Latest News

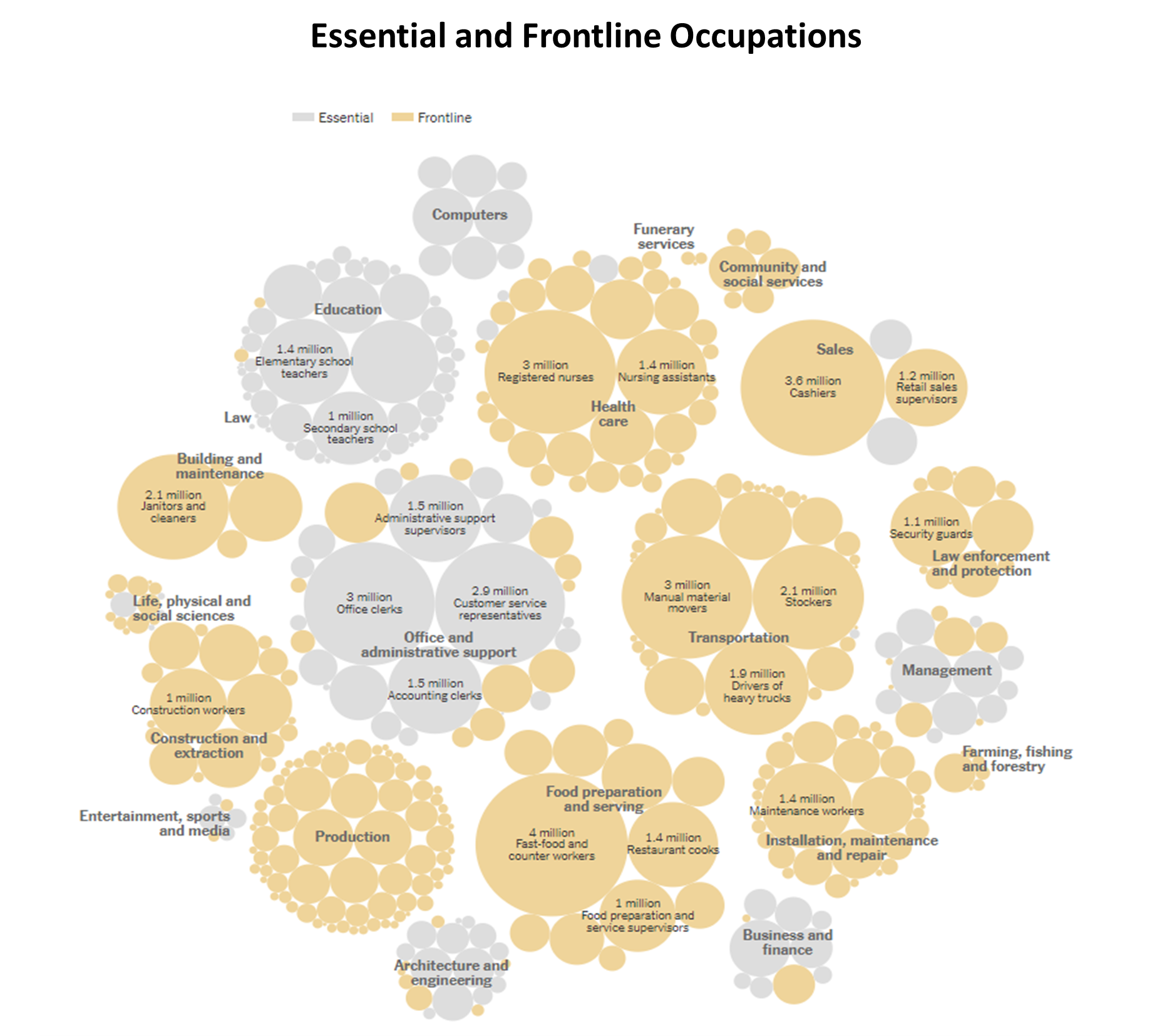

Who Should Get the Coronavirus Vaccine First? (New York Times). With initial coronavirus vaccine supplies limited, the United States faces a hard choice: Should the country’s immunization program focus in the early months on the elderly and people with serious medical conditions, who are dying of the virus at the highest rates, or on essential workers, an expansive category encompassing Americans who have borne the greatest risk of infection? There are about 90 million essential workers nationwide. A subset are considered “frontline” workers, meaning their jobs cannot be performed from home. Because there will not be enough doses to reach everyone at first, states are preparing to make tough decisions: Louisiana’s preliminary plan, for example, puts prison guards and food processing workers ahead of teachers and grocery employees. Nevada’s prioritizes education and public transit workers over those in retail and food processing.

