Latest News

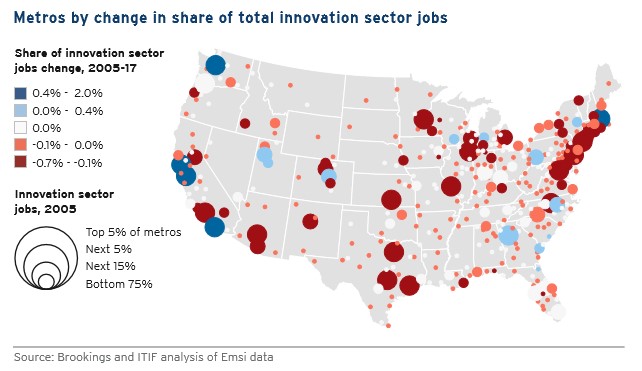

The Case for Growth Centers: How to Spread Tech Innovation Across America (Brookings and Information Technology and Innovation Foundation). The innovation sector has generated significant technology gains and wealth but has also helped spawn a growing gap between the nation’s dynamic “superstar” metropolitan areas and most everywhere else. Neither market forces nor bottom-up economic development efforts have closed this gap, nor are they likely to. Instead, these deeply seated dynamics appear ready to exacerbate the current divides. Which is why the nation requires a major push to counter these dynamics. Specifically, the nation needs a massive federal effort to transform a short list of metro areas into self-sustaining “growth centers” that will benefit entire regions. This should include a federal competition to award 10 metros some $10 billion each over 10 years in R&D, placemaking, infrastructure, and workforce development money—all part of an “innovation surge” to spur the development of more tech hubs.

State Economic Performance

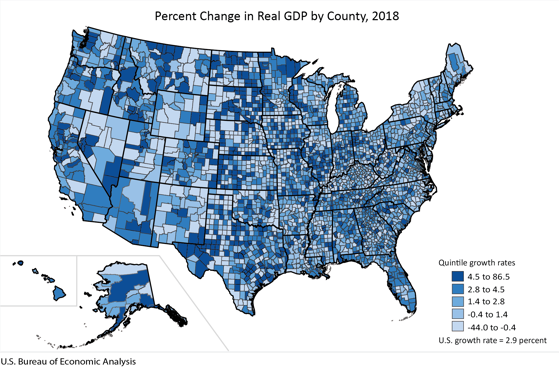

Gross Domestic Product by County (U.S. Bureau of Economic Analysis). Real gross domestic product (GDP) increased in 2,375 counties, decreased in 717, and was unchanged in 21 in 2018, according to data released by the U.S. Bureau of Economic Analysis (BEA). This is BEA’s first official release of GDP by county statistics for all counties in the United States. GDP is the value of goods and services produced within a county. Real values are inflation-adjusted statistics—that is, these exclude the effects of price changes. The size of a county’s economy as measured by GDP varies considerably across the United States. In 2018, the total level of real GDP ranged from $18.4 million in Issaquena County, MS, to $710.9 billion in Los Angeles County, CA.

Topics and Trends

Industry Watch

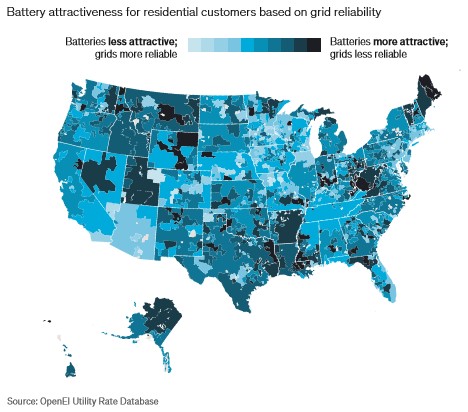

Redefining the Power Industry (McKinsey Quarterly). The demands of a changing climate are starting to affect how many businesses operate, from attempting to tamp down their carbon emissions and ramp up energy efficiency, to adjusting to new risks caused by violent weather. Electric utility companies in the United States are no exception. Here are four quick takes on the changes in store for the power industry. The first two size up the rising peril to utility assets and show how one US state is aspiring to meet new, tough clean-power mandates. Then a look at the potential of residential batteries and how they might buttress the industry’s stressed-out grids. Networks of residential batteries could provide backup power and help utilities manage challenges to the grid. As shown on the map, home storage is becoming more attractive to consumers as well. Lastly, one expert warns that climate change may be shifting the economics of long-term infrastructure investment. Power suppliers and many other businesses will need to be much more resilient in this changing environment.

