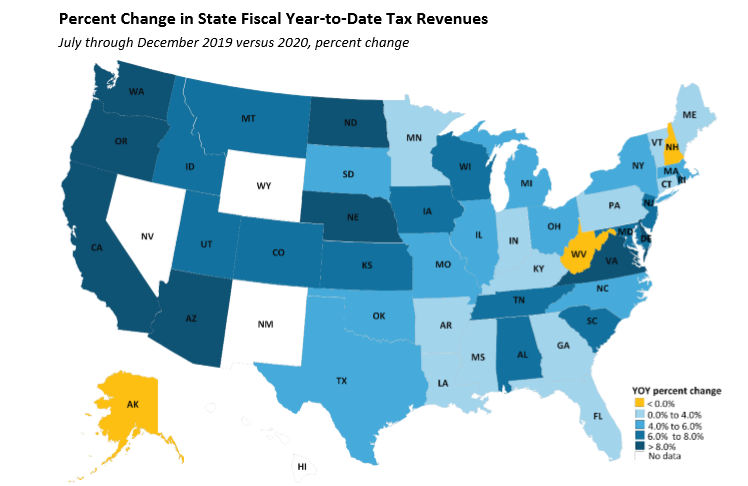

State Tax Revenues Trend Higher (Urban Institute). Recent data from 46 states show continued growth in overall state tax collections, including reported growth in all three major sources of taxes: personal income tax, corporate income tax, and sales tax. State tax revenues totaled $429.7 billion from July 2019 through December 2019 (which corresponds to the first six months of fiscal year 2020 for 46 states). This was $25.1 billion or 6.2 percent higher than the previous year. From July–December 2019, 43 states reported growth while 3 states reported declines in total tax revenue collections compared with the same period a year earlier. Four states did not yet report data. The State and Local Finance Initiative at the Urban Institute reports Monthly State Revenue Highlights on tax revenue trends for major sources of taxes and trends across the states.

Topics and Trends

Industry Watch

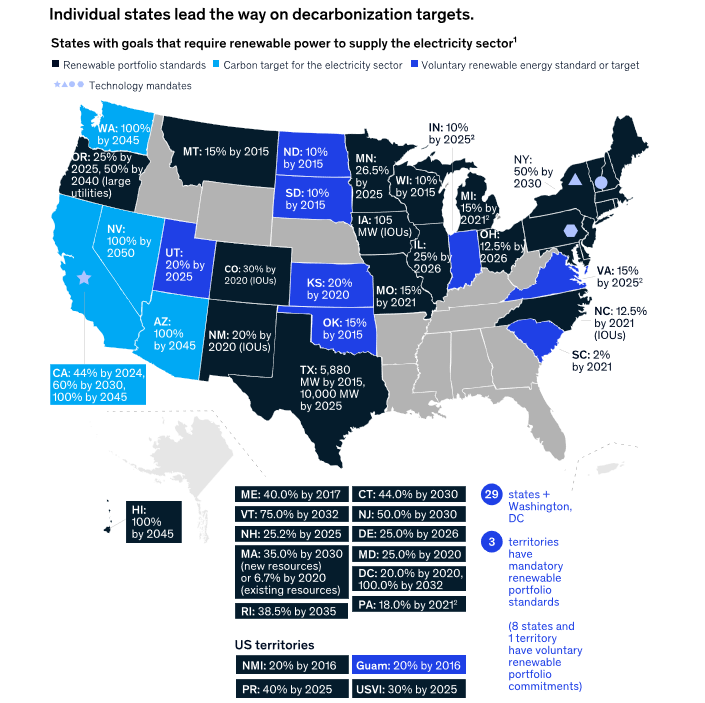

The Future of Natural Gas in North America (McKinsey & Company). Industry discussions about the future of gas in North America are polarizing. On one hand, the shale revolution keeps delivering, displacing liquefied natural gas (LNG) imports since the late 2000s, as abundant gas resources and technological innovation drive costs down. In the past few years, shale has entered a new phase with the rise of LNG exports from North America. By 2023, North America is expected to head the list of the world’s top LNG exporting regions. On the other hand, as state-level decarbonization policies ramp up, the demand for natural gas in key segments such as power generation and local distribution companies is expected to decline. These contrasting outlooks reflect different perspectives and interests of stakeholders, regions, and segments. However, gas will continue to play a role in North America, even in areas with nearly full decarbonization policies. Expect to see gas turbines using “clean”—that is, zero-carbon—gas such as biogas, hydrogen (co-firing), gas plus carbon capture and storage (CCS), or nature-based solutions. However, scaling these gas sources will take some time.