* New SEDE Data Available *

State Economic Development Organization Structures Profiles

SEDE network members have expressed interest in learning about how other states organize and operate their economic development efforts. In response, CREC has developed a resource designed to help states benchmark and provide a one-stop resource to explore alternative structures for executing state economic development functions. CREC collected publicly available information about 21 economic development organizations in 15 states including: agency mission, organization structure and leadership, budget (sources of funding and how funds are disbursed across functions within the agency), numbers of employees by function, outcomes, and agency accountability. These profiles are now available on the SEDE website behind the firewall. Thanks to the many state leaders who contributed to this work. If you would like further information on this project, please contact Mark Troppe at mtroppe@crec.net.

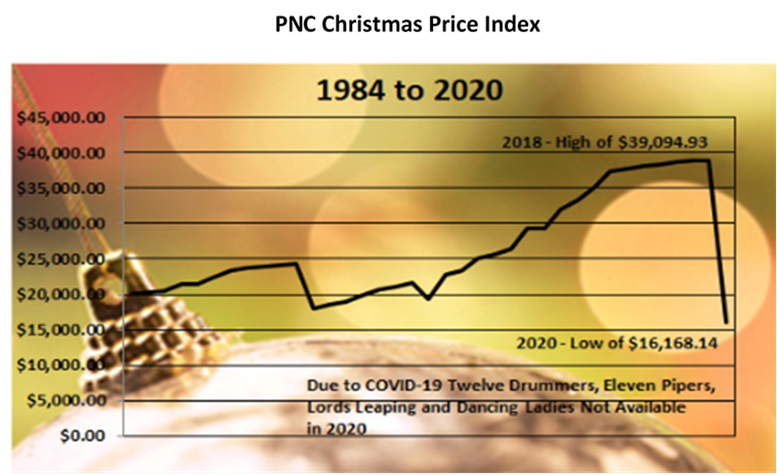

Twelve Days of Christmas Price Index Affected by Pandemic (PNC Wealth Management). For the 37th year, PNC Wealth Management has released its Christmas Price Index, a whimsical look at the cost of the gifts in the classic Holiday song, “The Twelve Days of Christmas”. This year, the index accounts for the impact of the pandemic when calculating the cost of the presents. For example, social distancing does not allow for performances such as the drummers drumming or ladies dancing. True Love who purchases the song’s gifts can get by with spending $16,168.14 in 2020 – a 53% decrease over last year due to the pandemic. With the exceptions of the recession in 2000 – 2001 and the pandemic of 2020, prices have been steadily climbing since 1995.