Trade/Tariffs

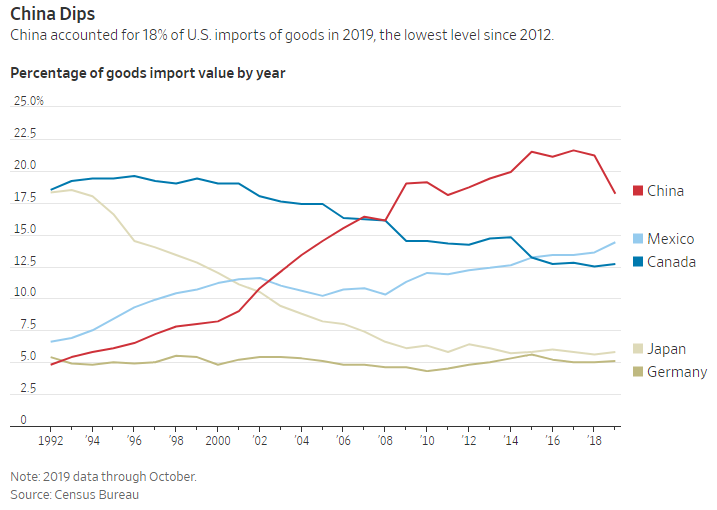

Tariffs, Trade Policy Rise on List of Concerns for Risk Officers (Wall Street Journal). A recent slowdown in global growth has prompted U.S. businesses over the past year to grow more cautious, with some retailers moving factory operations out of China as tariffs on clothing and other imports take effect. Those decisions reflect a growing perception among executives and board members that economic-policy decisions could hinder their companies’ growth opportunities in the year ahead, according to an annual ranking of business risks. Concerns about economic policy jumped nine spots to second place on the Top Business Risks for 2020. In addition to worries about trade and tariffs, executives—particularly in the financial services sector—said they worried a prolonged period of low interest rates could continue to put pressure on profits. Other top risks included cybersecurity concerns, regulatory changes and the ability to attract top talent.

US-China Achieve Phase I Trade Deal (ABC News). Under a limited trade agreement, the U.S. dropped its plan to impose new tariffs on $160 billion of Chinese imports set for mid-December — a tax that would have likely led to higher prices on many consumer goods. The U.S. also agreed to reduce its existing import taxes on about $112 billion in Chinese goods from 15% to 7.5%. In return, China agreed to buy $40 billion a year in U.S. farm products over two years, even though U.S. agricultural exports to China have never topped $26 billion a year. In addition, Beijing committed to ending a long-standing practice of pressuring companies to hand over their technology as a condition of gaining access to the Chinese market. China also agreed to lift certain barriers to its market for such products as beef, poultry, seafood, pet food and animal feed. In all, the U.S. expects a $200 billion boost in exports over two years as a result of the deal.