Trade/Tariffs

Coronavirus Will Impact the U.S. Economy (The Conversation). As coronavirus spreads around the world, and confirmed cases and deaths mount, economists are increasingly concerned about the impact on the U.S. economy. In a recent report to Congress, the Federal Reserve warned that disruptions from the coronavirus could spill over into the global economy, creating new risks here as well. Goldman Sachs estimates the virus will cut a half point off U.S. economic output in the first quarter of 2020. Specific disruptions to monitor include sales to China, as one of the largest markets for U.S. products, especially for electronics and fashion. Second, manufacturers that use components in their products mostly sourced from infected areas in China such as Wuhan, where more than 500 car parts manufacturers operate, are coping with constrained and disrupted supply chains. Many U.S. companies have or are looking to move all or most of their manufacturing facilities out of China to other countries in the region, such as Vietnam, Taiwan, Bangladesh and South Korea. Third, US tourism will take a hit. The number of visitors coming to the United States from China could drop by as much as 28% in 2020, translating to $5.8 billion in less spending this year.

Opportunity Zones

Final Regulations Offer More Certainty to OZ Investors (Orrick, Herrington & Sutcliffe LLP). OZ investment stalled in 2018 and 2019 due to significant uncertainty over how the tax incentives enacted by Congress in 2017 would be implemented by the Internal Revenue Service. The Final Regulations issued by the IRS in December 2019 have addressed many areas of major concern for managers of a qualified opportunity fund (QOF) and investors in those QOFs, opening the door for many more opportunities for these tax-advantaged investments. The Final Regulations are effective for tax years beginning after March 13, 2020 but an election may be made to apply the regulations retroactively, which likely will be applied in most cases. The Final Regulations are divided into six parts, corresponding with operative sections of the Internal Revenue Code: (1) Procedure for deferring gains and operative definitions; (2) Inclusion of gains that have been deferred; (3) Issues associated with QOF investments that have been held for at least 10 years; (4) Requirements for QOZP; (5) QOZB property requirements; and (6) Reinvestment of proceeds and anti-abuse rules. To view the Final Regulations on Opportunity Zones issued by the U.S. Treasury Department and IRS, click here.

Opportunity Zones Bring New Life to Small Town Indiana (Opportunity Investment Consortium Indiana). Brookville, Indiana, a town of about 3,000 people, had seen no new development in more than 20 years. Town leaders sought to transform their community and began by organizing a redevelopment plan for the historic downtown. Leadership then approached a local developer with a strong track record in redeveloping similar projects near and around Brookville. The project proposed to provide mixed-income apartments with an assisted living component for seniors and retail on the first floor, including a pharmacy, restaurant, primary care facility, and other community-servicing amenities. The project also entailed rehabilitation of the historic buildings along the corridor as well as new construction of apartments to meet workforce needs in the area. When an area family sold their business – Sur-Seal – in June 2018 and incurred significant capital gains, they saw Opportunity Zones as a chance to further invest in their community and specifically this project. The designation of the Opportunity Zone allowed the family to form a partnership with the developer where they committed to financing the remaining components of the deal – allowing the developer to move forward with the full concept as initially planned. For more information on Opportunity Zones, CDFA has extensive resources available, click here.

Why Cannabis and Opportunity Zones Could be a Budding Industry (Bisnow Los Angeles). Downtown Los Angeles could soon see one of the first mixed-use cannabis projects in a designated opportunity zone in the nation. Oakland-based Oak Investment Fund is planning to develop the estimated $75M to $100M project on the former 50K SF Honda dealership across the street from the Los Angeles Convention Center. The proposed mixed-use development will feature a boutique hotel that could rise as high as 50 stories, with a music recording studio, a film screening room, an event space, retail, and a cannabis dispensary and lounge on the ground floor. This could be the start of a bigger nationwide trend of cannabis investors and operators setting up cannabis operations in opportunity zones, despite the federal government classifying the drug in its most restrictive category. Why? The OZ program published a list of prohibited investments or “sin businesses” that includes setting up country clubs, massage parlors, strip clubs, racetracks, liquor stores and casinos in opportunity zone areas. Cannabis businesses were not included on the list. While the IRS might classify cannabis businesses in the program’s liquor store sin category, or in its own separate category in the future, the developer feels confident they can include a cannabis operation as part of this mixed-use project.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Rural Community Action Guide (Office of National Drug Control Policy). Rural communities face many hurdles in addressing opioid and other drug addiction. Research shows that people living in rural America who need help are falling through the cracks, often losing their lives. Treatment services are insufficient to meet rural demand. Access to quality medical care, resources, and training is limited in rural communities, particularly for specialized populations, such as pregnant women, parents, and seniors. Further, drug courts, which are known to be significantly more effective than incarceration for non-violent offenders, are not available in many rural areas. In recent years, drug overdose deaths in rural counties jumped by 325 percent as compared to 198 percent in metropolitan areas. The Rural Community Action Guide is a compilation of data collected from numerous community organizations. The guide aims to provide an overview of the key challenges rural communities face when addressing the consequences of prescription opioid misuse and the use of other illicit substances. It also showcases localized efforts implemented to help mitigate the impact of substance use disorder.