State Economic Performance

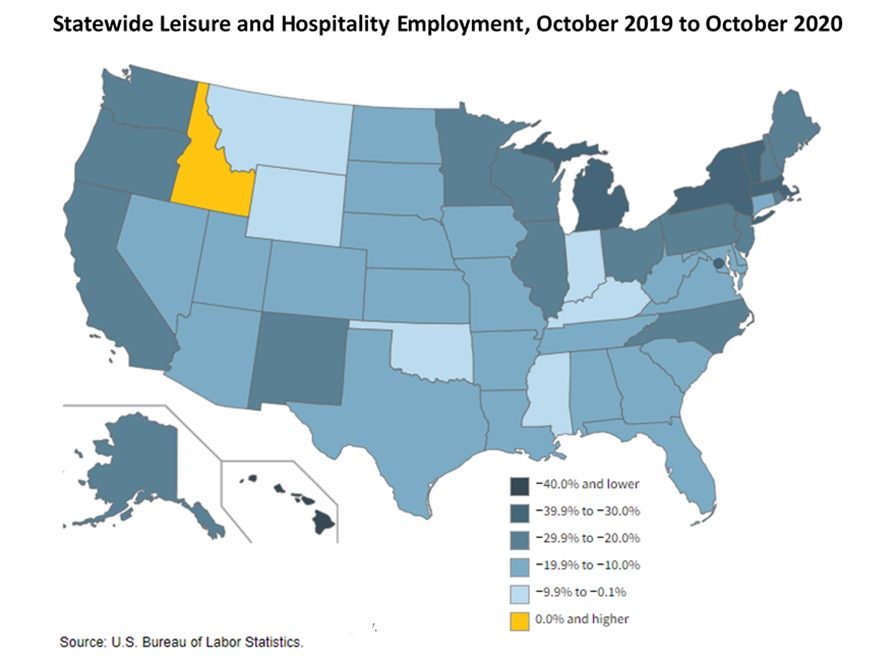

State Leisure and Hospitality Employment (Bureau of Labor Statistics). From October 2019 to October 2020, Idaho was the only state with an increase in leisure and hospitality employment (0.5 percent). All other states saw declines. Leisure and hospitality included accommodation, food services, arts, entertainment, and recreation-related jobs. Hawaii employment in leisure and hospitality decreased 49.6 percent. Other states with at least a 30-percent decrease in leisure and hospitality employment were New York (−35.0 percent), Massachusetts (−34.9 percent), Vermont (−33.7 percent), and Michigan (−32.1 percent). Leisure and hospitality jobs in the District of Columbia also decreased 35.9 percent over that period. These data are from the BLS Current Employment Statistics (State and Metro Area) program and are seasonally adjusted.

* Economic Outlook *

U.S. Presidential Election & Implications on Trade Policy

President-elect Joe Biden’s economic team is taking shape with plans to remake the Trump administration’s approach to economic relations overseas, with a distinction: agreement with President Trump’s assertion that globalization has been hard on many Americans but differences on how to address it. The World Trade Center St. Louis held a virtual bipartisan panel discussion on the U.S. Presidential election and its implications on trade policy. The panel included Jordan Bernstein of Cassidy & Associates, Kenny Hulshof of Kit Bond Strategies and Robert Shapiro of Thompson Coburn. The session examined how the election outcome affects Free Trade Agreements, tariffs, exports, imports, reshoring, compliance and more. For additional insights on shifting trade tides, check out Biden’s Economic Team Charts a New Course for Globalization, With Trumpian Undertones, click here.

* * *

Topics and Trends

Industry Watch

Ten Trends to Watch in 2021 (The Economist). The coming year promises to be especially unpredictable, given the interactions between the pandemic, an uneven economic recovery, and fractious geopolitics. As 2021 approaches, The Economist has released its annual World in 2021 publication. Here are ten trends to watch in the year ahead.

Trade/Tariffs

U.K. to Drop Tariffs on U.S. Goods in Airbus-Boeing Dispute (Bloomberg). The U.K. government said it will drop the tariffs that the EU had imposed on $4 billion of U.S. goods, part of the long-running dispute over illegal aid to aircraft manufacturers Boeing Co. and Airbus SE. The move is designed to reduce trade tensions with the U.S. and show that the U.K. is serious about reaching a negotiated outcome. Britain will set its own tariff policy when it completes its split from the EU at year-end. The move comes amid broader questions over how much power the U.K. retains post-Brexit to legally impose tariffs in cases that pre-date its exit from the EU. In the case of the Airbus-Boeing dispute, the U.K. insists it has kept that power. The EU announced the tariffs, which target various Boeing models and products including spirits, nuts, and tractors, in November as part of a tit-for-tat escalation against the U.S. — which itself imposed levies on $7.5 billion of EU products in 2019. British exports ranging from Scotch whisky to biscuits to clotted cream have suffered from the duties.

Opportunity Zones

Do OZ Investments Make Sense During Covid-19 Crisis? (Forbes). There are several businesses that are good fits within the Opportunity Zone program because they require significant investment capital relative to the purchase price of land or buildings, as well as having most deal returns generated upon disposition. If the sale of the investment occurs at least 10 years after the purchase, the investor will enjoy the QOZ tax benefits on the sale-generated gains. Expect to see developments of brownfields, energy infrastructure projects (both traditional and alternative energy), and data centers as QOZ businesses. They are usually geographically flexible, and there may be numerous QOZ sites that fulfill the product criteria. Certain corporate expansion efforts — clinics and banking for example — and new or expanding businesses with expensive mobile assets like trucks, airplanes, construction equipment or even semi-permanent solar power storage units might keep those assets in QOZs to enjoy QOZ tax benefits. Finally, QOZ lends itself to impact investing, where there is a financial investment in a business that provides a financial return and a social return. To view the Final Regulations on Opportunity Zones issued by the U.S. Treasury Department and IRS, click here.