Opportunity Zones

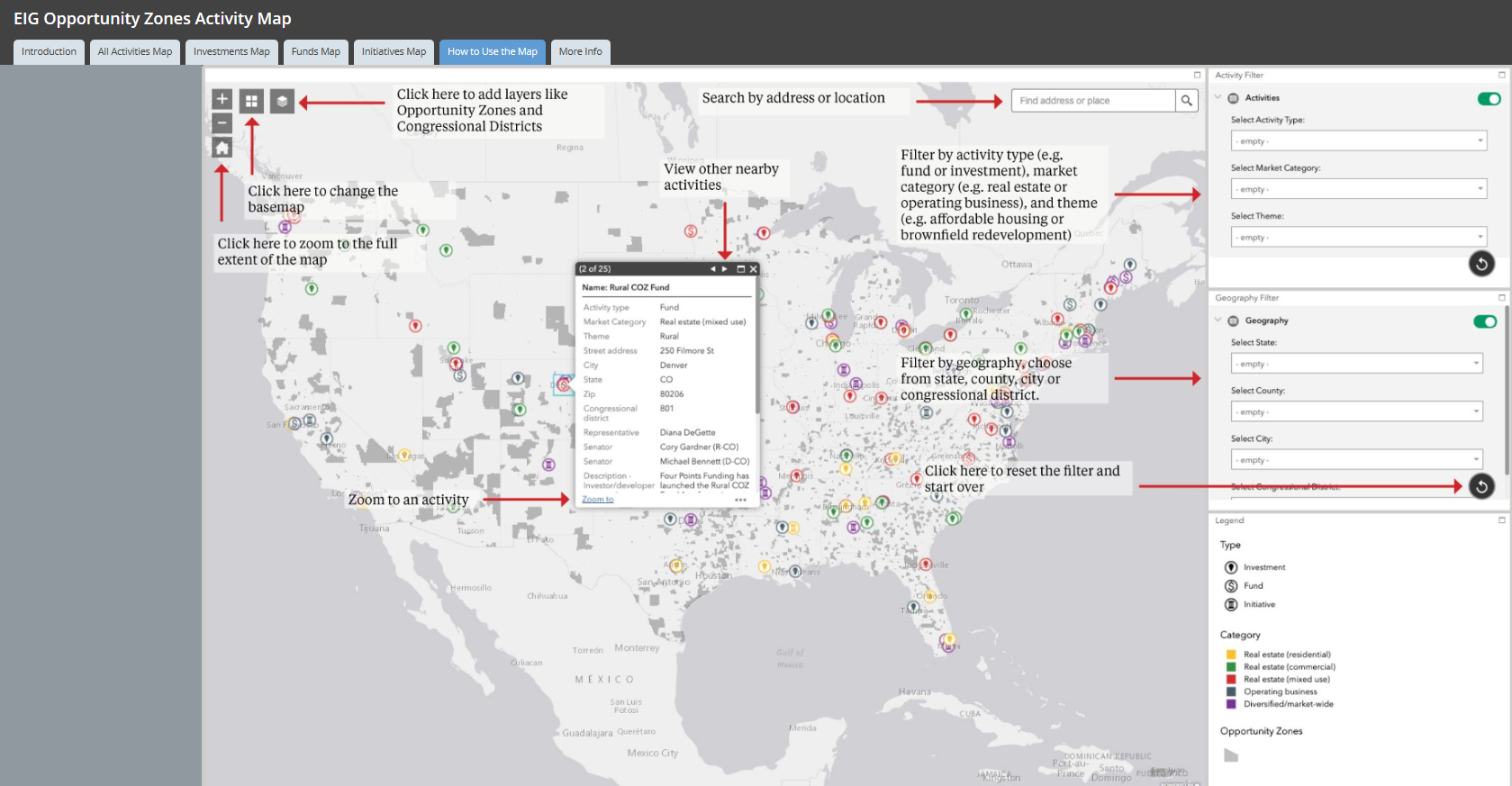

New Interactive Opportunity Zones Activity Map Launched (Economic Innovation Group). EIG launched a new Opportunity Zones Activity Map, an interactive online portal highlighting many of the most innovative and impactful developments catalyzed in the early stages of this new policy. It is entirely sourced from local press and public announcements. The map depicts the core components of the emerging Opportunity Zones marketplace, including investments utilizing the incentive, new funds forming to deploy capital into zones, and public and civic sector initiatives driving impact in communities. This portal features four maps that highlight the core components of the emerging marketplace: 1) Map of All Activities tracked in Opportunity Zones; 2) Map of Investments into Opportunity Zones; 3) Map of Funds that have formed to steward investment capital in Opportunity Zones; and 4) Map of Initiatives at the state and local levels that adapt Opportunity Zones to local priorities. The map will be updated on a rolling basis.