Innovation

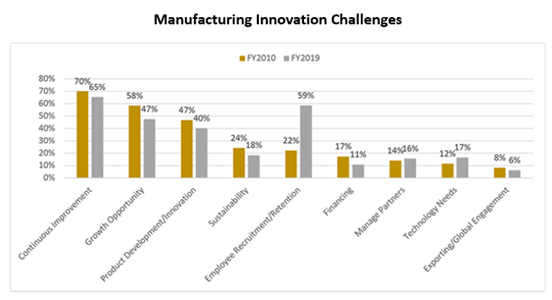

Preparing for a New Decade of U.S. Manufacturing (NIST MEP). U.S. manufacturing is entering this new decade in a much different state than when it entered the last. The industry is no longer shaking off the aftereffects of the Great Recession, but it is still grappling with the economic uncertainty that comes with new trade deals and tariffs. There is also the need to keep pace with the ever-increasing speed of technological change. Industry 4.0 and its adoption by U.S. manufacturers has begun to pick up steam, and manufacturing’s digitization is only going to increase. Things like 3D printing, advanced robotics, artificial intelligence, and smart factories are becoming more commonplace, emphasizing a deepening need for stronger cybersecurity. The prioritization of challenges among the Manufacturing Extension Partnership (MEP) National Network of clients is shown below. Some of the challenges have been consistent such as continuous improvement, while others have become increasingly important over time. For instance, the share of MEP Center clients reporting employee recruitment and retention as a challenge has more than doubled and is now the second most frequently reported challenge companies are facing.

Infrastructure

FCC Approves $20 Billion Rural Broadband Funding Plan (Route Fifty). The Federal Communications Commission (FCC) voted to approve a $20.4 billion plan to subsidize the construction of high-speed broadband networks in rural America. FCC Chairman Pai called the vote the “biggest step the FCC has ever taken to close the rural digital divide.” The Rural Digital Opportunity Fund will help internet service providers deploy broadband over 10 years to areas currently lacking service of at least 25 megabits per second download and 3 Mbps upload speeds. The federal agency estimates about six million rural homes and businesses are located in areas that could benefit from the initiative. Internet service providers, including telecoms and government utilities, would bid to provide broadband and voice services to the locations. The FCC released an analysis in January indicating which states had the most locations eligible for funding. California, Texas, Michigan and Wisconsin topped the list. For the number of locations eligible for bidding in each state for high-speed broadband, click here.

Deal Makers

Incentives in Action

States Use Annual Caps to Control Tax Incentive Costs (Pew Charitable Trusts). Research by The Pew Charitable Trusts shows that caps are among the most effective tools for governments to guarantee that business incentives do not cost more than expected or intended. A cap is an annual limit on a state’s costs or commitments from an incentive program. Some jurisdictions place limits on the amount of incentives that individual companies can receive, but to offer the greatest protection, these caps generally must apply to entire programs—a film tax credit cap, for instance, would limit the credits that all film productions could receive, not just any single production. Most states cap at least some of their programs, but few use this protection consistently. By applying caps systematically, policymakers can ensure incentives do not cause unexpected strains on state budgets, while still achieving their economic development goals.

New Mexico Releases Economic Development Innovation Recommendations (New Mexico Economic Development Department). House Memorial 16 passed in 2019 directed the New Mexico Economic Development Department (NMEDD) to bring together stakeholders and convene an Economic Development Innovation Task Force to spur collaboration and develop concepts and ideas to enhance the state’s economy. A major recommendation from this effort was the proposed creation of a $100 million New Mexico Infrastructure Innovation Fund to identify and prepare sites to garner the attention of site selection firms and meet the economic development needs of communities. The fund would help establish a Certified Sites designation that identifies properties that are shovel ready for capital investment. Broadband and projects supporting targeted industries would also be priorities. Task Force recommendations also included increased funding for the New Mexico Partnership to $3 million annually, $2 million each year for an Economic Development Cooperative Advertising/Marketing Fund to support community level business attraction efforts, and $1 million annually for an Economic Development Grant Program requiring a 1:1 match from regional and local economic development organizations, among others.