Colorado Receives Opportunity Zone Housing Investment (Business Wire). Arctaris Impact Investors, LLC announced two Opportunity Zone investments to provide workforce housing for low-income communities in rural Colorado. Total development cost is estimated at $60 million for these projects, which include a 100-unit workforce housing project in Glenwood Springs, a 96-unit workforce housing project in Grand Junction and a 74-unit glamping campsite also in Grand Junction. The properties address an immediate need for accessible workforce housing as workers in hospitality, healthcare and trades are getting priced out of the area as more affluent populations move to the region. Arctaris is investing in these projects alongside Four Points Funding, a private real estate investment firm, based in Steamboat Springs and Denver, that manages a series of Opportunity Zone Funds composed of multi-family housing and outdoor-focused hospitality projects. Four Points Funding invests exclusively in Colorado with a focus on smaller and emerging rural communities. For more information on Opportunity Zones, CDFA has extensive resources available, click here.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Recovery and Resilience in Rural America (Brookings). As the COVID-19 pandemic tests the resilience of rural economies in real time, attention should not be focused on an outdated, inaccurate image of rural America, but rather on understanding, sustaining, and investing in the hyperlocal strategies already working to bring growth and equity to increasingly diverse and dynamic rural areas. Using in-depth, on-the-ground research in three rural communities—Wheeling WV, Laramie WY, Emporia KS—the findings highlight key place-based strategies as well as the policy and capacity-building supports needed to sustain and scale them in the years to come. Among the strategies: Main Streets are a key driver of equitable economic recovery in rural America; rural small businesses need local solutions to survive; rural resilience needs a flexible, accessible, and healthy built environment; economic revival requires bridging social divides; and a shared vision of rural resilience comes through community-led civic structures. For additional insights on building resilient rural places, check out Aspen Institute’s Equitable Recovery and Resilience in Rural America, click here.

Innovation

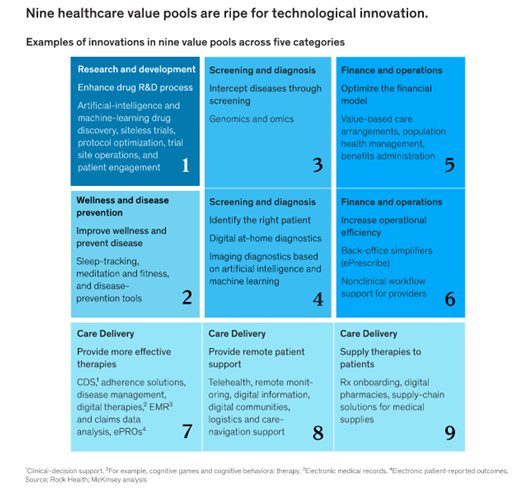

Healthtech in the Fast Lane (McKinsey & Company). Digital technology has enabled healthcare players to provide more targeted and effective interventions to patients worldwide. As the COVID-19 crisis continues to shape the next normal, it is crucial that stakeholders in the healthcare industry understand the digital health landscape. Broadly, digital health can be defined as the application of digital technology to improve health or care delivery. The first half of 2020 has seen unprecedented digital health activity: record levels of venture funding of $5.4 billion; megadeals, such as Teladoc Health’s $18.5 billion acquisition of Livongo; and accelerated virtual care delivery, such as telehealth and remote monitoring. As adoption of healthcare technology accelerates, it is a good time for healthcare companies to consider investing in digital among nine potential “value pools.”

