Latest News

*SEDE Network Members Testify at IRS Opportunity Zone Hearing *

Opportunity Zone Experts Voice Concerns over Program’s Rules, Suggest Fixes in IRS Hearing The Internal Revenue Service sought feedback in creating the regulations at a five-hour hearing on February 14, during which over two dozen stakeholders highlighted concerns they have with the rules of the program and suggestions for how they can be improved. Several stakeholders pushed the IRS to loosen the restrictions on funds investing in businesses, as the proposed IRS regulations make it difficult for funds to put money into businesses.

These stakeholders included Rhode Island Secretary of Commerce Stefan Pryor and Delaware Prosperity Partnership CEO Kurt Foreman, who testified on behalf of a group of 12 state economic development executives, outlining four key recommendations to ensure OZs fulfill the intent of Congress to attract scarce equity capital to underinvested communities for two purposes: the development of brick and mortar projects as well as the growth of operating businesses.

State Economic Performance

How Venture Capital will Change in 2019 (GeekWire). With seed deal size rising, more non-traditional investment vehicles, and an increasing amount of companies going public, the venture capital industry continues to evolve. Analysts from investment data research firm, PitchBook, made six predictions for 2019 on shifts in the VC climate from current levels:

- IPOs as a proportion of total VC exit value will hit another decade high.

- New participants in VC will continue to proliferate.

- Median early-stage valuation step-ups will hit 2.0x in 2019.

- Median angel & seed deal size will continue to climb.

- Growth in median fund size will decelerate.

- Banks will back more institutional blockchain solutions.

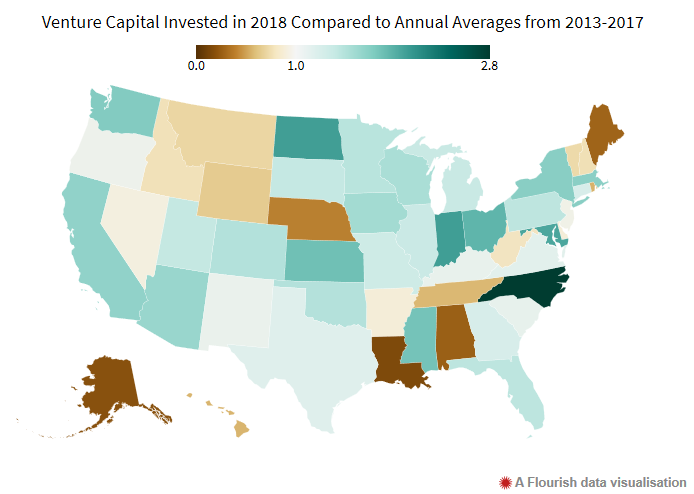

In separate research based on PitchBook data, SSTI found that VC investments nearly tripled in the past six years; and 31 states outperformed 5-year averages for VC dollars invested in 2018. The SSTI information on VC investment by state and changes over time is available for viewing and download.

Topics and Trends

Industry Watch

Best Industries for Starting a Business in 2019 (Inc.). To launch a successful business, you need a good idea and the boldness to act on it. While all first-time entrepreneurs have their work cut out for them, anyone who can identify industries uniquely positioned for growth has a clear advantage. Each year, Inc. crunches the latest data and speaks with industry experts to determine the sectors that are most likely to take off. Key growth industries for tomorrow’s fastest-growing startups include:

- Micromobility

- Digital Therapeutics

- Cannabidiol (CBD) Products

- Personalized Nutrition

- Healthy Jerky

- Baby Tech

- Selfie Services

- Workleisure Apparel

In separate research reported in Entrepreneur, 99designs compared thousands of design contests and projects launched in 2018 with those launched in 2013 and identified artificial intelligence (AI) for healthcare, personal coaching, founding an influencer agency, and the drone industry as growing industries. The AI healthcare category, for example, which includes the likes of virtual doctors and smart health apps, showed a 48 percent spike since 2013.

Trade/Tariffs

Tariffs May Live on as Best Bet to Enforce a China Deal (Bloomberg). Trump advisers say China has failed to meet commitments in the past, one reason they decided early in the president’s term to emphasize the stick over the carrot. U.S. tariffs on Chinese goods have upended financial markets, shaken the world economy, and caused businesses to reconsider their supply chains. They’re due to more than double on March 2 if the countries can’t reach a deal. But even if they can, analysts say, that doesn’t mean the import duties will disappear forever. Any accord is likely to include assurances by China on issues such as granting licenses to U.S. companies without hidden regulations that undermine them; buying more American goods over the long run, rather than just conceding a one-time feel-good boost; and punishing theft of U.S. commercial secrets. And all those commitments will need to be monitored by the U.S.