Developments Spurred by Opportunity Zone Tax Breaks Rising in SC, Amid Controversy (Charleston Post and Courier). A long-planned technology center on the Charleston peninsula, a $37 million gated luxury apartment complex on the Charleston peninsula called The Merchant, downtown redevelopment in Rock Hill, office buildings in Charleston, and redevelopment projects on the former Charleston Naval Base in North Charleston are all tapping into Opportunity Zone tax breaks. Across the nation and in U.S. territories, 8,764 census tracts with above-average poverty have become Opportunity Zones. In South Carolina, 538 census tracts met the criteria, but only 135 could be chosen, because states could designate only 25 percent of qualifying areas. The fact that much of the Charleston peninsula qualified, from Calhoun Street north, is partly because so many college students with little taxable income live there. The big question, and the one behind a vigorous and ongoing debate, is whether the OZ tax breaks are prompting beneficial developments that wouldn’t have happened otherwise, or enriching investors in developments that would have happened anyway. For more information on Opportunity Zones, CDFA has extensive resources available, click here.

Senators Unveil Bill to Expand ‘Opportunity Zone’ Reporting Requirements (The Hill). A group of GOP senators in early December rolled out a new bill to expand reporting requirements about investments in “opportunity zones” as the program aimed at revitalizing economically distressed communities faces mounting scrutiny, particularly from Democrats. The initial standalone legislation on opportunity zones included reporting requirements, but those requirements were not included in the final tax law because of the budget rules that the Senate used to pass the law. Sen. Tim Scott (R-S.C.), a leader on the initial OZ legislation, introduced the new bill that would codify requirements for investors and funds to report information about investments made in opportunity zones and adds penalties for individuals and funds that fail to appropriately file required forms. It also would require the Treasury Department to make information about investments in opportunity zones public and to work with other agencies to issue reports about new businesses, household income and housing in opportunity zones compared to low-income areas that weren’t designated opportunity zones.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Intelligent Design of Inclusive Growth Strategies (Harvard Business School). Improving corporate engagement with society, as advocated in the Business Roundtable’s 2019 statement, should not be viewed as a zero-sum proposition where attention to new stakeholders detracts from delivering shareholder value. Corporate programs for sustainable and ethical sourcing practices, however, have fallen far short of solving the underlying causes of extreme poverty, extensive use of child labor, and threats to the environment and human health. However, the role for a new actor, a catalyst, can help companies forge new relationships with external funders, local intermediary companies, NGOs, and community leaders. The catalyst aligns the multiple stakeholders from multiple sectors into enduring, mutually- beneficial relationships that produce more value than that currently produced when stakeholders connect only by transactional relationships. For example, Golden Triangle Development LINK, a regional development agency in northeast Mississippi, acted as the catalyst for public-private partnerships among the state, TVA (electrification), local universities, and a financing authority to attract companies that have built and now operate manufacturing plants and pay high wages to formerly-unemployed workers in the region.

Innovation

First U.S. Cross-Country Commercial Freight Run by a Self-Driving Truck (Auto Channel). Plus.ai, a leading provider of self-driving trucking technology, announced that it has completed the first coast-to-coast commercial freight run with an autonomous truck on behalf of Land O’Lakes, Inc. The autonomous truck completed the 2,800-mile hub-to-hub trip from Tulare, CA to Quakertown, PA in less than three days. The truck was equipped with Plus.ai’s advanced autonomous driving system which utilizes multimodal sensor fusion, deep learning visual algorithms, and simultaneous location and mapping (SLAM) technologies. The journey was an important milestone in validating the system’s ability to safely handle a wide range of weather and road conditions. The vehicle drove primarily in autonomous mode through the 2,800 miles across interstate 15 and interstate 70, passing through varied terrains and weather conditions. A safety driver was onboard to monitor and assume control if needed, and a safety engineer was present to monitor system operations.