Infrastructure

Strategies to Expand Affordable Broadband Access (National Governors Association). According to the FCC, at least 18.3 million people, or 6 percent of the total U.S. population, lacked access to fixed broadband that meets minimum internet speeds of 25 megabits per second (Mbps) download and 3 Mbps upload, referred to as “25/3” service. Of those people, 14 million live in rural areas and 1 million live on Tribal lands, which amounts to 22 percent and 28 percent of those respective geographic populations. Recognizing the multiple benefits of broadband connectivity, states are implementing a range of policies and programmatic solutions to expand access and increase affordability. While many of these efforts focus on expanding wired infrastructure, more internet-enabled mobile devices, along with the difficulty of expanding fiber in many rural regions, has made wireless technologies a viable alternative. However, for the highest speeds and most reliable connection, fiber remains the gold standard. The COVID-19 pandemic has created a new urgency for these expansion efforts and, as a result, states are increasingly implementing nearer-term solutions to bridge coverage gaps and provide affordable access to those who lack it.

Deal Makers

Incentives in Action

* SEDE Incentives Compliance Training Held *

Nevada’s Approach to Incentive Compliance

SEDE sponsored a training workshop in November 2020 to provide state agency staff with the skills and insights to implement best practices in incentives monitoring and management. The workshop reviewed common operating procedures, identified critical issues, and explored options and tradeoffs to help staff make intentional choices to protect taxpayer investments in business incentives. The training included expert interviews, with insights from Melanie Sheldon, Director of Business Development at the Nevada Governor’s Office of Economic Development, above.

Hawaii Launches Remote Work Program (Motley Fool). Hawaii needs bodies to stimulate its economy, so it is establishing what it calls a “Movers and Shakas” program that will offer free round-trip tickets to Oahu for out-of-state remote workers who are willing to live in the state for at least 30 consecutive days. Given the number of people who no longer need to report to a physical office building, setting up shop in Hawaii may be an appealing notion. But participants cannot expect to just do their regular jobs and then spend their remaining time lounging on the beach. Those granted those free tickets must commit to helping the state’s economy — specifically, by donating a few hours every week to a nonprofit where they can put their skills to good use. Another anticipated outcome from the program is to boost the state’s vacation rental industry. In 2019, about 30,000 people arrived in Hawaii every day, and that number inched toward 40,000 during the summer travel season. But since the pandemic began, daily arrivals have dipped below 500, which is hurting the state’s economy in a very meaningful way.

Rhode Island Approves Incentives for Portsmouth Innovation Center (Providence RI Journal). The Rhode Island Commerce Corporation unanimously approved $1.5 million in state incentives for 401 Tech Bridge, a proposed advanced materials and technology center in a renovated building in Portsmouth. The goal of an Innovation Center is to connect partners and turn new technologies into products, businesses, and jobs. The 401 Tech Bridge project has already attracted manufacturers, entrepreneurs, academics, and researchers who hope to build on the state’s strengths in textiles, advanced materials, marine products, and undersea devices developed by the Navy. The $1.5 million in approved incentives includes $1 million in Rebuild Rhode Island tax credits that will be available after the building is completed and $500,000 in First Wave closing funds for the building’s financing. The renovation of the building in Portsmouth should start early next year with an opening in the second half of 2021. The $1.5 million in state incentives is on top of $6.8 million previously received from state and federal sources and nonprofit groups.

New Growth Opportunities

Wyoming Making Big Bet on Digital Currency (Tech Transfer Central). Wyoming approved the country’s first special purpose depository institution (SPDI), which is designed to handle digital currencies, in Fall 2020. Two SPDI applications have since been approved. State leaders hailed the new banking institutions, which allow those using digital assets, like cryptocurrency, to access reliable financial services, protect consumers and allow businesses a way to hold digital assets safely. Digital currencies are intangible and can only be owned and transacted by using computers or electronic wallets connected to the Internet or designated networks. Various forms of “cyber cash” are gaining rapidly as a technology driving change in banking and supply chain management, among other fields. The state passed legislation in 2019 which aimed to create a regulatory environment to foster blockchain application growth and diversify the state’s economy. Most recently, the University of Wyoming launched a new Center for Blockchain and Digital Innovation. The center is an interdisciplinary entity with connections to UW’s colleges of Business, Engineering and Applied Science, Agriculture and Natural Resources, and Law. The new center will focus on fostering innovation; applied research and education; technology development; economic development and job growth; and corporate engagement.