Opportunity Zones

Model Opportunity Zone Reporting Framework Released (U.S. Impact Investing Alliance). The Opportunity Zones Reporting Framework is a voluntary guideline designed to define best practices for investors and fund managers looking to invest in Opportunity Zones. This tool is specifically focused on how Opportunity Fund managers can thoughtfully deploy the capital they raise from investors. It includes a set of first principles and a detailed impact measurement framework. The Opportunity Zones Framework was a project of the U.S. Impact Investing Alliance and the Beeck Center for Social Impact + Innovation at Georgetown University, and developed in consultation with a broad array of industry leaders — including investors, asset managers, academics, policy experts and community stakeholders — who all contributed to developing the principles and measurement framework. For more information on Opportunity Zones, our partners at CDFA have extensive resources available, click here.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Policies to Promote Inclusive Urban Growth (George W. Bush Presidential Center). Inclusive growth is economic growth that is distributed fairly across society and creates opportunities for all. The Bush Center recently hosted a symposium on what American cities can do to better promote upward mobility among people who feel left behind by economic growth in their city and nationwide. A video of the proceedings has been released, including expert panels and case studies detailing how American cities can successfully stabilize neighborhoods, revive the urban middle class, and address the growing attainable housing crisis.

Innovation

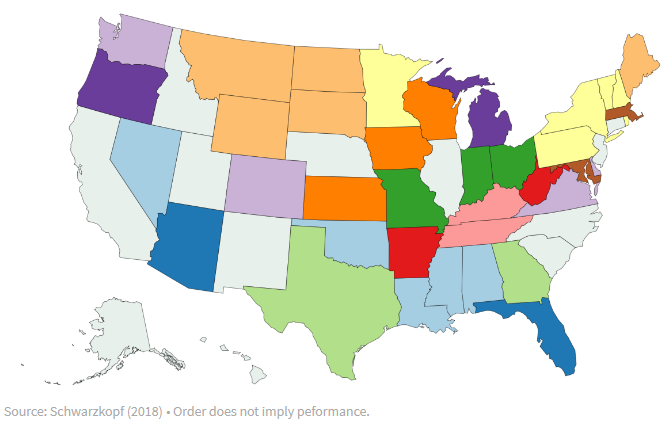

Identifying Peer States for Technology-Based Economic Development (SSTI). New research finds that all 50 states improved on more than half of 53 TBED measures published by the NSF through its Science & Engineering Indicators series. The measures were tracked over a dozen years and revealed “really persistent peers” among states based on similarities that appear at the beginning of the measurement period and remain until the end of the period. A map of the 12 “really persistent peer” clusters is shown below, which gives each state a better idea of who their peers are when they are evaluating their own progress on TBED measures.

“Really Persistent Peers” and Technology-Based Economic Development

Infrastructure

What’s Up for Energy Infrastructure in 2019 (InsideSources). Energy infrastructure is a broad term, encompassing not only oil and natural gas pipelines, but also power plants, transmission lines, and the other parts of what is generally termed “the grid.” As currently designed, the grid has been successful in getting the U.S.–even in its most rural areas–electrified. Now the challenge is integrating intermittent renewable energy sources, such as wind and solar, and also trying to better secure the grid against attacks from cyber criminals and foreign adversaries. Historically, economic growth has been accompanied by increased energy needs. Experts predict there is a lot to build in the coming year for additional grid infrastructure and 2019 could set records.

Deal Makers

Incentives in Action

North Dakota Legislators Look at Budgeting Money for Housing Incentive Fund (Dickinson ND Press). North Dakota legislators are considering putting money back into the Housing Incentive Fund, a state program that seeks to make housing affordable. The program that was first funded in 2011 has been used to help finance 2,500 rental housing units statewide, but the state didn’t have dollars available in 2017. This year, legislators are evaluating three proposals that would provide $10 million to $40 million for the Housing Incentive Fund. The Governor recommended $20 million for the Housing Incentive Fund, with the dollars coming from the Strategic Investment and Improvements Fund, saying the program would help North Dakota develop and retain workers and build healthy, vibrant communities.