Infrastructure

Funding Opportunity of $550 Million Announced for High-Speed Internet in Rural America (U.S. Department of Agriculture). More than half of a billion dollars in United States Department of Agriculture (USDA) Reconnect Pilot Program funding will be available in 2020 to develop high-speed broadband internet infrastructure in rural parts of the United States. The Broadband ReConnect program offers grants, loans and combinations thereof to improve rural e-connectivity. USDA will make available up to $200 million for grants, up to $200 million for 50/50 grant/loan combinations, and up to $200 million for low-interest loans. The application window for this round of funding will open Jan. 31, 2020. Applications for all funding products will be accepted in the same application window, which will close no later than March 16, 2020. To date, USDA has awarded $191 million through the ReConnect program with offers out to 47 additional potential recipients totaling more than $600 million in investments.

Deal Makers

Incentives in Action

Roundtable Held on Evaluating Economic Development Tax Incentives (National Conference of State Legislatures and Pew Charitable Trusts). States and cities are now publishing more evaluations than ever and are using creative techniques to showcase evaluation results, including the use of podcasts in Kansas and YouTube videos in Washington. Recently, the National Conference of State Legislatures (NCSL), with support of The Pew Charitable Trusts, hosted the 5th Annual NCSL/Pew Incentive Evaluators Roundtable. The meeting is designed to discuss state activity around economic development evaluations. The roundtable process provides attendees the opportunity to share evaluation tips and strategies garnered from evaluators from across the country. To access the agenda and presentations, click here.

Utah Tax Rebates Bring Nearly 10,000 New High-Paying Jobs (Deseret News). A long-running state tax rebate program for businesses closed out 2019 with five new awardees announced that could lead to almost 3,000 new jobs in Utah. The final announcement for the year brings the 2019 totals for the Economic Development Tax Increment Financing (EDTIF) rebate program to 9,643 potential new jobs from 20 different companies that represent both in-state expansions and new, out-of-state investment. The tax increment financing program, which launched in 2005, offers a post-performance tax rebate of up to 30 percent of new state revenues that include Utah sales, corporate and withholding taxes paid out over a term that typically runs five to 10 years. The tax rebate is available to Utah companies expanding and other companies relocating or establishing additional operations in Utah. To qualify for rebates, companies must meet a set of criteria that includes minimum wages of 110% of county average wage in certain, targeted employment categories. Awardees this year included companies from the tech sector, manufacturing, aerospace, outdoor products and a new airline. The program is managed by the Utah Governor’s Office of Economic Development.

Five States to Work on Improving Business Regulations (National Governors Association). The National Governors Association (NGA), in partnership with The Pew Charitable Trusts, will work with five states – Colorado, Alaska, Delaware, Rhode Island and Tennessee – to help them improve their business regulatory processes to promote economic development. The five states will be part of a two-year policy academy tailored to the needs of each state, as defined by its governor, to look for ways state government can remove barriers for businesses to launch, grow and succeed. States and territories can potentially strengthen their economies by improving regulatory processes, and the five states will work to identify baseline data and action steps for pilot initiatives so that successes can ultimately be scaled up.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

State Policy Innovations to Support Creative Placemaking (Federal Reserve Bank of San Francisco). “Creative placemaking” is the practice of integrating arts, culture, and design activities into efforts that strengthen communities. States are actively involved with these efforts, as 36 state arts agencies have grant programs dedicated to creative placemaking or community arts development. Another 15 states have established cultural district certification programs that use cultural resources to encourage synergies between economic and community development. However, critical gaps exist. To address these gaps, states should pursue the following public policy strategies: Elevate creative placemaking as a policy strategy in state plans; Establish mechanisms for connectivity among state agencies whose missions relate to placemaking or culture; Strengthen existing state policies that are positioned to foster creative placemaking and arts-based community development; Amplify and coordinate state funding streams; Educate federal funding gatekeepers about creative placemaking; Embed artists and designers into government agencies that influence creative placemaking or community development; and Equip more artists and cultural organizations to play significant community engagement and development roles.

