Latest News

State Economic Performance

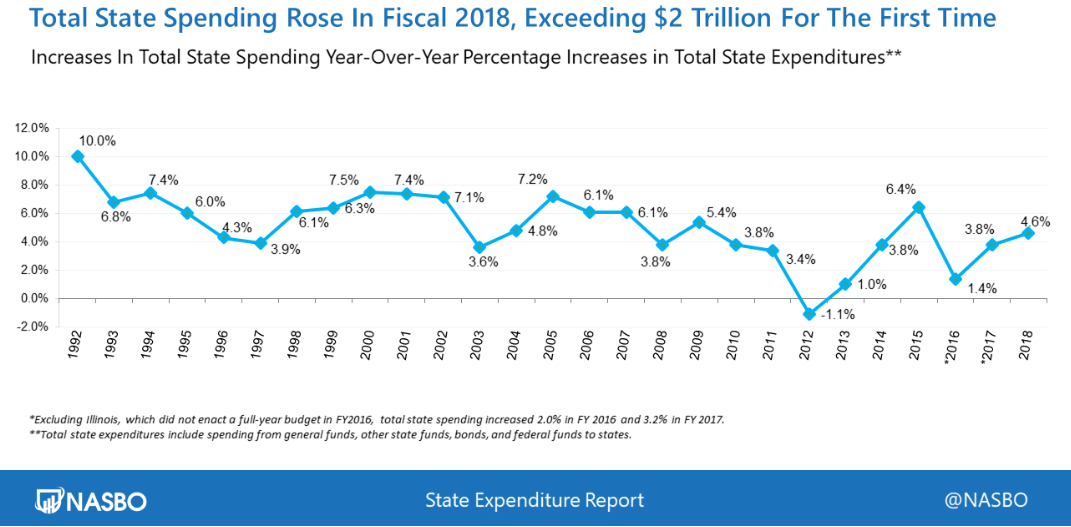

Total State Spending Exceeds Record $2 Trillion in Fiscal 2018 (National Association of State Budget Officers). A report released by NASBO found that state governments will spend more than a combined $2 trillion this fiscal year – a new high – led by spending on transportation infrastructure, education and entitlement programs. The State Expenditure Report also found that state government spending rose by 4.6 percent in fiscal year 2018, slightly higher than FY 2017’s (3.8 percent) growth, but below a three-decade average of 5.6 percent. While all geographic regions saw a slight increase in FY 2018 spending, the strongest growth was reported in the far West and the Southeast.

Topics and Trends

Industry Watch

Is the Future of Work in Manufacturing at Risk? (Deloitte). According to a report released by Deloitte, there will be 4.6 million new manufacturing jobs in the U.S. between 2018 and 2028, but over half of those newly created jobs – 2.4 million – are predicted to go empty, unless manufacturers start exploring new strategies to find and retain qualified individuals to work in their specialized factories. The report attributes the lack of qualified employees to three things: an increase in the skill level required for manufacturing jobs, as manufacturers make more use of automation; a loss of many experienced workers as baby boomers transition out of or leave the workforce; and, the continuing negative perception of the manufacturing industry by both students and parents. Short-term possible solutions to address and stem the shortage of potential employees involve raising wages to attract or retain workers, outsourcing some tasks or activities, and allowing for more flexibility in hiring requirements (e.g., looking for potential in hires rather than experience).

The story above is from MEP State News published monthly by the State Science and Technology Institute (SSTI). SSTI provides information and services for those involved in technology-based economic development. For more information visit www.ssti.org.

Trade/Tariffs

New Tariffs on Christmas Lights Arrive Just in Time for the Holiday Season (Tariffs Hurt the Heartland). Because there are no major American Christmas light manufacturers, nearly all Christmas tree lights are imported. According to U.S. Census data, over 80% of US imports of Christmas lights from the world in 2017 came between August and October as companies stock up for the holiday season, with China accounting for about 85% of those imports. Already subject to 8% Most Favored Nation (MFN) tariffs, the Section 301 dispute added another 10% tariff, to 18% overall. Lights could become even more expensive next Christmas, as the Section 301 tariff will increase to 25% (or an overall rate of 33%) on January 1st 2019.

Opportunity Zones

Trump to Steer More Money to ‘Opportunity Zones’ (New York Times). President Trump directed federal agencies via an Executive Order signed on Wednesday, December 12 to steer spending toward certain distressed communities across the country — part of his administration’s push to turn a tax break included in last year’s $1.5 trillion tax package into a broader effort to combat poverty and geographic inequality. Mr. Trump signed the executive order which establishes the White House Opportunity and Revitalization Council and charges it to encourage public and private investment in urban and economically distressed areas, including qualified opportunity zones, read Executive Order. Mr. Trump told attendees at the meeting that the zones would receive “massive incentives” for private-sector investment with the goal being to help draw investment into neglected and underserved communities of America. For more information on Opportunity Zones, our partners at CDFA have extensive resources available, click here.

The Opportunity Zones program provides a tax incentive for investors to re-invest their unrealized capital gains into Opportunity Funds that are dedicated to investing into Opportunity Zones designated by the chief executives of every U.S. state and territory. Treasury has certified more than 8,700 census tracts as Qualified Opportunity Zones (QOZs) across all states, territories, and the District of Columbia. For a map of all designated QOZs, click here.