Mississippi Moves to Re-instate Movie Industry Incentives (WLBT Jackson MS). Mississippi lawmakers seem to be on board with re-instating movie incentives that expired, causing the state to lose out on films based in Mississippi but shot out of state. The measure gives film production companies up to 25 percent rebates and sales tax and use tax reductions. Each movie is capped at $10 million dollars. Movies like Get On Up, the James Brown Story, the western The Making of Helena and others were filmed in Mississippi before the tax incentive expired in 2017. According to supporters, money spent by production crews add up in local salaries, lodging, food and more.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

DOJ Reverses Course, Changing the Odds on the State-Regulated Gambling Industry (Venable). The regulatory framework for online gambling recently took a wild turn when the Department of Justice Office of Legal Counsel (“OLC”) announced its view that the Wire Act applies to all forms of gambling—not merely sports betting. This marked a 180-degree reversal from the OLC’s previous stance. Four states—Delaware, Nevada, New Jersey and Pennsylvania—currently allow online gambling, and Michigan came close to legalizing it at the end of last year. The new OLC opinion is surprising on many levels, not least of which because it comes so closely on the heels of the Supreme Court’s May 2018 Murphy decision, which paved the way for legalized sports betting—but for the Wire Act.

Talent Development/Attraction

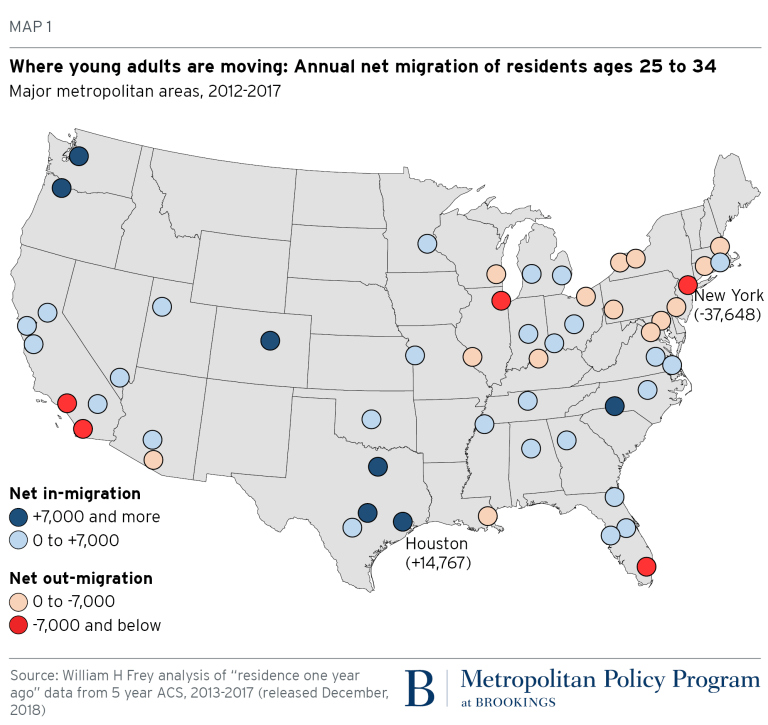

How Migration of Millennials and Seniors has Shifted since the Great Recession (Brookings). While millennials and baby boomers are America’s largest generations, they are following quite different post-recession migration paths. Today’s Millennials are more mobile than their elders and more apt to shift with changing opportunities, particularly to areas with knowledge-based economies. In contrast, those seniors who do move are zeroing in on a smaller set of exclusively Sun Belt destinations that have long been associated with retirees, warm climates and recreation. The study uses recently released migration data from the U.S. Census Bureau’s American Community Survey to identify major metropolitan areas that attract age groups dominated by millennials and baby boomers. The data show that the top regional magnets for young adults (ages 25-34) do not overlap with those attracting seniors (ages 55 and older) and for both groups, the recent magnets differ from those prior to the Great Recession.

How Manufacturers Will Tackle the Talent Shortage in 2019 (IndustryWeek). There is an overall hiring crisis in America. According to the U.S. Bureau of Labor Statistics, there are currently more job openings in the U.S. economy than there are people looking for work. However, manufacturers are feeling the pinch more than most because the sector is suffering the consequence of an aging workforce. Nearly 27% of manufacturing workers are set to retire over the next ten years, taking their specialized skills and institutional knowledge with them. And despite manufacturing being increasingly high-tech oriented—with robotics, specialized software, artificial intelligence, and computer-connected equipment quickly becoming the new norm—young people don’t view industrial manufacturing as a desirable career path. In 2019, manufacturers will attack the lack of workers problem head on.