Talent Development/Attraction

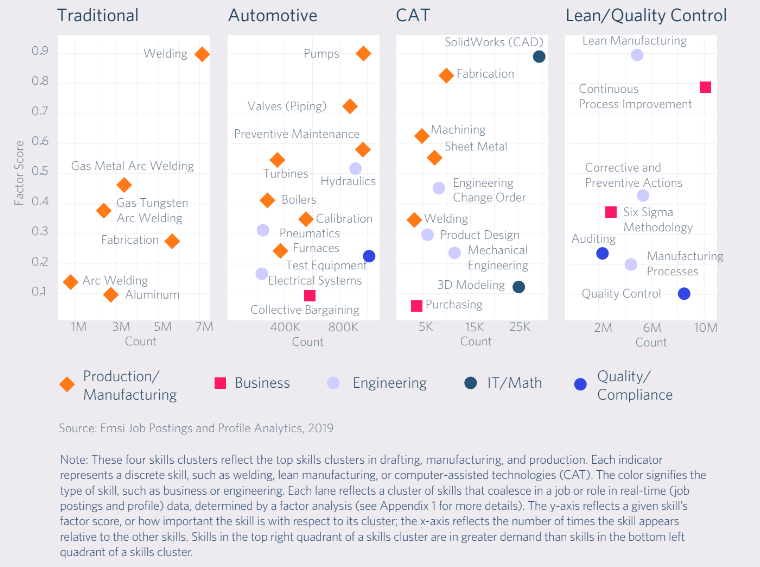

The New Geography of Skills (Strada Institute for the Future of Work). Skills define jobs. Jobs are made up of sets of tasks that require distinct skills in order to be successfully performed. The “skill shape” for any role like a software engineer is formed by the interactions between companies and industries in a specific region. When Amazon, IBM, or a small business is looking for a software engineer, they will not be looking for the same person with a similar skill shape because the skills depend on the specific work to be done. Supplemented with traditional labor market information, or LMI, these skill shapes offer unique insights into the job market as derived from the skills articulated by workers and employers themselves to better understand regional talent demands. Skill shapes provide a new lens into the job market by looking underneath occupations and industries to understand precisely the skills employers are looking for and how they compare to the supply of skills in the regional workforce.

The Scope of Modern Apprenticeship (Urban Institute). The “Fourth Industrial Revolution” will dramatically change future workplaces as new technology redefines necessary job skills. Apprenticeship programs should be a key part of training future workers. Beyond their success in the building trades, apprenticeships are now increasingly recognized as a cost-effective way to create new career pathways and increase economic mobility, all while addressing skill mismatches in the labor market. Effective apprenticeship programs: Build high-caliber talent pools, which is good for business, good for states (it drives business investment), good for those seeking to enter or move up in the workforce, and good for parents and other caretakers who come to understand that apprenticeship offers a viable entrance into a meaningful, gainful career. These programs can also change the economic welfare of whole communities, open occupations and related opportunities to people who otherwise would not have access, offer alternatives to student debt, and provide a highly marketable skill set (both technical and soft skills).

The SEDE Network Steering Committee includes: Stefan Pryor (RI), Chair; Val Hale (UT), Vice Chair; Julie Anderson (AK); Dennis Davin (PA); Jennifer Fletcher (SC); Kurt Foreman (DE); Joan Goldstein (VT); Manuel Laboy Rivera (PR); Jeff Mason (MI); Kevin McKinnon (MN); Don Pierson (LA); Mike Preston (AR); Sandra Watson (AZ).

For further questions on the content in this Bulletin or for information on the SEDE Network contact Marty Romitti, CREC Senior Vice President, at mromitti@crec.net