Inclusive Growth

Why Rural Areas Can’t Catch a Break on Speedy Broadband (CNet). Broadband is a game changer for rural America. In previous generations, communities thrived based on their proximity to infrastructure like roads, railways, airports and rivers to distribute goods. Today, it’s about having access to reliable, affordable high-speed internet. Communities without access may simply wither and die. However, even after billions of dollars in private investment and government subsidies over multiple decades, the numbers still paint a disturbing picture. Roughly 39 percent of rural Americans lack access to high-speed broadband, compared with just 4 percent of urban Americans. The biggest barrier to getting broadband in certain areas of the country is low population density. Broadband providers simply won’t offer service if they can’t get enough customers to pay for it.

Innovation

How Can States and Cities Join the Growing AI Economy? (Government Technology). As Artificial Intelligence (AI) gains ground, many countries are setting national strategies to promote the technology’s adoption. AI is poised to make a significant impact on the global economy, adding a projected $15.7 trillion to the GDP by 2030. State and local governments may not have those same resources, but they can make AI more accessible. A key challenge faced is ensuring that AI is accessible, available and affordable for local businesses, especially small and medium-sized businesses that may not have the resources of their larger counterparts.

Infrastructure

Talent Wants Transit: Companies Near Transportation Gaining the Upper Hand (National Public Radio). Talent is choosing to ride transit. For example, McDonald’s traded the lawns, trees and ponds of its suburban corporate offices for sidewalks, concrete, glass and steel and moved into a new corporate headquarters building, just west of downtown Chicago. It’s within walking distance of a stop on two Chicago Transit Authority “L” lines. Chicago isn’t the only region experiencing this business boom along transit lines. From Seattle to St. Louis and Minneapolis to Atlanta, studies show that companies are relocating to be near transit lines, as they seek to attract workers, especially millennials, who prefer living in more urban areas and increasingly don’t want the long, driving commutes of their parents’ generation.

A State-by-State Look at the Fastest Internet Download Speeds (Open Signal). According to new data about the state of mobile broadband in the US from OpenSignal, the fastest download speeds are along the East Coast, as well as other population centers like California and Florida. For instance, New Jersey outperformed other states in upload and download speeds, with an average download connection of 24.1 Mbps and an average upload connection of 7.1 Mbps. Rural states without any major urban population centers tended to have slower download speeds.

Deal Makers

Incentives in Action

Inside Tesla’s Massive Gigafactory in Nevada (The Verge). Tesla told the state of Nevada that the factory would eventually create 6,500 on-site jobs and give a $100 billion boost to Nevada’s economy over the next two decades. The company has met and even exceeded some of those goals. Tesla employs more than 7,000 workers on-site; Panasonic, which leases part of the Gigafactory and makes battery cells for Tesla, employs 3,000 more people. While CEO Elon Musk has said that he plans to open around a dozen Gigafactories, he has also guessed it would take 100 Gigafactories across the globe to run the entire world on sustainable energy.

New York’s Agreement with Amazon (Smart Incentives). After conducting a yearlong search for a second home, Amazon selected the Long Island City neighborhood of Queens and the Crystal City area of Arlington, Va., a Washington DC suburb. This article examines the terms of New York’s memorandum of understanding with Amazon pertaining to $1.7 billion in incentives from the Excelsior Jobs Program (tax credits) and Empire State Development (capital grant).

Hollywood Sees a Jobs Boost Thanks to California Tax Incentives (Los Angeles Times). Each year, California awards hundreds of millions of dollars in tax credits to movie and TV productions that shoot in-state. That money has helped to give a significant boost to production jobs. According to the California Film Commission report, productions receiving state tax credits hired more than 18,000 cast and 29,000 crew members during the first three years of the program. The current incentive program was set to expire in 2020, but state officials recently extended it to 2025, at the same level of $330 million in credits per year.

The State Business Incentives Database is a national database maintained by the Council for Community and Economic Research (C2ER) with almost 2,000 programs listed and described from all U.S. states and territories. The Database gives economic developers, business development finance professionals, and economic researchers a one-stop resource for searching and comparing state incentive programs. To view the information available in the database, click here.

New Growth Opportunities

Curbing Carbon Emissions Could Boost State Economies (CNN Money). The Global Commission on the Economy and Climate projected that a set of policies aimed at combating global warming could yield $26 trillion in economic gains through 2030 if governments and businesses start enacting them in the next two to three years. The commission is composed of former heads of state, big city mayors, CEOs, and directors of international institutions like the World Bank. The report’s principal recommendation: Imposing a tax on carbon to generate revenue that can then be used to pay for an estimated $90 trillion in sustainable infrastructure like mass transit and energy efficient buildings. Seventy states and countries already have various types of carbon taxes. British Columbia, for example, imposed an annual tax of $8 per each ton of carbon dioxide in 2008, which rose to $24 a ton since 2012. The Canadian province’s economy has grown faster than the national average, with help from clean energy businesses that sprang up to meet the increased demand.

Talent Development/Attraction

The Promise of Community Colleges as Pathways to High-Quality Jobs (Brookings). In this podcast, representatives from the Brookings Metropolitan Policy Program and the Brown Center on Education Policy discuss the important role that community colleges play in putting young adults on a pathway to higher-quality jobs and other strategies for improving economic outcomes for youth from lower-income and disadvantaged backgrounds. The Brookings Podcast Network is a platform for high-quality, informative, and relevant discussions with public policy experts about their ideas and solutions to the most important challenges of our time.