Talent Development/Attraction

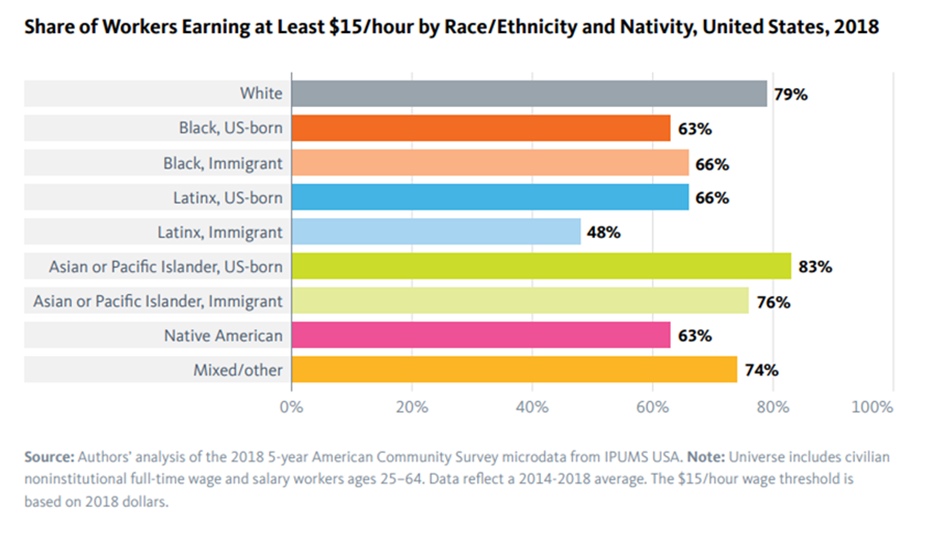

Advancing Workforce Equity in the U.S. (PolicyLink-USC Equity Research Institute). The face of the nation is changing—and with it, the demographics of the workforce. In about 25 years, the United States will no longer have a single majority racial/ethnic group. White people comprise 62 percent of the U.S. workforce overall, but 75 percent of those ages 55 or older. As baby boomers retire, they are being replaced by a much more diverse generation of workers: in 2018, for the first time, people of color accounted for more than half of all new hires of prime working age. As people of color become much of the U.S. workforce, racial inequities in the labor market represent a rising liability for the economy. For instance, racial gaps in the share of workers earning at least $15/hour have been persistent over the past several decades. Among the report’s recommendations: make racial equity a priority and develop systems to track progress; develop targeted strategies to connect people of color to quality employment opportunities; and invest in innovative training and credentialing models.

Occupational Licensing: Assessing State Policies and Practices (National Conference of State Legislatures). Occupational licensing comprises nearly 25% of the U.S. workforce, up from 5% nearly 60 years ago. The increase in occupations that require government permission to work, while meant to protect consumer health and safety, has also created many discrepancies in requirements across state lines and barriers to work for certain population groups. More than 3,500 occupational licensing bills have been introduced across the country since 2017. Of these, 176 bills sought to ease barriers for people with a criminal record, while 120 bills focused on military veterans and spouses. The findings are part of a new report aimed at providing state policy options and examples on occupational licensing. In addition, the National Conference of State Legislatures (NCSL), in partnership with The Council of State Governments (CSG) and the National Governors Association (NGA Center) for Best Practices, has produced numerous resources. These resources are designed to help state policymakers better understand the variances in licensing laws and the challenges they present for many workers.

* * *

SEDE Network Updates

* Wishing the SEDE Network Happy Holidays *

&

State Economic Development Success for 2021!

* * *

The SEDE Network Steering Committee includes: Stefan Pryor (RI), Chair; Val Hale (UT), Vice Chair; Julie Anderson (AK); Mike Preston (AR); Sandra Watson (AZ); Kurt Foreman (DE); Don Pierson (LA); Kelly Schulz (MD); Kevin McKinnon (MN); Chris Chung (NC); Alicia Keyes (NM); Michael Brown (NV); Andrew Deye (OH); Dennis Davin (PA); Manuel Laboy Rivera (PR); Jennifer Fletcher (SC); Adriana Cruz (TX); Joan Goldstein (VT); Mike Graney (WV).

For further questions on the content in this Bulletin or for information on the SEDE Network contact Marty Romitti, CREC Senior Vice President, at mromitti@crec.net