Behind Amazon’s HQ2 Fiasco: Jeff Bezos Was Jealous of Elon Musk (Bloomberg). When Elon Musk secured $1.3 billion from Nevada in 2014 to open a gigantic battery plant, Jeff Bezos noticed. In meetings, the Amazon.com Inc. chief expressed envy for how Musk had pitted five Western states against one another in a bidding war for thousands of manufacturing jobs; he wondered why Amazon was okay with accepting comparatively trifling incentives. It was a theme Bezos returned to often, according to four people privy to his thinking. Then in 2017, an Amazon executive sent around a congratulatory email lauding his team for landing $40 million in government incentives to build a $1.5 billion air hub near Cincinnati. The paltry sum irked Bezos, the people say, and made him even more determined to try something new. And so, when Amazon launched a bakeoff for a second headquarters in September 2017, the company made plain that it was looking for government handouts in exchange for a pledge to invest $5 billion and hire 50,000 people. The contest for HQ2 attracted bids from 238 cities across North America and ended with Amazon deciding on New York and Virginia.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

Digital Infrastructure Opportunities Expected to Stay on Growth Track (Pensions & Investments). Infrastructure for the growing digital economy, which are in both real estate and infrastructure portfolios, will continue to grow in 2020. In its annual global outlook report, LaSalle Investment Management notes that emerging real estate sectors including data centers and cybersecurity have the potential to earn higher returns, even in a slow-growth economy. The roll out of 5G and 5G-enabled handsets will be ushering in another up cycle of growth in the digital infrastructure sector. While there is uncertainty around the T-Mobile and Sprint merger, which together represent one-third of the market, the merger was recently found by the court to be lawful. Attorneys general for 14 states had sued to stop the merger, claiming that it would harm competition and raise prices. However, one way or another, there will have to be significant investment in networks as 5G requires a significantly denser network design. There will be new macro towers and many small cell antennas, primarily in urban areas. Each existing cell tower will also have to be modified so it can handle 5G.

Talent Development/Attraction

Preparing for the Future of Work (American Association of Community Colleges). The nature of work is changing right before our eyes. Technology advancements are transforming existing industries and creating new ones at an unprecedented pace. The World Economic Forum predicts significant disruption in the jobs landscape over the next three years, with as many as 75 million current job roles being displaced. The upside is that more than 130 million new roles could emerge. Many of those roles will be those enhanced by technology, or what the National Science Foundation describes as the “future of work at the human-technology frontier.” These are technologies that can collaborate with humans to enrich lives and workplaces. The challenge is ensuring the future workforce can acquire the expanding skill sets necessary for success in a rapidly changing employment environment. Therefore, helpful advice includes don’t ignore the future, strengthen your employer partnerships, leverage stackable credentials, and focus on outcomes.

Hiring in the Modern Talent Marketplace (U.S. Chamber of Commerce Foundation). As the U.S. labor market becomes one of the most competitive talent markets in recent history, employers of all sizes across multiple industries are struggling to hire qualified candidates. More than half of U.S. states (28) have more open jobs than available workers to fill them. This means that even if every single individual in that state who wants a job – and is available to work – could find a job, there would still be positions left unfilled. As competition for job candidates increases, hiring mangers face pressure to get innovative and deliver qualified candidates who are the ‘right fit’ for their organizations. To better understand the modern talent marketplace, the U.S. Chamber of Commerce Foundation commissioned a survey of HR professionals. Among the findings, nearly three-quarters of respondents (74%) agree that a ‘skills gap’ persists in the current U.S. labor and hiring economy. Employers and hiring managers are preparing for a world where competencies – not degrees – are the most important factors when filling a job. According to the survey, respondents (78%) acknowledged the need to overhaul their hiring practices to make this shift to focus on competencies. Employers are also working with higher education to align what is taught in the classroom with the needs of the economy.

The SEDE Network Steering Committee includes: Stefan Pryor (RI), Chair; Val Hale (UT), Vice Chair; Julie Anderson (AK); Dennis Davin (PA); Jennifer Fletcher (SC); Kurt Foreman (DE); Joan Goldstein (VT); Manuel Laboy Rivera (PR); Jeff Mason (MI); Kevin McKinnon (MN); Don Pierson (LA); Mike Preston (AR); Sandra Watson (AZ).

For further questions on the content in this Bulletin or for information on the SEDE Network contact Marty Romitti, CREC Senior Vice President, at mromitti@crec.net